AU AUS140ES 2023-2025 free printable template

Show details

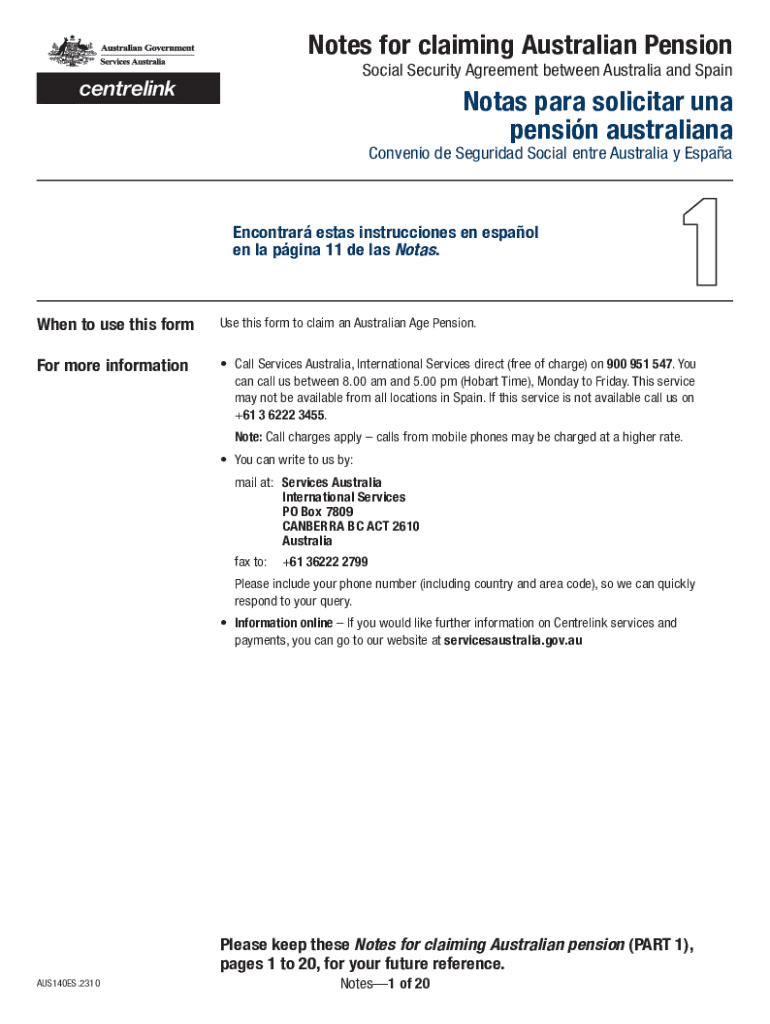

Si proporciona una dirección electrónica o un número de teléfono celular, es posible que reciba ... (llamada gratuita) al 900 951 547 o al +61 3 6222 3455.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notes for claiming australian

Edit your notes for claiming australian form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notes for claiming australian form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU AUS140ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out notes for claiming australian

How to fill out AU AUS140ES

01

Gather all necessary personal information including your address and contact details.

02

Obtain documentation required to support your claims, such as income statements or proof of residency.

03

Carefully read all instructions provided with the AU AUS140ES form to ensure you understand what is required.

04

Start filling out the form by entering your personal details in the designated sections.

05

Provide accurate information in response to each question, making sure to double-check for any errors.

06

Attach any required supporting documents or evidence as specified in the instructions.

07

Review the completed form to ensure all information is correct and complete before submission.

08

Submit the form according to the provided submission guidelines, either online or by mail.

Who needs AU AUS140ES?

01

Individuals or organizations applying for benefits under the Australian government program that utilizes the AU AUS140ES form.

02

Anyone needing to report changes in their personal circumstances that may affect their eligibility for assistance.

03

Clients or service users who have been instructed by an agency or government office to complete the AU AUS140ES form for their case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AU AUS140ES?

AU AUS140ES is an Australian tax form used to report and pay the estimated tax liabilities for the income year.

Who is required to file AU AUS140ES?

Individuals and entities that are required to pay estimated tax during the income year must file AU AUS140ES.

How to fill out AU AUS140ES?

To fill out AU AUS140ES, you need to provide your personal details, income estimates, deductions, and calculate your estimated tax for the year.

What is the purpose of AU AUS140ES?

The purpose of AU AUS140ES is to facilitate the process of reporting and paying estimated tax liabilities to the Australian Taxation Office (ATO).

What information must be reported on AU AUS140ES?

The information that must be reported on AU AUS140ES includes taxpayer details, income estimates, deductions, and the calculation of estimated tax obligations.

Fill out your notes for claiming australian online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notes For Claiming Australian is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.