Get the free Cohort Default Rates 101 - tgslc

Show details

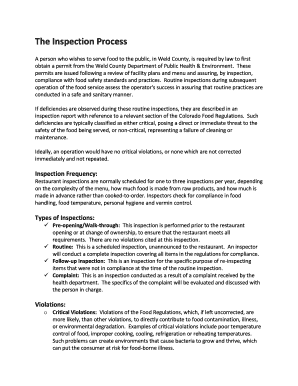

This document provides an overview of cohort default rates for federal student loans, explaining how rates are calculated, the implications of high default rates for educational institutions, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cohort default rates 101

Edit your cohort default rates 101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cohort default rates 101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

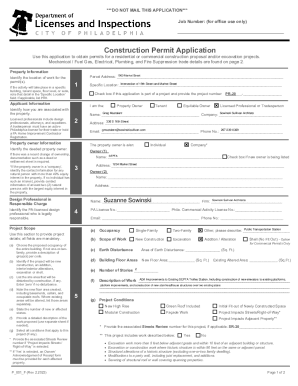

How to edit cohort default rates 101 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cohort default rates 101. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cohort default rates 101

How to fill out Cohort Default Rates 101

01

Gather necessary student loan data for the relevant cohort year.

02

Determine the number of borrowers in the cohort who entered repayment during that period.

03

Calculate the number of borrowers who defaulted on their loans within the specified timeframe.

04

Divide the number of defaults by the total number of borrowers in the cohort.

05

Multiply the result by 100 to get the default rate percentage.

06

Ensure all data is accurately documented and compiled for reporting.

Who needs Cohort Default Rates 101?

01

Educational institutions looking to assess their loan repayment performance.

02

Federal and state agencies monitoring loan default rates.

03

Policy makers interested in understanding education financing issues.

04

Students seeking information on the financial stability of institutions.

Fill

form

: Try Risk Free

People Also Ask about

What is the 3 year default rate on student loans?

The type of college with the highest default rate for all students is generally for-profit colleges. For-profit colleges often have higher tuition fees and lower graduation rates compared to public or non-profit colleges.

What is an acceptable default rate?

Due to COVID-19-related student loan forbearance, the three-year federal student loan default rate in 2024, was technically 0.0%. The student loan default rate has declined since 2020. In 2022, the three-year student loan default rate was 2.3%. From 2016-2020, student loan default rates were around 10-11.5%.

What is the cohort default rate?

2) ing to the Sphere Standards, a default rate of less than 15% is perceived as “acceptable”. 3) The four core performance indicators of a malnutrition treatment program (esp. the Community Management of Acute Malnutrition, CMAM) are recovery rate, death rate, default rate and non-recovery rate.

Will defaulted student loans be offset in 2025?

The Government's Plan To Begin Collection of Defaulted Student Loans. The Department's announcement says that it plans to start forced collection using the Treasury Offset Program beginning May 5, 2025.

What is the default rate for student loans?

The student loan default rate has declined since 2020. In 2022, the three-year student loan default rate was 2.3%. From 2016-2020, student loan default rates were around 10-11.5%. People who attend for-profit colleges default at higher rates than those who attend public or nonprofit institutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cohort Default Rates 101?

Cohort Default Rates 101 is an introductory overview of the calculation and significance of cohort default rates, which represent the percentage of a school's borrowers who enter default status on federal student loans within a specific time frame.

Who is required to file Cohort Default Rates 101?

Participating institutions in federal student aid programs are required to report their cohort default rates to ensure compliance with federal regulations and maintain eligibility for federal funding.

How to fill out Cohort Default Rates 101?

To fill out Cohort Default Rates 101, institutions must collect and report relevant data on student loans, including the number of borrowers, defaults, and timelines specified by the Department of Education.

What is the purpose of Cohort Default Rates 101?

The purpose of Cohort Default Rates 101 is to provide institutions with the knowledge and tools needed to accurately report their cohort default rates, facilitating accountability and compliance with federal funding requirements.

What information must be reported on Cohort Default Rates 101?

Institutions must report data including the number of borrowers who entered repayment, the number who defaulted, the time period for reporting, and other borrower demographics as required by the Department of Education.

Fill out your cohort default rates 101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cohort Default Rates 101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.