Get the free How Private Placement Affects Share Price

Show details

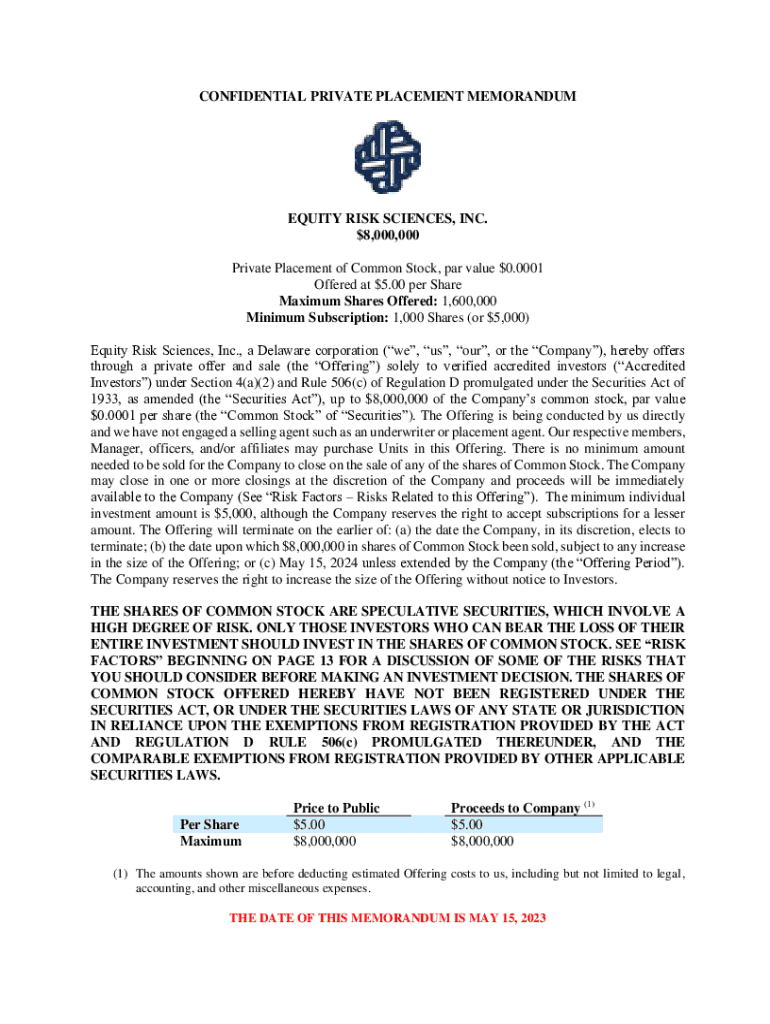

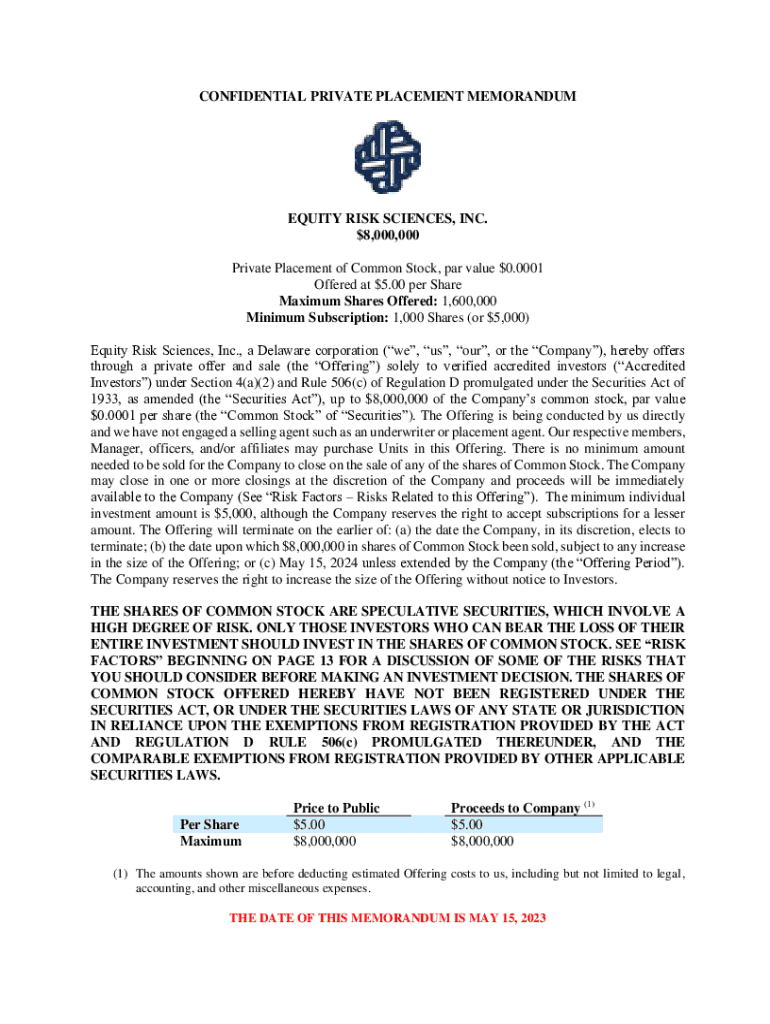

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUMEQUITY RISK SCIENCES, INC. $8,000,000 Private Placement of Common Stock, par value $0.0001 Offered at $5.00 per Share Maximum Shares Offered: 1,600,000 Minimum

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how private placement affects

Edit your how private placement affects form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how private placement affects form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how private placement affects online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how private placement affects. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how private placement affects

How to fill out how private placement affects

01

Start by understanding the concept of private placement and its purpose.

02

Identify the specific securities regulations and legal requirements governing private placements in your jurisdiction.

03

Determine the type of private placement offering you are interested in, such as equity, debt, or hybrids.

04

Evaluate the potential risks and benefits associated with a private placement.

05

Find and engage legal counsel or a qualified securities professional to assist with the process.

06

Prepare the necessary documentation, including a private placement memorandum (PPM) and subscription agreement.

07

Identify potential investors who may be interested in participating in the private placement.

08

Adhere to applicable securities regulations regarding investor suitability and disclosure requirements.

09

Conduct due diligence on prospective investors to ensure they meet the necessary criteria.

10

Execute the private placement by finalizing the subscription agreements and collecting funds from investors.

11

Comply with ongoing reporting and regulatory obligations, such as filing Form D with the Securities and Exchange Commission (SEC) in the United States.

12

Monitor the impact of the private placement on your company's capital structure, ownership, and financial position.

Who needs how private placement affects?

01

Startups and early-stage companies seeking capital without going through public offerings.

02

Established companies looking to raise additional funds for expansion, acquisitions, or working capital.

03

Real estate developers and property owners aiming to finance development projects or property acquisitions.

04

Private equity firms and venture capitalists seeking investment opportunities.

05

High-net-worth individuals or sophisticated investors looking for alternative investment options.

06

Companies in industries where access to public capital markets is limited or restricted.

07

Companies facing financial distress or restructuring efforts that require private funding.

08

Institutions or organizations that need to raise funds for specific projects or initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify how private placement affects without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your how private placement affects into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the how private placement affects electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your how private placement affects in seconds.

Can I edit how private placement affects on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share how private placement affects on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is how private placement affects?

Private placement affects the way companies raise capital by allowing them to sell securities directly to a select group of investors, which can streamline the fundraising process and potentially lead to less regulatory scrutiny compared to public offerings.

Who is required to file how private placement affects?

Companies engaging in private placements must file the appropriate forms with regulatory authorities, typically including any entity that raises capital through the sale of securities to private investors, such as private equity firms and startups.

How to fill out how private placement affects?

To fill out the filing for private placement, companies need to provide detailed information about the offering, including the type of securities being offered, the total amount of capital to be raised, information about the purchasers, and disclosures related to risks and use of proceeds.

What is the purpose of how private placement affects?

The purpose of filing how private placement affects is to ensure transparency and compliance with securities regulations, while allowing the market to understand the financial health and capital structure of the company.

What information must be reported on how private placement affects?

Companies must report details including the nature of the securities, the identity of investors, the amount raised, and how the funds will be utilized, along with any risks associated with the investment.

Fill out your how private placement affects online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Private Placement Affects is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.