Get the free Anti-Money Laundering Laws and Regulations Key BSA ...

Show details

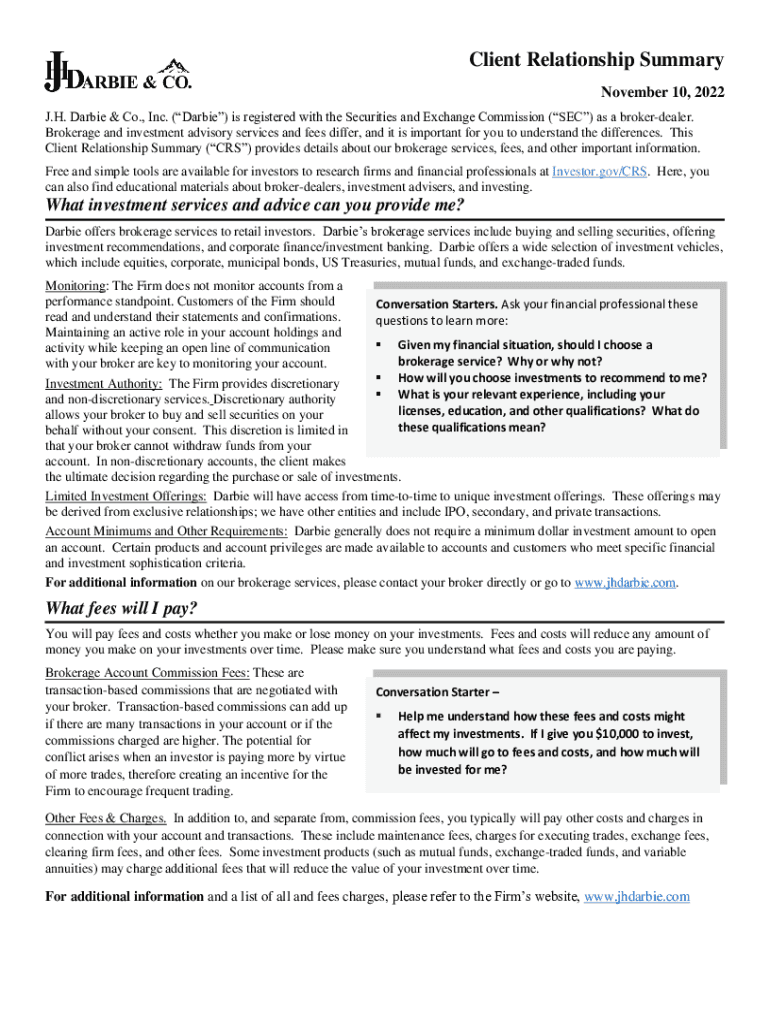

Client Relationship Summary November 10, 2022, J.H. Barbie & Co., Inc. (Barbie) is registered with the Securities and Exchange Commission (SEC) as a broker dealer. Brokerage and investment advisory

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering laws and

Edit your anti-money laundering laws and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering laws and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit anti-money laundering laws and online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit anti-money laundering laws and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering laws and

How to fill out anti-money laundering laws and

01

Familiarize yourself with the anti-money laundering laws and regulations in your jurisdiction.

02

Understand the key objectives and requirements of the anti-money laundering laws.

03

Implement a risk-based approach to identify, assess, and manage money laundering risks within your organization.

04

Establish internal policies, procedures, and controls to detect, prevent, and report suspicious activities.

05

Conduct proper due diligence on customers, clients, and counterparties to ensure they are not involved in money laundering activities.

06

Train employees and staff members on the importance of anti-money laundering laws and how to comply with them.

07

Monitor financial transactions for any unusual or suspicious activities.

08

Maintain comprehensive records of transactions, customer information, and suspicious activity reports.

09

Cooperate with law enforcement agencies and regulatory authorities when required.

10

Regularly review and update your anti-money laundering program to stay compliant with evolving regulations.

Who needs anti-money laundering laws and?

01

Financial institutions such as banks, credit unions, and insurance companies need anti-money laundering laws to safeguard their operations and protect against financial crimes.

02

Money service businesses such as money transfer agencies, currency exchange bureaus, and casinos need anti-money laundering laws due to the increased risk of money laundering and terrorist financing.

03

Professionals in the financial sector, including accountants, auditors, and financial advisors, need anti-money laundering laws to maintain the integrity of the industry and ensure ethical practices.

04

Legal entities involved in high-value transactions, such as real estate companies, jewelers, and luxury goods dealers, need anti-money laundering laws to prevent money laundering through their business activities.

05

Governments and regulatory authorities need anti-money laundering laws to maintain stability in the financial system, combat organized crime, and fulfill international obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my anti-money laundering laws and in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your anti-money laundering laws and as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find anti-money laundering laws and?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific anti-money laundering laws and and other forms. Find the template you need and change it using powerful tools.

How do I execute anti-money laundering laws and online?

Completing and signing anti-money laundering laws and online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is anti-money laundering laws?

Anti-money laundering laws are regulations that aim to prevent the process of making illegally obtained money appear legitimate. These laws require financial institutions and other regulated entities to monitor customer transactions and report any suspicious activities.

Who is required to file anti-money laundering laws?

Entities that are typically required to file under anti-money laundering laws include banks, credit unions, insurance companies, and other financial institutions, as well as professionals such as accountants and lawyers who handle financial transactions.

How to fill out anti-money laundering laws?

Filling out anti-money laundering forms generally involves providing detailed information about transactions, the parties involved, and any identified suspicious activity. It is important to follow the guidelines set by the relevant regulatory body when completing these forms.

What is the purpose of anti-money laundering laws?

The purpose of anti-money laundering laws is to combat financial crime by detecting and preventing money laundering and terrorist financing activities. They help maintain the integrity of the financial system.

What information must be reported on anti-money laundering laws?

Information that must be reported includes the details of any suspicious transactions, customer identification information, transaction amounts, dates, and descriptions of why the transaction is considered suspicious.

Fill out your anti-money laundering laws and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Laws And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.