Get the free CHEQUES vs PROMISSORY NOTES

Show details

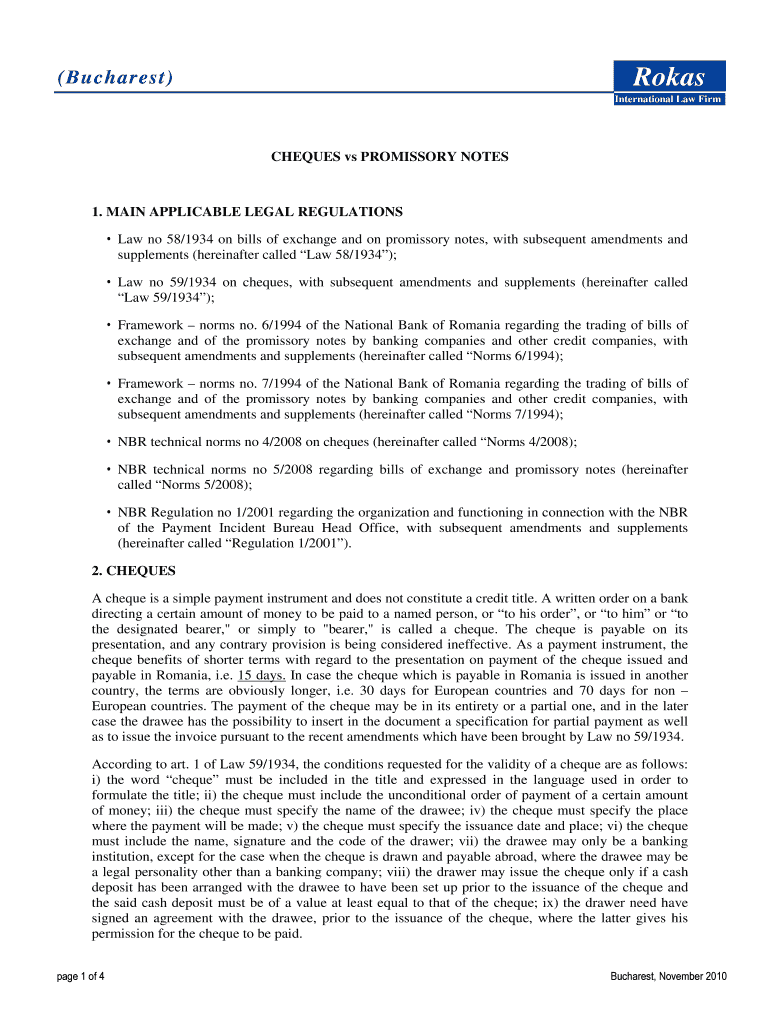

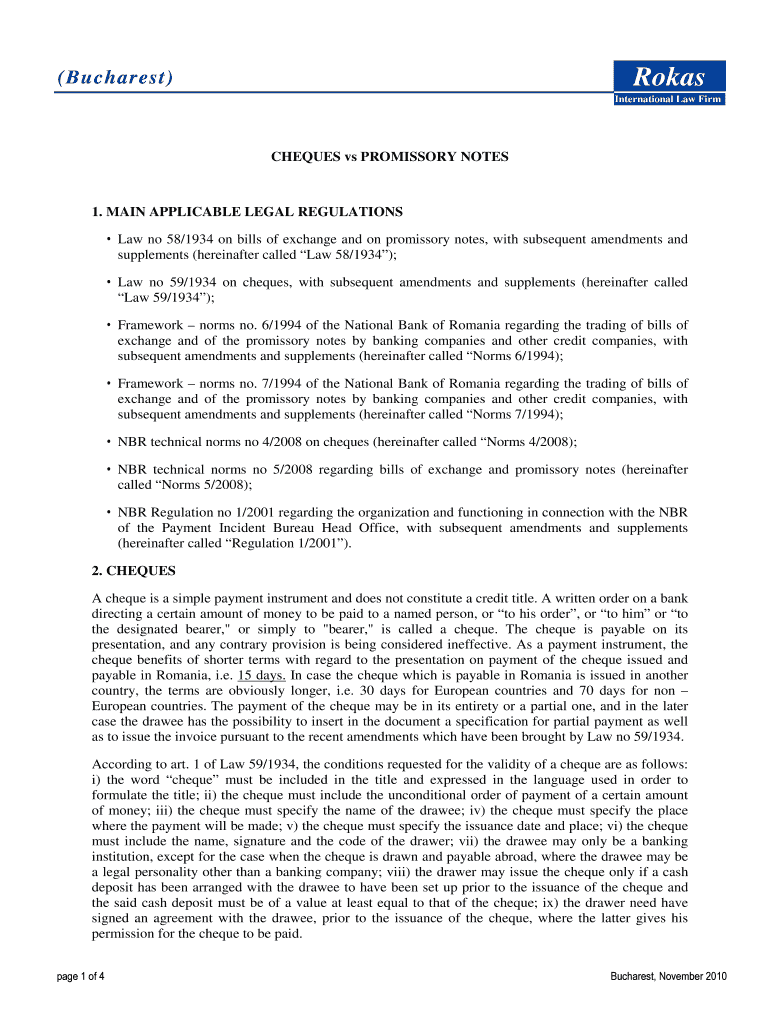

This document analyzes and compares the laws and regulations surrounding cheques and promissory notes in Romania, outlining their definitions, legal requirements, and implications for use as payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cheques vs promissory notes

Edit your cheques vs promissory notes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cheques vs promissory notes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cheques vs promissory notes online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cheques vs promissory notes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cheques vs promissory notes

How to fill out CHEQUES vs PROMISSORY NOTES

01

For cheques, write the date on the top right corner.

02

Write the name of the payee on the line that says 'Pay to the order of'.

03

Fill in the amount in numbers in the box on the right.

04

Write out the amount in words on the line below the payee's name.

05

Sign the cheque at the bottom right in the designated area.

06

Include a memo for personal tracking if desired.

07

For promissory notes, start with the title 'Promissory Note'.

08

Clearly state the date of the agreement.

09

Identify the parties involved (the borrower and the lender).

10

Specify the amount being borrowed and the interest rate, if applicable.

11

Outline the repayment terms, including the due date.

12

Include any additional terms, such as penalties for late payment.

13

Sign the document at the end to validate the agreement.

Who needs CHEQUES vs PROMISSORY NOTES?

01

Individuals or businesses making payments to others may need cheques.

02

Freelancers or contractors often use cheques to receive payments.

03

Promissory notes are useful for borrowers and lenders in personal or business loans.

04

Investors may use promissory notes to formalize agreements on loans or credit.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a cheque and a promissory note?

A promissory note is a written promise of payment within the specified time to an amount, more usually between two parties or persons. On the other hand, a cheque is an order written by an account holder in favour of their bank to pay out a specified amount of money for one who has been identified as a beneficiary.

What is the difference between cheque bill of exchange and promissory note pdf?

A promissory note is a written promise, whereas a bill of exchange is a written order. The promissory note allows no copies, whereas a bill of exchange can have multiple copies.

Why is a check considered a negotiable instrument?

It is essentially a piece of paper that can be transferred multiple times from one person or entity to another without the use of actual cash. A check that can be endorsed multiple times by different parties is an example of a negotiable instrument.

Why is it called negotiable instrument?

The term “negotiable” in a negotiable instrument refers to the fact that they are transferable to different parties. If it is transferred, the new holder obtains the full legal title to it. Non-negotiable instruments, on the other hand, are set in stone and cannot be altered in any way.

Why can a promissory note be considered a negotiable instrument?

Promissory notes are a common type of financial instrument in loan transactions. As the payer of such a note, it's important to know that, unless a note expressly stipulates that it is not negotiable, promissory notes are negotiable instruments that can be transferred or assigned by the original payee to a third party.

What is bill of exchange as a negotiable instrument?

5. A “bill of exchange” is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay on demand or at fixed or determinable future time a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.

Why are bills of exchange promissory notes and Cheques called negotiable instruments?

When a promissory note, bill of exchange or cheque is transferred to any person, so as to constitute that person the holder thereof, the instrument is said to be negotiated.

What is a promissory note in English?

(1) A promissory note is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on demand or at a fixed or determinable future time, a sum certain in money, to, or to the order of, a specified person or to bearer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHEQUES vs PROMISSORY NOTES?

Cheques are written orders directing a bank to pay a specific amount from the account of the issuer to the person named on the cheque. Promissory notes, on the other hand, are written promises to pay a specified amount to a designated party at a future date.

Who is required to file CHEQUES vs PROMISSORY NOTES?

Issuers of cheques and promissory notes are responsible for ensuring they are filled out correctly and filed, if necessary, as part of their financial documentation. In some jurisdictions, certain types of promissory notes may need to be filed with local authorities to be legally enforceable.

How to fill out CHEQUES vs PROMISSORY NOTES?

For a cheque, fill in the date, payee's name, amount in numbers and words, and sign it. For a promissory note, include the date, the names and addresses of both parties, the amount to be paid, the interest rate (if any), the payment schedule, and the signatures of both parties.

What is the purpose of CHEQUES vs PROMISSORY NOTES?

The purpose of cheques is to facilitate the transfer of money between parties without the need for cash. Promissory notes serve as a formal agreement where one party promises to pay another a specified amount, often used for loans or credit transactions.

What information must be reported on CHEQUES vs PROMISSORY NOTES?

Cheques must typically include the date, payee's name, amount, issuer's signature, and bank details. Promissory notes must include the full names and addresses of both parties, the principal amount, interest rate, repayment terms, and signatures.

Fill out your cheques vs promissory notes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cheques Vs Promissory Notes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.