Get the free Loan Guaranty

Show details

This document serves as a loan guaranty agreement where a guarantor unconditionally guarantees the prompt payment of a loan by the debtor to the lender. It outlines the responsibilities and liabilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan guaranty

Edit your loan guaranty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan guaranty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan guaranty online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan guaranty. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan guaranty

How to fill out Loan Guaranty

01

Obtain the Loan Guaranty application form from the appropriate financial institution or the government website.

02

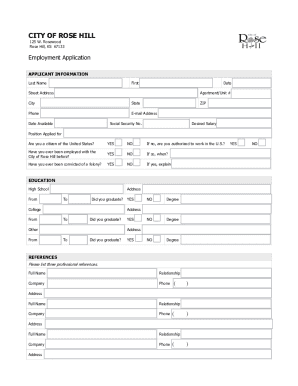

Fill in your personal information including name, address, social security number, and contact details.

03

Provide information about your employment history and income sources.

04

Specify the type of loan you are applying for and the amount needed.

05

Include details about the property that the loan will finance, if applicable.

06

Gather required documentation such as credit reports, income statements, and proof of assets.

07

Review the completed application for accuracy and completeness.

08

Submit the application along with any necessary documentation to the lender.

Who needs Loan Guaranty?

01

Veterans who are looking to buy a home.

02

Active-duty service members seeking favorable loan terms.

03

Surviving spouses of veterans who are eligible for benefits.

04

Individuals with a solid credit history looking for assistance with loan guarantees.

Fill

form

: Try Risk Free

People Also Ask about

What is a guaranty in a loan?

A loan guarantee is a legally binding commitment to pay a debt in the event the borrower defaults. This most often occurs between family members, where the borrower can't obtain a loan because of a lack of income or down payment, or due to a poor credit rating.

What are the disadvantages of a VA guaranteed loan?

Although VA does not set a cap on how much a veteran can borrow to finance a home purchase, the department will only guarantee 25 percent of the VA loan limit.

What is the VA loan guaranty?

The objective of the VA Home Loan Guaranty program is to help eligible Veterans, active-duty personnel, surviving spouses, and members of the Reserves and National Guard purchase, retain, and adapt homes in recognition of their service to the Nation.

What is a synonym for loan guarantee?

agreement, assurance, certificate, collateral, contract, deposit, insurance, security, warranty. Strong matches. attestation, bail, bargain, bond, certainty, certification, charter, covenant, earnest, gage, guaranty, lock, oath, pawn, pipe, recognizance, surety, testament, , undertaking, vow, warrant, word.

What is a VA loan guaranty?

How much is the guaranty? VA will guarantee up to 50 percent of a home loan up to $45,000. For loans between $45,000 and $144,000, the minimum guaranty amount is $22,500, with a maximum guaranty, of up to 40 percent of the loan up to $36,000, subject to the amount of entitlement a veteran has available.

What is the term loan guarantee?

A guaranteed loan is a type of loan in which a third party agrees to pay if the borrower should default. A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan Guaranty?

Loan Guaranty is a promise made by a guarantor to honor the obligations of a borrower if they fail to repay a loan, thus providing additional security to lenders.

Who is required to file Loan Guaranty?

Individuals or entities seeking to ensure the repayment of their loans or those offering loans requiring a guarantee are typically required to file Loan Guaranty.

How to fill out Loan Guaranty?

To fill out Loan Guaranty, you need to provide the required borrower information, specify the loan details, include the guarantor's information, and sign the document to acknowledge the guarantee.

What is the purpose of Loan Guaranty?

The purpose of Loan Guaranty is to minimize the risk for lenders by ensuring that the loan will be repaid, either by the borrower or the guarantor.

What information must be reported on Loan Guaranty?

Information that must be reported on Loan Guaranty typically includes borrower and guarantor details, loan amount, repayment terms, and any relevant financial disclosures.

Fill out your loan guaranty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Guaranty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.