Get the free Guide to HFA loans: What is an HFA loan and who qualifies?

Show details

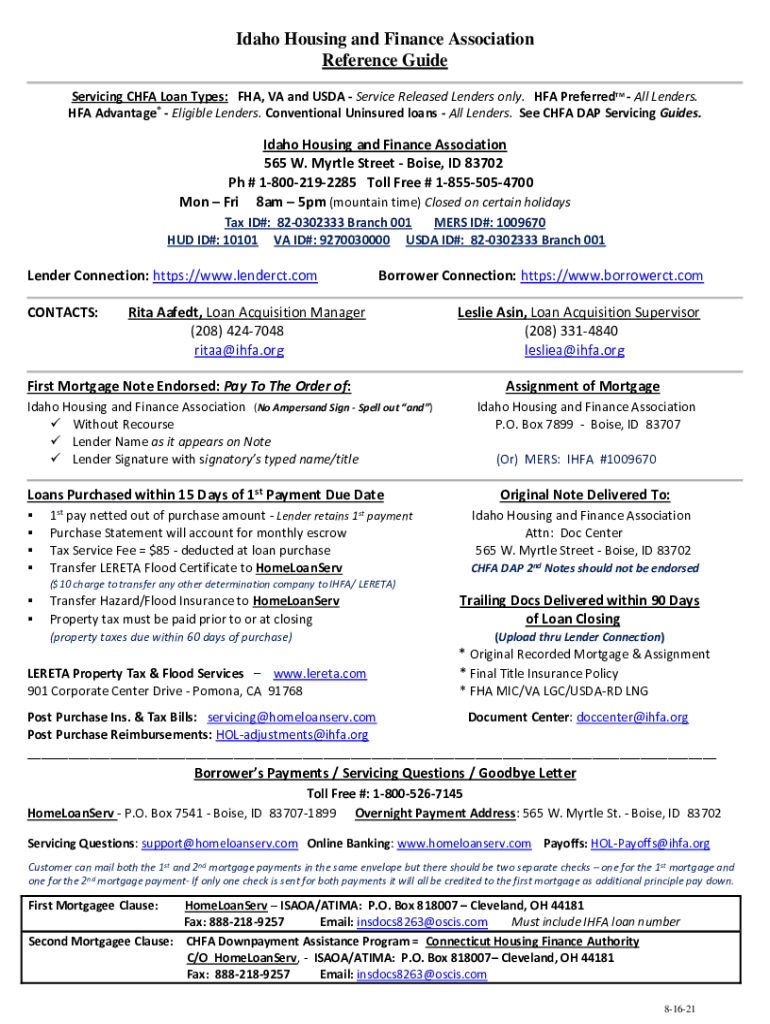

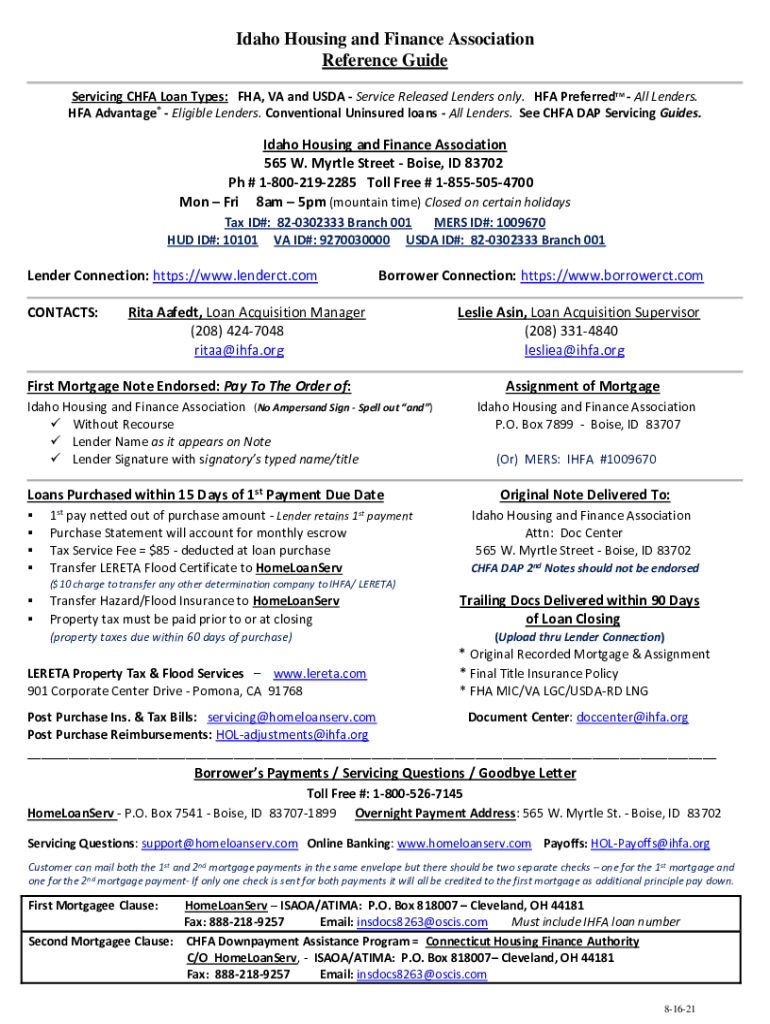

Idaho Housing and Finance Association Reference Guide Servicing CFA Loan Types: FHA, VA and USDA Service Released Lenders only. HF Preferred TM All Lenders. HF Advantage Eligible Lenders. Conventional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to hfa loans

Edit your guide to hfa loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to hfa loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guide to hfa loans online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guide to hfa loans. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to hfa loans

How to fill out guide to hfa loans

01

Gather all necessary financial documents including proof of income, tax returns, and bank statements.

02

Research different HFA loan programs to determine which one best fits your financial situation.

03

Contact your local HFA office or a participating lender to begin the application process.

04

Complete the application form accurately and honestly, providing all requested information.

05

Attend any required homebuyer education classes or counseling sessions.

06

Wait for approval and review any financing offers to choose the best option for your needs.

07

Close on your HFA loan and begin making affordable monthly payments.

Who needs guide to hfa loans?

01

First-time homebuyers looking for affordable financing options.

02

Low to moderate income individuals or families who may not qualify for conventional loans.

03

Individuals seeking government-backed loans with flexible terms and down payment assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send guide to hfa loans to be eSigned by others?

When you're ready to share your guide to hfa loans, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit guide to hfa loans online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your guide to hfa loans to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I fill out guide to hfa loans on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your guide to hfa loans. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is guide to hfa loans?

The guide to HFA loans provides comprehensive information on how Housing Finance Agencies (HFAs) support eligible homebuyers by offering affordable mortgage financing options, including down payment assistance and favorable interest rates.

Who is required to file guide to hfa loans?

Entities that participate in HFA loan programs, such as lenders, mortgage servicers, and other housing finance professionals, are typically required to file the guide to HFA loans.

How to fill out guide to hfa loans?

To fill out the guide to HFA loans, participants should follow the provided instructions, include all necessary financial information, ensure accuracy, and submit any supporting documentation as required by the HFA.

What is the purpose of guide to hfa loans?

The purpose of the guide to HFA loans is to facilitate the processing and reporting of loan data, ensuring compliance with HFA regulations and helping to promote accessibility to affordable housing.

What information must be reported on guide to hfa loans?

Key information to be reported includes borrower details, loan amounts, property information, and any applicable assistance or subsidies provided as part of the loan.

Fill out your guide to hfa loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Hfa Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.