Get the free Delinquent Tax Suit

Show details

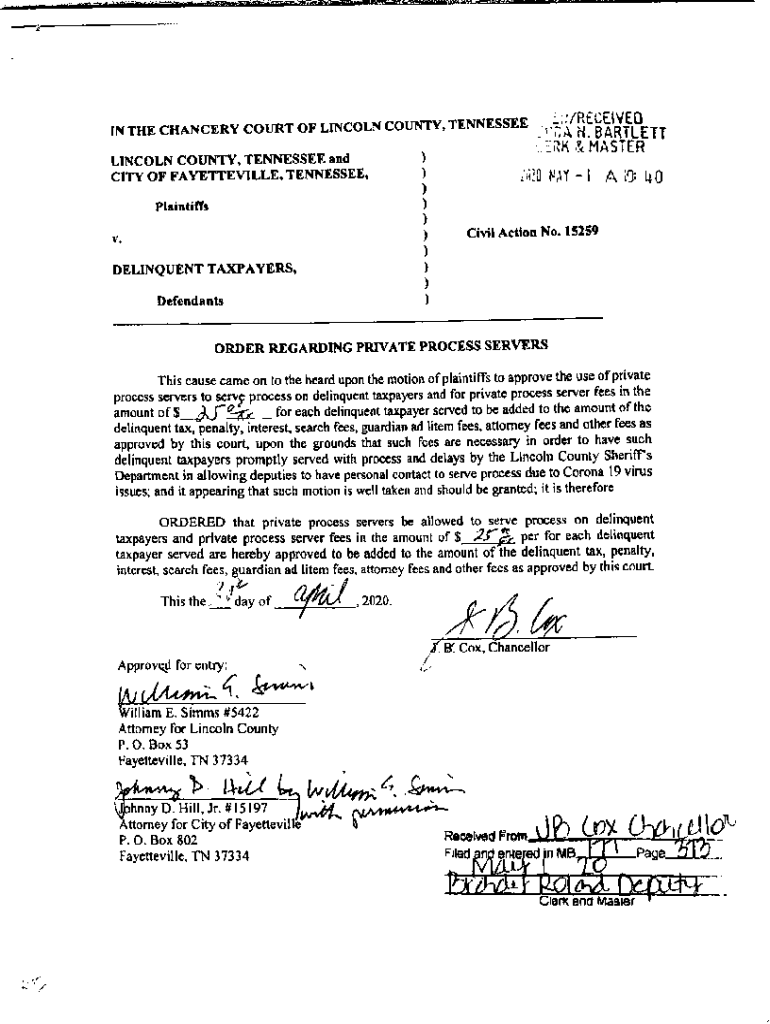

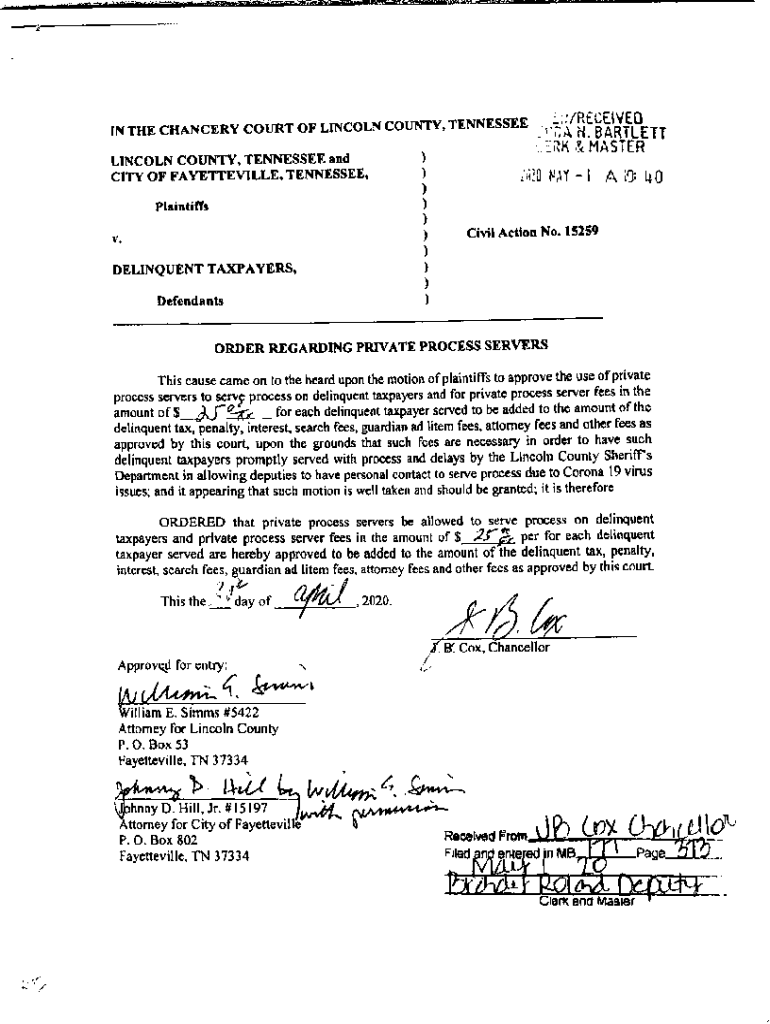

IN THE CHANCERY COURT OF LINCOLN COUNTY, FAYETTEVILLE, TENNESSEE LINCOLN COUNTY, TENNESSEE, and CITY OF FAYETTEVILLE, TENNESSEE, Vs. Plaintiffs, CIVIL ACTION NO. 15259DELINQUENT TAXPAYERS, Defendants.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent tax suit

Edit your delinquent tax suit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent tax suit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit delinquent tax suit online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit delinquent tax suit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delinquent tax suit

How to fill out delinquent tax suit

01

Understand the requirements: Familiarize yourself with the specific laws and regulations regarding delinquent tax suits in your jurisdiction.

02

Gather necessary documents: Collect all relevant documents such as tax records, payment histories, and any correspondence related to the delinquent taxes.

03

File a lawsuit: Prepare a complaint and file it with the appropriate court, ensuring that you follow all the procedural requirements.

04

Serve the defendant: Serve the defendant with a copy of the complaint and any accompanying documents according to the legal process serving methods.

05

Attend court hearings: Participate in all scheduled hearings and provide any additional documents or evidence as required by the court.

06

Obtain a judgment: If the court rules in your favor, obtain a judgment against the defendant, specifying the amount owed and any applicable penalties or interest.

07

Enforce the judgment: Take necessary steps such as garnishing wages, placing liens on property, or seizing assets to collect the delinquent taxes.

08

Ensure compliance with legal requirements: Throughout the process, make sure to comply with all legal procedures and deadlines to protect your rights and avoid any potential issues.

Who needs delinquent tax suit?

01

Government authorities: Local government bodies often need to file delinquent tax suits to collect unpaid taxes and ensure compliance with tax laws.

02

Tax agencies: State or federal tax agencies can initiate delinquent tax suits to recover outstanding taxes owed by individuals or businesses.

03

Financial institutions: Lenders or banks may require the filing of delinquent tax suits as part of their risk management strategies when dealing with borrowers in default.

04

Property owners' associations: Homeowners' associations sometimes resort to delinquent tax suits to handle unpaid dues or levies from property owners within their jurisdiction.

05

Individuals or businesses owed money: Any individual or business entity that is owed delinquent taxes can pursue a delinquent tax suit to collect the outstanding amounts.

06

Legal professionals: Attorneys who specialize in tax law or debt collection may handle delinquent tax suits on behalf of their clients.

07

Real estate investors: Investors who acquire properties with delinquent taxes may need to file suits to clear title issues and establish clear ownership rights.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify delinquent tax suit without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your delinquent tax suit into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the delinquent tax suit in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your delinquent tax suit directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit delinquent tax suit straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing delinquent tax suit right away.

What is delinquent tax suit?

A delinquent tax suit is a legal proceeding initiated by a government entity to collect unpaid taxes from property owners. It often leads to a lien on the property or foreclosure if the taxes remain unpaid.

Who is required to file delinquent tax suit?

Typically, the local government or tax authority is required to file a delinquent tax suit against property owners who have failed to pay their taxes.

How to fill out delinquent tax suit?

To fill out a delinquent tax suit, one must complete the appropriate legal forms provided by the court, detailing the property in question, amounts owed, and other relevant information. It's advisable to seek legal counsel or assistance if unsure about the process.

What is the purpose of delinquent tax suit?

The purpose of a delinquent tax suit is to recover unpaid taxes, enforce tax liens, and protect the revenue stream for local governments, ultimately ensuring compliance with tax laws.

What information must be reported on delinquent tax suit?

A delinquent tax suit must report information such as the property owner's name, property address, tax amounts owed, relevant tax periods, and any previous notices of delinquency.

Fill out your delinquent tax suit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent Tax Suit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.