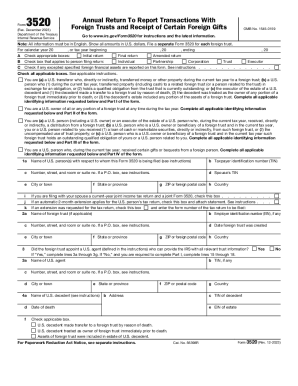

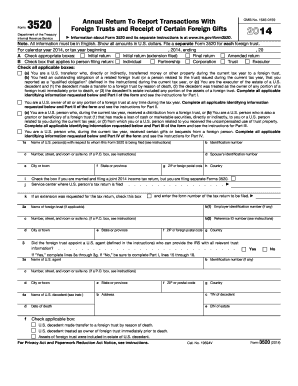

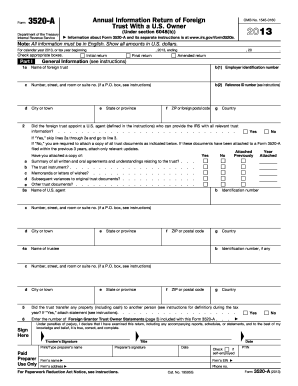

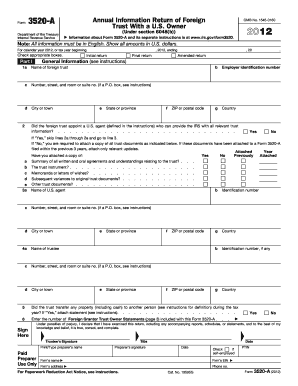

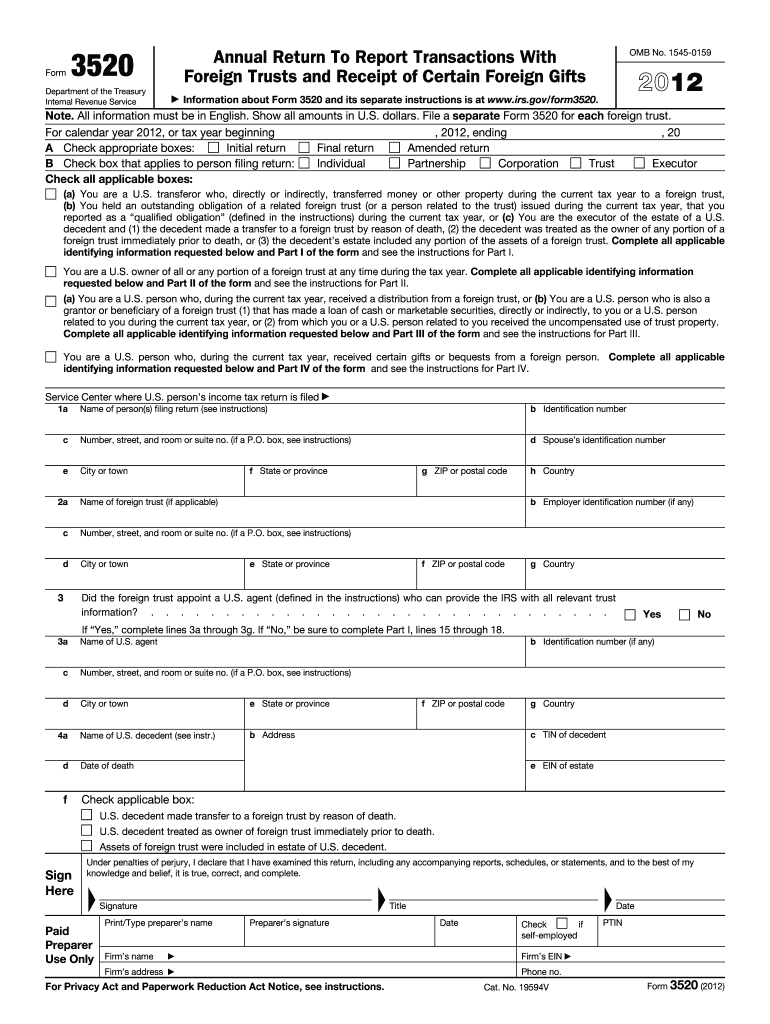

IRS 3520 2012 free printable template

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

About IRS 3 previous version

What is IRS 3520?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 3520

What should I do if I realize I made a mistake after submitting my gifts from foreign personinternal?

If you find an error in your gifts from foreign personinternal after submission, you can file an amended form to correct the mistake. Ensure to specify the original submission and clearly outline the changes made to prevent any confusion during processing.

How can I check the status of my gifts from foreign personinternal submission?

To verify the status of your gifts from foreign personinternal submission, you can use the IRS online tracking system. This will allow you to see if it has been received, processed, or if there are any issues that need your attention.

What common errors should I be aware of when filing the gifts from foreign personinternal?

Common errors include incorrect amounts reported and failing to include all required information about the foreign person. Double-check your entries and ensure all fields are complete to avoid rejection during the processing of your gifts from foreign personinternal.

How long should I retain records related to my gifts from foreign personinternal?

It is advisable to retain records related to your gifts from foreign personinternal for at least three years after the filing date. This allows you to provide necessary documentation in case of any inquiries or audits regarding your submissions.

Are there specific technical requirements for e-filing gifts from foreign personinternal?

Yes, when e-filing gifts from foreign personinternal, consider verifying that your software is compatible with IRS specifications. Additionally, ensure your internet browser is updated to avoid technical issues during the submission process.

See what our users say