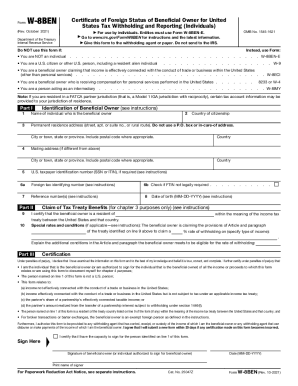

What is the W-8BEN Form?

The W-8BEN Form is a US Internal Revenue Service document known as the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). This form is used to collect NRA (Nonresident Alien) taxpayer data for reporting purposes, verify their country of residence, and certify that they can qualify for a lower tax withholding rate. If a person does not submit the record, they will have to pay the total 30% tax rate applicable for all non-US citizens.

Who needs to fill out the W-8BEN form?

Individuals foreign to the US must fill out the IRS form W-8BEN to document their alien status and claim applicable treaty benefits. Note that the document is relevant only when a tax treaty between the foreigner's country of origin and the United States has been signed. A tax treaty guarantees a reduced rate or exemption from withholding of all or particular items of income if the payer of the revenue is properly notified.

If you represent a foreign business entity, use the form W-8BEN-E instead.

What information do you need to file the tax form W-8BEN?

Filling out the IRS template is straightforward, but be sure you have the documents containing the following information:

- Full name

- Country of citizenship

- Complete residence address with a postal code

- Mailing address

- SSN or ITIN, if required

- Foreign tax identification number

- Date of birth.

In Part II, you must provide information if special rates are applicable for you and explain additional conditions to be eligible for the withholding rates. If you are unsure about correct explanations, ask for a specialist's advice.

How do I Fill out the W-8BEN form in 2007?

Follow the instructions on the IRS website or fill out the template online using a professional solution with legally-binding electronic signatures:

- Click the Get Form button at the top of the page.

- Select the fillable fields to insert your information.

- Provide owner's personal information in Part I: name, citizenship, residence address, SSN or ITIN, DOB, etc.

- Write the claim of tax treaty benefits in Part II.

- Double-check the correctness of your data before moving to Part III.

- Click on the Signature field to eSign the document, add the date, and print the signer's name.

- Select Done to save changes and download or send your file.

Is IRS Form W-8BEN Accompanied by any Other Documents?

So far as the sample is filled out when a withholding agent asks the foreign individual about it, the accompanying documents can be requested at their discretion. Typically, tax form W-8BEN is submitted along with form W-8 (Certificate of Foreign Status).

When is Form W-8BEN Due?

Remember, the template is filled out only upon request, which is always made before the payment.

Where do I send Form W-8BEN?

The completed document must be directed to the requestor, not the Internal Revenue Service.