Get the free Are you covered when you tell borrowers to Sign

Show details

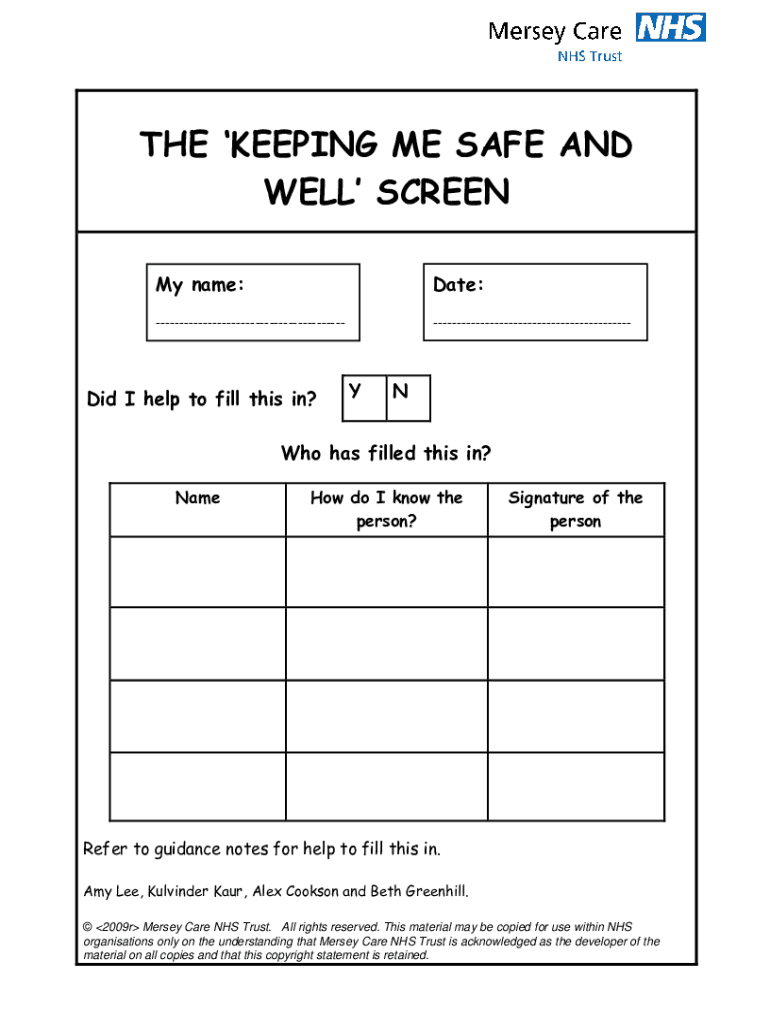

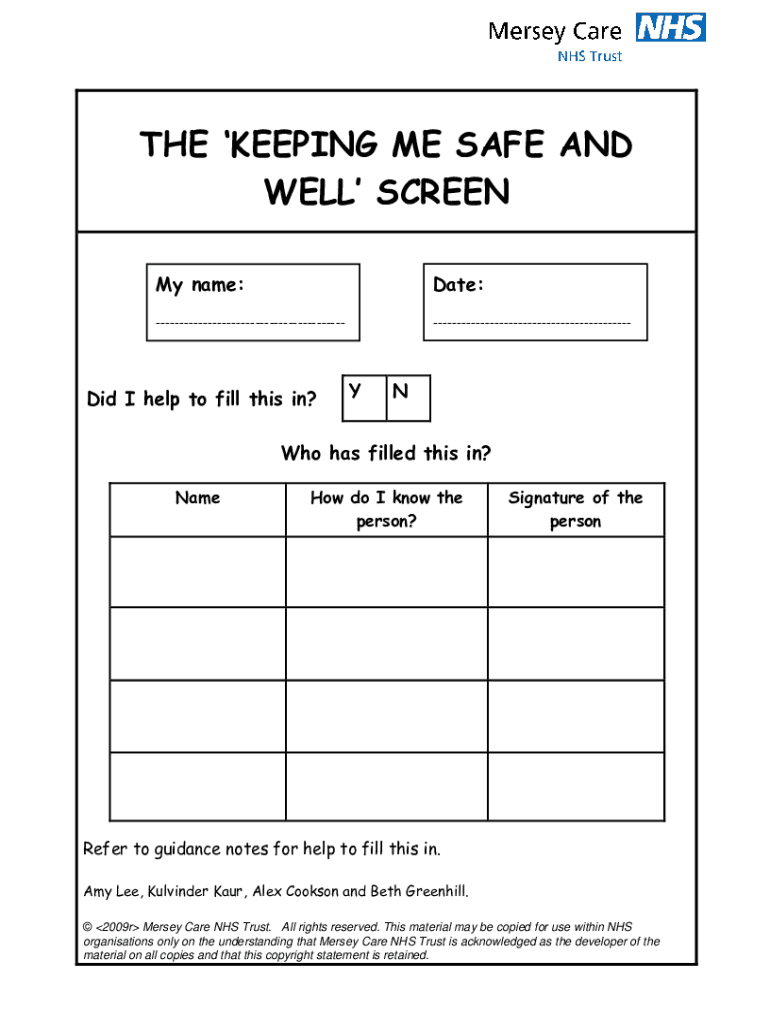

THE KEEPING ME SAFE AND WELL SCREEN My name:Date:Did I help to fill this in?YNWho has filled this in? NameHow do I know the person?Signature of the personRefer to guidance notes for help to fill this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign are you covered when

Edit your are you covered when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your are you covered when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing are you covered when online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit are you covered when. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out are you covered when

How to fill out are you covered when

01

Start by gathering all necessary information such as your personal details, insurance policy details, and any relevant documents or forms.

02

Review your current insurance coverage and understand what it offers and what it doesn't.

03

Determine the specific areas or aspects you want to be covered for, such as medical expenses, property damage, or liability.

04

Research different insurance providers and compare their coverage options, pricing, and customer reviews.

05

Contact the insurance provider of your choice and request a quote or application form.

06

Fill out the application form accurately and provide all required information.

07

Review the completed form to ensure it is free of errors or missing information.

08

Attach any necessary supporting documents, such as medical records or proof of ownership for valuable items.

09

Submit the filled-out application form and required documents to the insurance provider through their preferred method (online, email, or in person).

10

Wait for the insurance provider to review your application and assess the coverage you are eligible for.

11

If necessary, provide any additional information or clarification requested by the insurance provider.

12

Once approved, carefully review the terms and conditions of the insurance policy before signing any contracts.

13

Make the initial premium payment as specified by the insurance provider to activate your coverage.

14

Keep a copy of the signed policy and any related documents for future reference.

15

Regularly review your insurance coverage and update it as needed to ensure you are adequately protected.

Who needs are you covered when?

01

Individuals who do not currently have any form of insurance coverage should consider getting 'Are You Covered When?' to protect themselves financially in case of unforeseen events or emergencies.

02

Homeowners or renters who want to safeguard their property and belongings against theft, damage, or natural disasters should look into 'Are You Covered When?'

03

Individuals with dependents or family members who rely on them financially should consider 'Are You Covered When?' to ensure their loved ones are taken care of in the event of their disability or death.

04

Business owners or self-employed individuals who want to protect their business assets, employees, or liabilities should explore 'Are You Covered When?' options.

05

People with specific health concerns or medical conditions may require 'Are You Covered When?' to manage potential medical expenses or treatments.

06

Travelers who frequently embark on trips, whether for business or pleasure, should consider 'Are You Covered When?' to mitigate travel-related risks and unexpected expenses.

07

Motor vehicle owners should have 'Are You Covered When?' to comply with legal requirements and protect themselves from financial loss in case of accidents or damages.

08

Individuals planning major events such as weddings, concerts, or conferences should consider 'Are You Covered When?' to minimize the financial impact of unforeseen cancellations, delays, or accidents.

09

People engaging in high-risk activities or sports should obtain 'Are You Covered When?' to protect themselves from potential injuries or damages.

10

Anyone who values peace of mind and financial security should assess their circumstances and consider 'Are You Covered When?' as a means of protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute are you covered when online?

pdfFiller has made it simple to fill out and eSign are you covered when. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out are you covered when using my mobile device?

Use the pdfFiller mobile app to complete and sign are you covered when on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit are you covered when on an iOS device?

Create, edit, and share are you covered when from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is are you covered when?

Are you covered when refers to the specific time period for which an individual has insurance coverage.

Who is required to file are you covered when?

Anyone who has insurance coverage during the specified time period is required to file Are you covered when.

How to fill out are you covered when?

You can fill out Are you covered when by providing information about your insurance coverage during the specified time period.

What is the purpose of are you covered when?

The purpose of Are you covered when is to ensure that individuals have the necessary insurance coverage during a specific time period.

What information must be reported on are you covered when?

The information that must be reported on Are you covered when includes details about the insurance coverage, such as the type of insurance and the policy number.

Fill out your are you covered when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Are You Covered When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.