Get the free Donor-Advised Fund Application Form - donorstrust

Show details

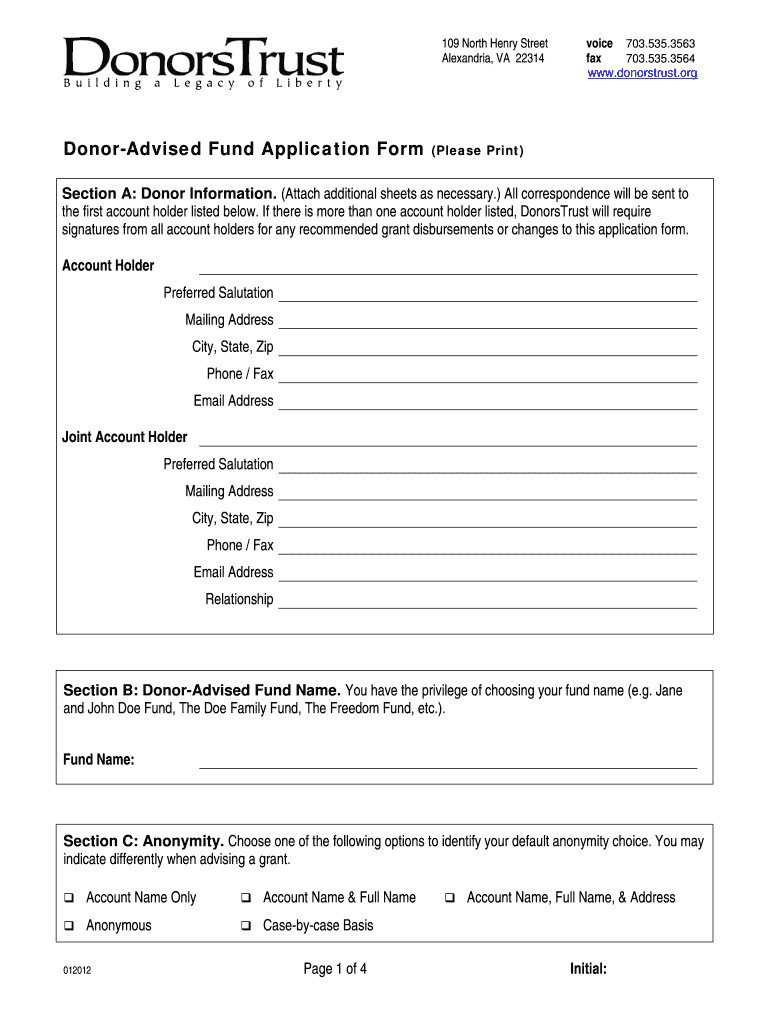

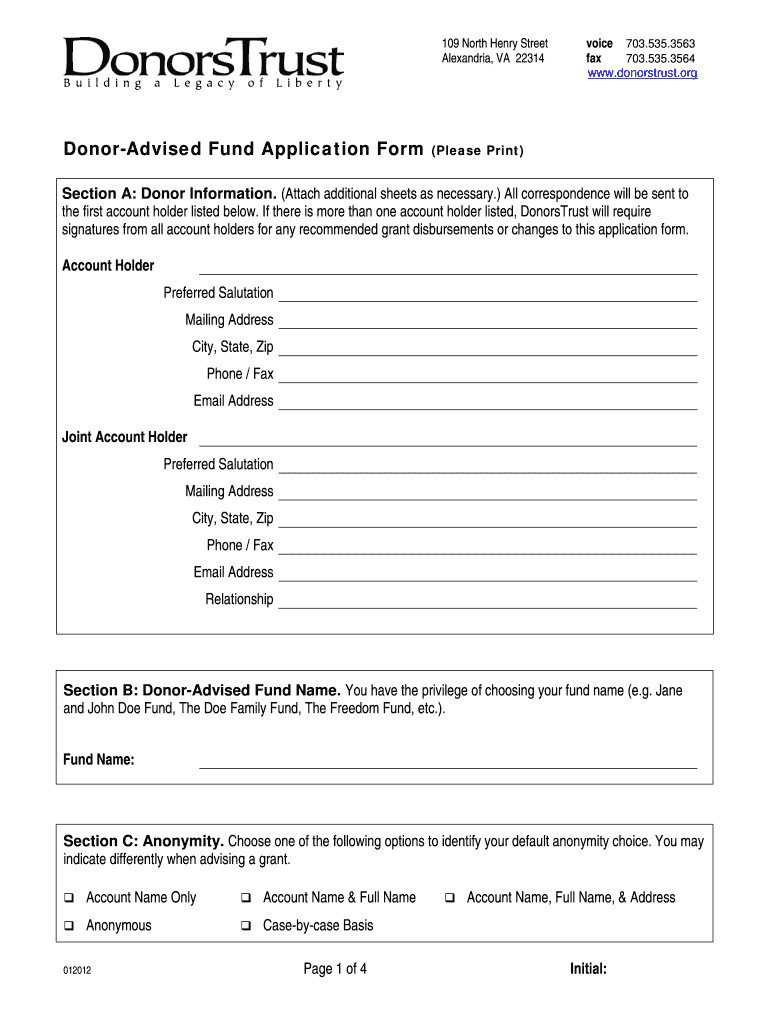

Application form for establishing a donor-advised fund at DonorsTrust, including sections for donor information, investment allocation, donor intent, and beneficiary designations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor-advised fund application form

Edit your donor-advised fund application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor-advised fund application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donor-advised fund application form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit donor-advised fund application form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor-advised fund application form

How to fill out Donor-Advised Fund Application Form

01

Begin by downloading the Donor-Advised Fund Application Form from the organization's website.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the required identification or tax information as requested.

04

Specify the name you would like to use for your Donor-Advised Fund.

05

Indicate your contribution amount and any preferences regarding grantmaking.

06

Review the fund's policies and ensure you comply with all guidelines.

07

Sign and date the application to confirm your agreement with the terms.

08

Submit the completed form via the specified method (online submission, email, or postal mail).

Who needs Donor-Advised Fund Application Form?

01

Individuals or families looking to manage their charitable giving in a tax-advantaged way.

02

Donors who wish to support multiple charitable organizations over time.

03

People wanting a structured way to involve family in philanthropy.

04

Anyone seeking to make significant charitable contributions while retaining control over the timing and recipients.

Fill

form

: Try Risk Free

People Also Ask about

What is a 990 form for donor-advised funds?

Purpose of Schedule Schedule D (Form 990) is used by an organization that files Form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

What is the 5% rule for donor-advised funds?

With private foundations, donors have more say in the use of their funds, must distribute 5% of average net asset value annually, and are subject to annual 1.39% excise tax on net investment income.

What is the downside to a donor-advised fund?

However, there are drawbacks: once a donation is made, it cannot be retracted and administrative fees can reduce the amount available for grants. Additionally, donors may have limited control over the fund's investments.

How much money do you need to start a donor-advised fund?

Sponsoring organizations often require a minimum initial contribution to establish a DAF account, which may range up to $250,000; NPT requires an initial contribution of $10,000. Once your DAF account is established and funded, you can make subsequent contributions in any amount at any time.

Can I set up my own donor-advised fund?

They are easy to set up and maintain. Opening a donor advised fund is a lot like opening an IRA. The minimum initial investment can be as low as $10,000, and it can be set up in a day. For balances under $500,000, investment options are simple and straightforward, from conservative to aggressive.

What is the downside to a donor-advised fund?

However, there are drawbacks: once a donation is made, it cannot be retracted and administrative fees can reduce the amount available for grants. Additionally, donors may have limited control over the fund's investments.

Can you setup your own donor-advised fund?

They are easy to set up and maintain. Opening a donor advised fund is a lot like opening an IRA. The minimum initial investment can be as low as $10,000, and it can be set up in a day. For balances under $500,000, investment options are simple and straightforward, from conservative to aggressive.

Who sets up donor-advised funds?

Generally, a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501(c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Donor-Advised Fund Application Form?

The Donor-Advised Fund Application Form is a document that individuals or organizations fill out to establish a donor-advised fund, which allows them to make charitable contributions while retaining advisory privileges on how those funds are distributed.

Who is required to file Donor-Advised Fund Application Form?

Individuals or organizations wishing to create a donor-advised fund at a sponsoring organization, such as a community foundation or financial institution, are required to file the Donor-Advised Fund Application Form.

How to fill out Donor-Advised Fund Application Form?

To fill out the Donor-Advised Fund Application Form, applicants typically need to provide personal information, details about the fund's purpose, the fund's name, and any specific instructions regarding donations and distributions, along with signatures from the donors.

What is the purpose of Donor-Advised Fund Application Form?

The purpose of the Donor-Advised Fund Application Form is to gather necessary information for establishing a donor-advised fund and to ensure compliance with regulatory requirements, benefiting the donor by allowing them to manage charitable contributions effectively.

What information must be reported on Donor-Advised Fund Application Form?

Information required on the Donor-Advised Fund Application Form typically includes the donor's name and contact information, the name of the fund, the intended purpose of the fund, and guidelines for grants, as well as any specific restrictions attached to the fund.

Fill out your donor-advised fund application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor-Advised Fund Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.