Get the free Gross Receipts Tax Rules - Arkansas Secretary of State

Show details

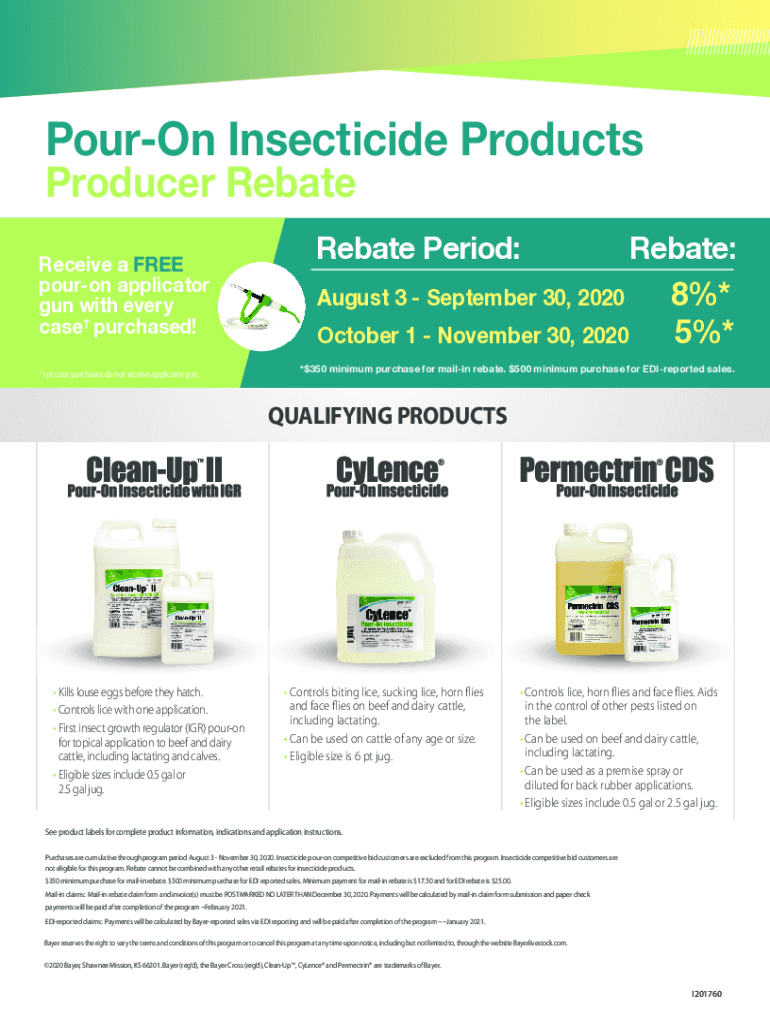

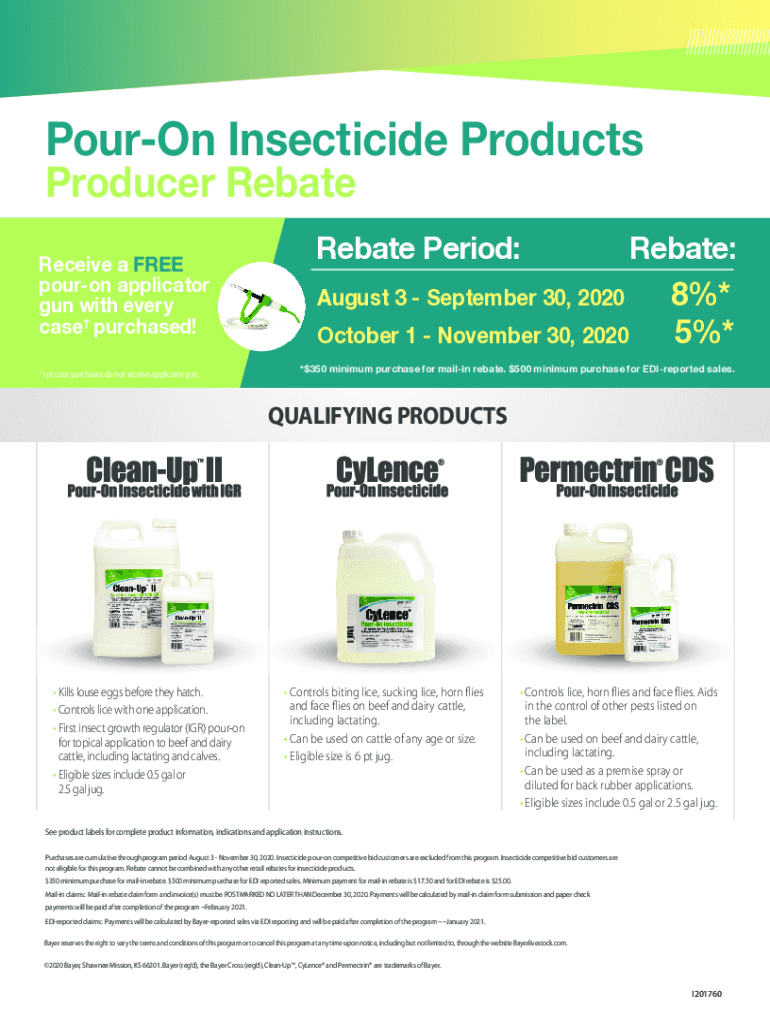

PourOn Insecticide Products Producer Rebate Receive a FREE pouron applicator gun with every case purchased! 1 pt case purchases do not receive applicator gun.Rebate Period: August 3 September 30,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gross receipts tax rules

Edit your gross receipts tax rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gross receipts tax rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gross receipts tax rules online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gross receipts tax rules. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gross receipts tax rules

How to fill out gross receipts tax rules

01

Gather all necessary information and documents related to your business gross receipts, such as sales records, invoices, and financial statements.

02

Familiarize yourself with the specific regulations and requirements of the gross receipts tax rules in your jurisdiction. These may vary between countries, states, or local municipalities.

03

Determine the applicable tax rate for your business based on the gross receipts tax rules. This information can usually be found on the official website of the tax authority or by consulting a tax professional.

04

Calculate your gross receipts for the designated tax period. This may involve summing up all sales revenue or deducting certain allowable deductions from your total business income.

05

Complete the necessary tax forms or reports as per the requirements of the gross receipts tax rules. Make sure to include accurate information and double-check for any errors or omissions.

06

Submit the completed tax forms along with any applicable payments by the specified deadline. Late filings or payments may result in penalties or interest charges.

07

Maintain proper records and documentation of your gross receipts and tax filings for future reference or potential audits. This will help ensure compliance with the gross receipts tax rules and facilitate any necessary reporting or inquiries.

08

Stay updated with any changes or revisions to the gross receipts tax rules that may affect your business. Regularly review official communications or seek professional advice to ensure ongoing compliance and accuracy in your tax filings.

Who needs gross receipts tax rules?

01

Businesses that operate in jurisdictions where gross receipts tax is imposed by the tax authorities.

02

Small and medium-sized enterprises (SMEs) that exceed certain sales thresholds or have significant gross receipts may need to comply with the gross receipts tax rules.

03

Retailers, wholesalers, manufacturers, service providers, and other types of businesses that generate significant revenue from sales or services may be subject to the gross receipts tax rules.

04

Certain industries or professions may have specific regulations regarding gross receipts tax, such as healthcare, construction, or financial services.

05

Individuals or entities engaged in rental or leasing activities, business consulting, or professional services may also need to consider the gross receipts tax rules.

06

It is advisable to consult with a tax professional or legal advisor to determine whether your business falls under the jurisdiction of gross receipts tax rules and the specific requirements that apply.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gross receipts tax rules to be eSigned by others?

When you're ready to share your gross receipts tax rules, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit gross receipts tax rules in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your gross receipts tax rules, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit gross receipts tax rules straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing gross receipts tax rules, you need to install and log in to the app.

What is gross receipts tax rules?

Gross receipts tax rules refer to the regulations governing the taxation of total revenues received by a business, without deductions for expenses. This tax applies to a wide range of business activities.

Who is required to file gross receipts tax rules?

Generally, any business entity that generates revenue is required to file gross receipts tax rules. This includes corporations, partnerships, and sole proprietorships, depending on the jurisdiction.

How to fill out gross receipts tax rules?

To fill out gross receipts tax rules, businesses must provide their total gross receipts for the reporting period, as well as any applicable deductions or exemptions, and complete the necessary forms provided by the tax authority.

What is the purpose of gross receipts tax rules?

The purpose of gross receipts tax rules is to generate revenue for state and local governments based on the total income businesses earn, thereby supporting public services and infrastructure.

What information must be reported on gross receipts tax rules?

Businesses must report their total gross revenues, any allowable deductions, the nature of their business activities, and relevant identifying information on their gross receipts tax forms.

Fill out your gross receipts tax rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gross Receipts Tax Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.