Get the free Pre-authorized Tax Payment Plan - City of Terrace

Show details

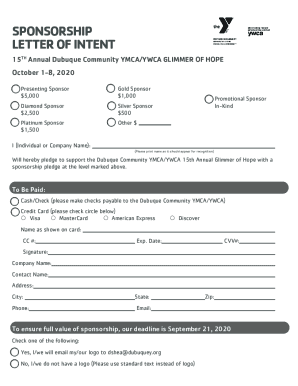

CITY OF TERRACE 3215 By Street, Terrace, B.C. V8G 2×8 Tel: 635-6311; Fax: 638-4777; Email: cashier terrace.ca PRE-AUTHORIZED TAX AND UTILITY PAYMENT PLAN The City of Terrace offers a Plan for taxpayers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized tax payment plan

Edit your pre-authorized tax payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized tax payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-authorized tax payment plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pre-authorized tax payment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-authorized tax payment plan

How to fill out pre-authorized tax payment plan:

01

Gather necessary documents: Before starting the process of filling out a pre-authorized tax payment plan, ensure you have all the required documents handy. This may include your social security number or tax identification number, previous tax returns, and any relevant financial statements.

02

Review the available options: Research and familiarize yourself with the different pre-authorized tax payment plan options that are offered by the tax authorities in your country. Understand the eligibility criteria, payment frequencies, and other terms and conditions associated with each plan.

03

Determine your eligibility: Determine whether you meet the eligibility requirements for the pre-authorized tax payment plan you are interested in. Each plan may have its own specific criteria, such as outstanding tax debt limits or previous compliance requirements.

04

Contact the tax authority: Reach out to the tax authority responsible for administering the pre-authorized tax payment plan. This can typically be done through a phone call, online portal, or in-person visit. Provide them with your details and express your interest in setting up a pre-authorized tax payment plan.

05

Submit the required forms: After initiating contact with the tax authority, you will likely need to fill out some forms to formally request the pre-authorized tax payment plan. These forms may ask for personal and financial information, as well as your preferred payment schedule and method.

06

Provide requested documentation: Along with the forms, you may need to submit additional documentation to support your application for the pre-authorized tax payment plan. This documentation could include copies of previous tax returns, proof of income, or any other documents requested by the tax authority.

07

Wait for approval: Once you have submitted all the required forms and documentation, patiently wait for the tax authority to process your application. This may take some time, so it is important to be patient and follow up as necessary.

08

Start making payments: If your pre-authorized tax payment plan application is approved, you will receive instructions on how to set up payments. Follow these instructions carefully to ensure your payments are made on time and according to the agreed schedule.

Who needs pre-authorized tax payment plan:

01

Individuals with irregular income: Freelancers, self-employed individuals, or those with variable income may find it difficult to set aside a lump sum for tax payments. A pre-authorized tax payment plan allows them to budget and make regular payments throughout the year.

02

Businesses and corporations: Companies that have significant tax liabilities can benefit from pre-authorized tax payment plans. By spreading out tax payment obligations, businesses can manage their cash flow more effectively and avoid financial strain.

03

Taxpayers with past tax debt: Individuals or businesses with outstanding tax debt may be eligible for a pre-authorized tax payment plan. This allows them to repay their debt in manageable installments, reducing the burden of a large lump-sum payment.

Overall, anyone who wants to simplify their tax payment process and avoid potential penalties or interest charges can benefit from a pre-authorized tax payment plan. It provides a structured approach to fulfilling tax obligations while minimizing financial strain.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pre-authorized tax payment plan?

A pre-authorized tax payment plan is a method for taxpayers to have their tax payments automatically withdrawn from their bank accounts on a regular schedule.

Who is required to file pre-authorized tax payment plan?

Taxpayers who want to ensure timely and consistent payment of their taxes may choose to file a pre-authorized tax payment plan.

How to fill out pre-authorized tax payment plan?

To fill out a pre-authorized tax payment plan, taxpayers need to provide their bank account information and authorize the tax authorities to withdraw payments on a regular basis.

What is the purpose of pre-authorized tax payment plan?

The purpose of a pre-authorized tax payment plan is to help taxpayers budget for their tax payments and avoid missing deadlines or incurring late fees.

What information must be reported on pre-authorized tax payment plan?

The pre-authorized tax payment plan must include the taxpayer's bank account information, the amount and frequency of payments, and any relevant tax identification numbers.

How can I send pre-authorized tax payment plan to be eSigned by others?

Once your pre-authorized tax payment plan is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in pre-authorized tax payment plan without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing pre-authorized tax payment plan and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the pre-authorized tax payment plan electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your pre-authorized tax payment plan.

Fill out your pre-authorized tax payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Tax Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.