Get the free Payroll diversion fraud: Preventing a direct deposit scam

Show details

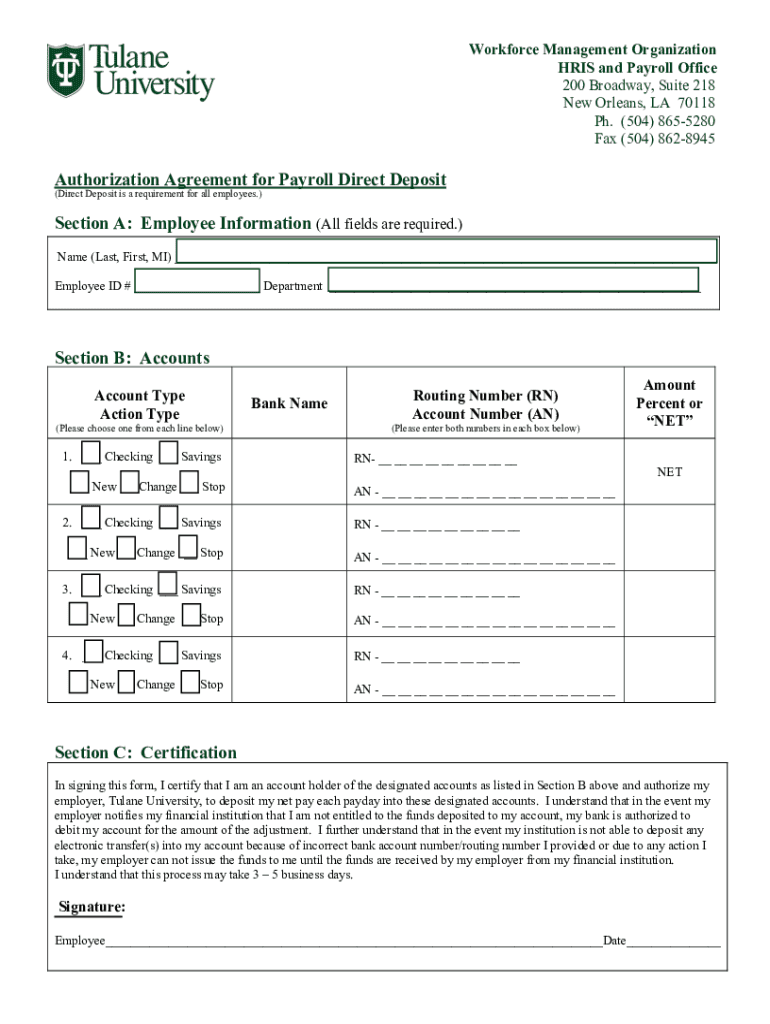

Workforce Management Organization HRIS and Payroll Office 200 Broadway, Suite 218 New Orleans, LA 70118 Ph. (504) 8655280 Fax (504) 8628945Authorization Agreement for Payroll Direct Deposit (Direct

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll diversion fraud preventing

Edit your payroll diversion fraud preventing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll diversion fraud preventing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll diversion fraud preventing online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll diversion fraud preventing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll diversion fraud preventing

How to fill out payroll diversion fraud preventing

01

Verify employee information: Make sure to accurately record employee information such as name, contact details, and bank account information.

02

Implement dual controls: Have multiple employees involved in the payroll process to reduce the risk of fraud. Assign different individuals to review and approve payroll transactions.

03

Regularly update payroll systems: Ensure that your payroll software is up to date with the latest security patches and fixes.

04

Conduct background checks: Perform background checks on new employees to verify their credentials and minimize the risk of hiring potential fraudsters.

05

Educate employees: Train your employees about payroll diversion fraud, its consequences, and how to identify potential warning signs.

06

Monitor payroll transactions: Regularly review payroll records and transactions for any discrepancies or unusual patterns.

07

Implement strong authentication methods: Use multi-factor authentication, like password and biometric authentication, to secure access to payroll systems.

08

Foster a culture of transparency: Encourage employees to report any suspicious activity or concerns related to payroll diversion fraud.

09

Conduct internal audits: Regularly perform internal audits of payroll processes to ensure compliance and detect any fraudulent activities.

10

Engage external experts: Consider hiring external experts or consultants specialized in payroll fraud prevention to assess your systems and provide recommendations.

11

Stay informed: Stay updated on the latest payroll fraud trends, techniques, and prevention strategies through industry publications and professional networks.

Who needs payroll diversion fraud preventing?

01

Businesses of all sizes: Payroll diversion fraud can affect small businesses as well as large corporations. It is essential for all organizations to implement fraud prevention measures.

02

Human resources departments: HR departments are responsible for managing payroll and ensuring employee compensation. They play a crucial role in preventing payroll diversion fraud.

03

Payroll administrators: Payroll administrators need to be well-equipped with knowledge and tools to effectively prevent and detect payroll diversion fraud.

04

Financial institutions: Banks and financial institutions that handle payroll transactions need to implement robust security measures to protect against payroll diversion fraud.

05

Governments and public sector organizations: Public sector entities managing payroll for employees need to be particularly cautious about preventing payroll diversion fraud.

06

Non-profit organizations: Non-profit organizations handling payroll need to implement fraud prevention measures to safeguard their limited resources.

07

Individuals receiving payroll payments: Employees or contractors who receive direct payroll payments are also stakeholders in preventing payroll diversion fraud.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute payroll diversion fraud preventing online?

Completing and signing payroll diversion fraud preventing online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit payroll diversion fraud preventing online?

The editing procedure is simple with pdfFiller. Open your payroll diversion fraud preventing in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the payroll diversion fraud preventing in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your payroll diversion fraud preventing.

What is payroll diversion fraud preventing?

Payroll diversion fraud preventing is a set of processes and controls implemented by organizations to detect and prevent unauthorized changes to payroll information, thereby protecting employees' earnings from being redirected to fraudulent accounts.

Who is required to file payroll diversion fraud preventing?

Employers who manage payroll services for employees are required to implement measures to prevent payroll diversion fraud, as it is their responsibility to protect the integrity of employee earnings.

How to fill out payroll diversion fraud preventing?

To fill out payroll diversion fraud preventing, employers should provide accurate employee information, implement verification steps for changes in payroll accounts, and document all processes that monitor and respond to alleged fraud attempts.

What is the purpose of payroll diversion fraud preventing?

The purpose of payroll diversion fraud preventing is to safeguard employee wages by ensuring that payroll funds are not misappropriated through unauthorized access or fraudulent activities.

What information must be reported on payroll diversion fraud preventing?

Reported information should include details of any identified fraudulent activity, steps taken to mitigate risks, employee responses to any fraudulent changes, and the effectiveness of fraud prevention measures implemented.

Fill out your payroll diversion fraud preventing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Diversion Fraud Preventing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.