Get the free 571-L BUSINESS PROPERTY STATEMENT

Show details

A declaration form for reporting property costs and related information for valuation for tax purposes in Tulare County, California.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 571-l business property statement

Edit your 571-l business property statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 571-l business property statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 571-l business property statement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 571-l business property statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 571-l business property statement

How to fill out 571-L BUSINESS PROPERTY STATEMENT

01

Gather all necessary information about your business property.

02

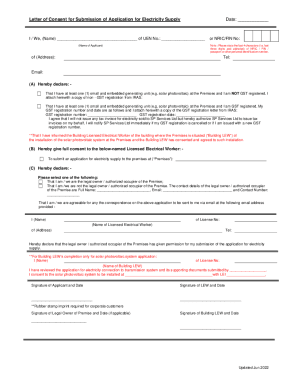

Download or obtain the 571-L BUSINESS PROPERTY STATEMENT form.

03

Fill out the identification section with your business name, address, and contact information.

04

List all business personal property owned or leased by your business.

05

Provide the original cost and the acquisition date for each item of property.

06

Indicate any property that has been sold or disposed of during the reporting period.

07

Complete the declaration section by signing and dating the form to certify accuracy.

08

Submit the completed form by the due date, either online or by mail.

Who needs 571-L BUSINESS PROPERTY STATEMENT?

01

All businesses that own or lease personal property in the jurisdiction requiring the statement.

02

Businesses seeking to report property for taxation purposes.

03

Organizations that need to comply with local or state property tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my California property tax statement?

Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. If you do not receive the original bill by November 1, contact the County Tax Collector or Assessor for a duplicate bill. Note, the original bill may still have the prior owner's name on it the first year.

What is personal property tax for a business?

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

What is form 571 L California property tax?

This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor's Office by the date cited on the

What is classified as business personal property?

Business personal property is all property owned or leased by a business except real property.

How much is business property tax in California?

Tax Rates. California's property tax rate is 1% of assessed value (also applies to real property) plus any bonded indebtedness voted in by the taxpayers.

What is a business personal property tax example?

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

What are examples of business use property?

Business Personal Property is the assets of the business. Desks, chairs, file cabinets, computers, printers, copiers, phones, fire extinguishers, shelving, trash cans, cleaning supplies, decor, hand trucks, forklifts, and other machinery and equipment are all personal property assets and must be reported per ORS.

What is an example of a personal property?

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 571-L BUSINESS PROPERTY STATEMENT?

The 571-L Business Property Statement is a form used by businesses to report personal property owned or rented as of January 1st of each year for tax assessment purposes.

Who is required to file 571-L BUSINESS PROPERTY STATEMENT?

All businesses that own or lease personal property with a value over a specified threshold are required to file the 571-L Business Property Statement.

How to fill out 571-L BUSINESS PROPERTY STATEMENT?

To fill out the 571-L Business Property Statement, businesses must provide details regarding their personal property, including type, location, cost, and the date of acquisition, along with any other relevant information.

What is the purpose of 571-L BUSINESS PROPERTY STATEMENT?

The purpose of the 571-L Business Property Statement is to ensure accurate assessment of property taxes for personal property owned or leased by businesses.

What information must be reported on 571-L BUSINESS PROPERTY STATEMENT?

The information that must be reported includes the description of the personal property, its cost, location, acquisition date, and any other relevant details to assess its taxable value.

Fill out your 571-l business property statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

571-L Business Property Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.