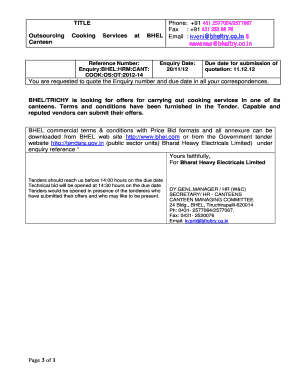

Get the free Fixed Assets & Surplus Forms - Purchasing - purchasing jordandistrict

Show details

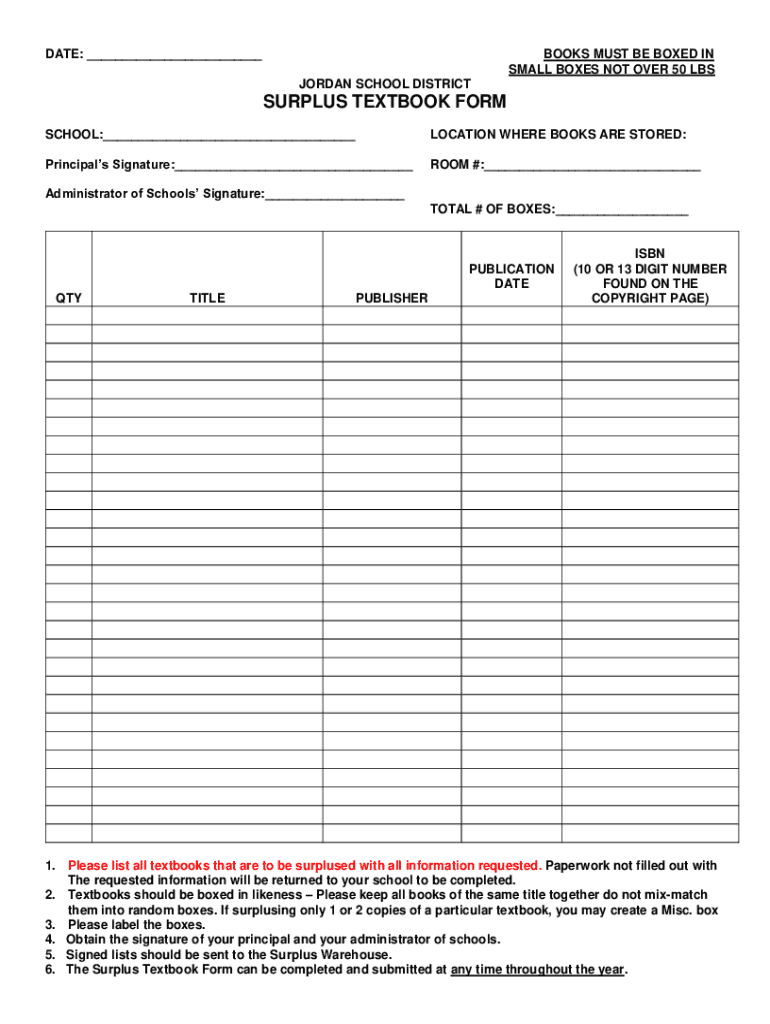

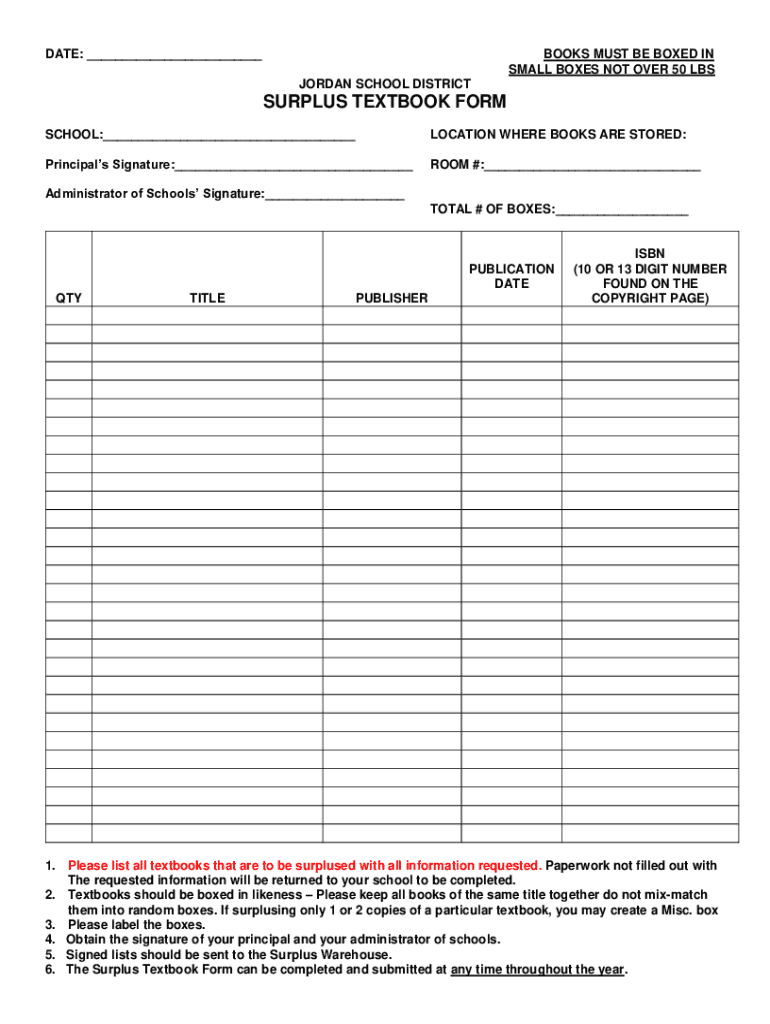

DATE: ___BOOKS MUST BE BOXED IN

SMALL BOXES NOT OVER 50 LBS

JORDAN SCHOOL DISTRICTSURPLUS TEXTBOOK FORM

SCHOOL:___LOCATION WHERE BOOKS ARE STORED:Principals Signature:___ROOM #:___Administrator of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed assets amp surplus

Edit your fixed assets amp surplus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed assets amp surplus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed assets amp surplus online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fixed assets amp surplus. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed assets amp surplus

How to fill out fixed assets amp surplus

01

To fill out fixed assets and surplus, follow these steps:

02

Begin by gathering all the necessary information and documents, such as financial statements, balance sheets, and any relevant supporting documentation.

03

Start by identifying and listing all the fixed assets owned by the company, including land, buildings, vehicles, machinery, and equipment.

04

Assign a monetary value to each fixed asset based on its fair market value or its purchase price.

05

Calculate the depreciation of each fixed asset, if applicable, based on its useful life and depreciation method chosen by the company.

06

Note down any changes or additions to the fixed assets during the reporting period, such as purchases, sales, or disposals.

07

Moving on to surplus, analyze the company's financial statements to determine the surplus amount.

08

Consider any additional factors that may affect the surplus, such as non-operating income or expenses.

09

Calculate the surplus amount by subtracting total expenses from total revenue.

10

Compile all the information and fill out the fixed assets and surplus section of the required form or financial statement.

11

Double-check all the calculations and ensure the accuracy of the information provided before submitting the form or financial statement.

12

Remember to consult with a financial professional or accountant if you have any doubts or need further assistance.

Who needs fixed assets amp surplus?

01

Fixed assets and surplus are typically needed by:

02

- Businesses and corporations: They need to keep track of their fixed assets for various purposes, such as financial reporting, tax calculations, and decision-making.

03

- Financial institutions: They require information on fixed assets and surplus to evaluate a company's financial stability and creditworthiness.

04

- Investors and shareholders: They want to assess the value and performance of a company, which includes understanding its fixed assets and surplus.

05

- Government agencies: They may require this information for regulatory compliance, tax assessments, or economic analysis.

06

- Non-profit organizations: They need to report fixed assets and surplus to stakeholders and donors to demonstrate financial responsibility and transparency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fixed assets amp surplus online?

The editing procedure is simple with pdfFiller. Open your fixed assets amp surplus in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit fixed assets amp surplus in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fixed assets amp surplus, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit fixed assets amp surplus on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing fixed assets amp surplus.

What is fixed assets amp surplus?

Fixed assets are long-term tangible property that a company owns and uses in its operations to generate income, such as buildings, machinery, and equipment. Surplus refers to the excess of the fixed assets over the liabilities associated with them, indicating financial strength.

Who is required to file fixed assets amp surplus?

Generally, businesses and organizations that own fixed assets must file a fixed assets and surplus report, including corporations, partnerships, and non-profits, as mandated by local or state regulations.

How to fill out fixed assets amp surplus?

To fill out fixed assets and surplus, accurately list all fixed assets owned, including their purchase dates, cost, accumulated depreciation, and current book value, along with any liabilities connected to those assets.

What is the purpose of fixed assets amp surplus?

The purpose of fixed assets and surplus is to provide a detailed overview of a company's long-term investments and remaining asset value, assisting in financial analysis, reporting, and taxation.

What information must be reported on fixed assets amp surplus?

Key information includes a description of each fixed asset, acquisition cost, date of purchase, accumulated depreciation, the net book value of each asset, and any related liabilities.

Fill out your fixed assets amp surplus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Assets Amp Surplus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.