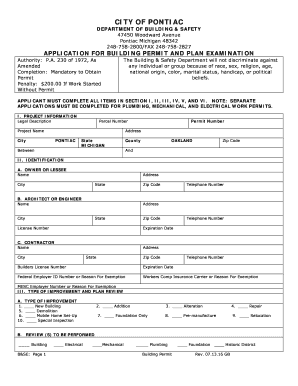

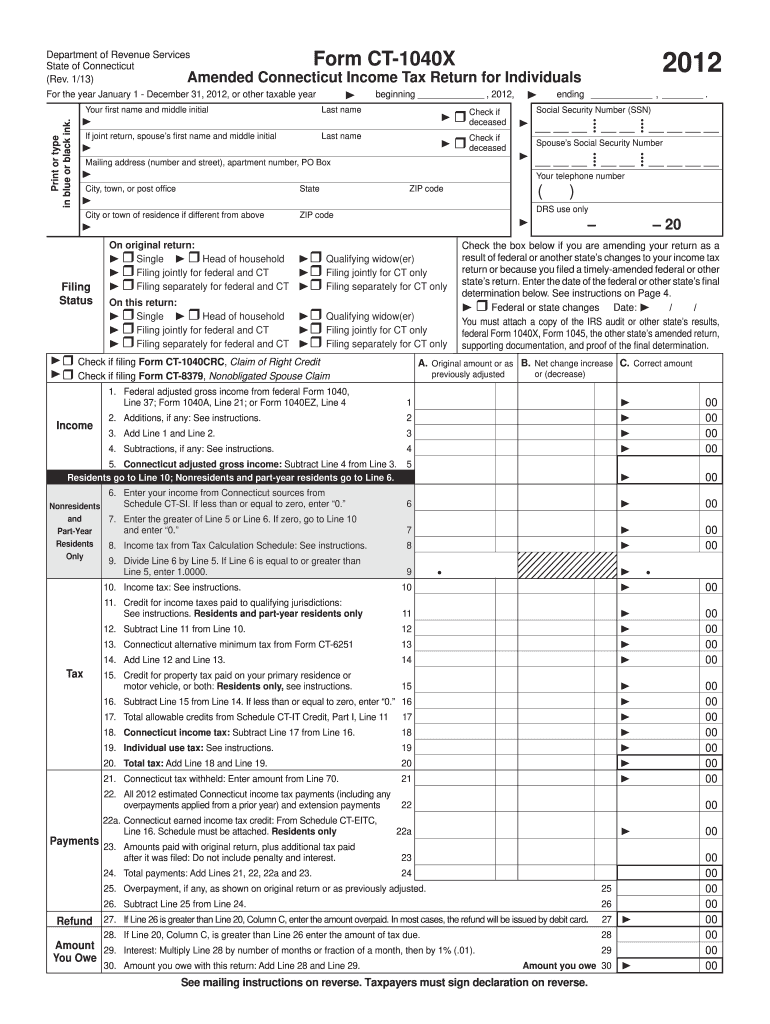

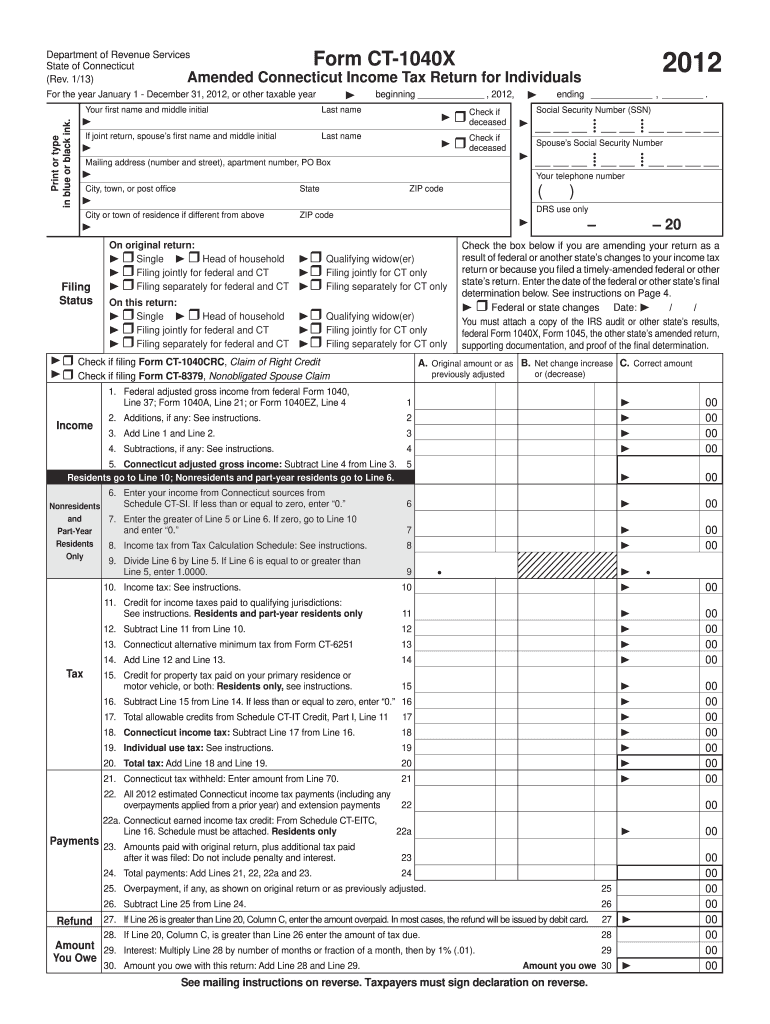

CT DRS CT-1040X 2012 free printable template

Show details

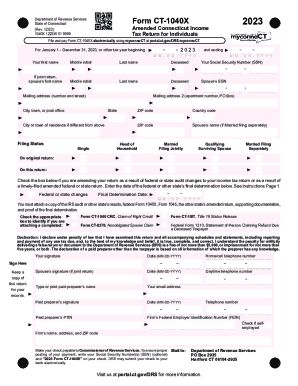

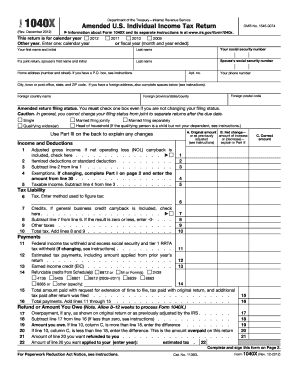

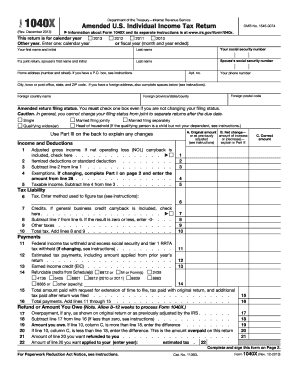

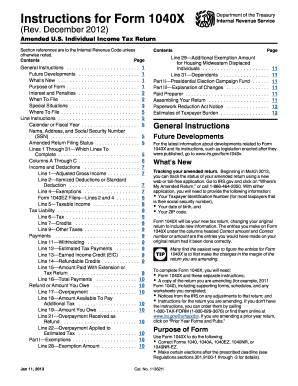

To ensure proper posting of your payment write your Social Security Number s SSN optional and 2012 Form CT-1040X on your check. Department of Revenue Services State of Connecticut Amended Rev. 1/13 Form CT-1040X beginning 2012 ending Print or type in blue or black ink. 70h. 70. Total Connecticut income tax withheld Enter here and on Line 21 Column C. Instructions for Amended Connecticut Income Tax Return Purpose Use this form to amend a previously- led 2012 not be used to amend any other...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-1040X

Edit your CT DRS CT-1040X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-1040X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-1040X online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT DRS CT-1040X. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1040X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-1040X

How to fill out CT DRS CT-1040X

01

Download the CT-1040X form from the Connecticut Department of Revenue Services (CT DRS) website.

02

Read the instructions provided to understand the purpose of the form and ensure it is the correct version.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

Indicate the tax year you are amending in the designated section.

05

Complete the appropriate sections of the form, including details of changes to your income, credits, and deductions.

06

Calculate the revised tax amount owed or the refund you are entitled to based on your changes.

07

If applicable, provide a detailed explanation of why you are amending your return in the designated area.

08

Attach any necessary documentation that supports the changes you are making.

09

Review the entire form for accuracy and completeness before signing.

10

Submit the completed CT-1040X form along with any required payment or additional tax owed to the CT DRS.

Who needs CT DRS CT-1040X?

01

Individuals who have filed a Connecticut income tax return and need to correct errors or make changes.

02

Taxpayers who are claiming additional deductions or credits that were not included in their original return.

03

Those who need to report changes in income or filing status that affect their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What is a standard printer ink?

A standard yield cartridge is the most common cartridge size on the market. It yields a smaller number of prints than the high yield or extra high yield, and is sold at a cheaper price. For customers that don't print very often, spending a bit less for a standard yield cartridge makes sense.

What is normal ink made of?

The base ingredient of printer ink is usually oil; either linseed oil, soybean oil, or a petroleum distillate. Carbon black and varnish are combined to make basic black ink. Colored ink are made with dyes/compounds like peacock blue, yellow lake, diarylide orange, and phthalocyanine green.

What is printer ink made from today?

The base ingredient of printer ink is usually oil; either linseed oil, soybean oil, or a petroleum distillate. Carbon black and varnish are combined to make basic black ink. Colored ink are made with dyes/compounds like peacock blue, yellow lake, diarylide orange, and phthalocyanine green.

What is Canon ink made of?

Ink is made up of pigment, solvent, additives and water. Pigment is dissolved at the molecular level in dye ink.

Does Canon use dye or pigment ink?

Canon ink cartridges work in sets of both pigment and dye-based inks, which is why most Canon printers take two black cartridges. For example the Canon PGI-450XL high yield black ink cartridge is pigment-based, while the Canon CLI-451XL high yield black ink cartridge is dye-based.

What are the 3 main ingredients of ink?

Essentially, the key ingredients to an ink are pigments, resins and waxes and additives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CT DRS CT-1040X in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your CT DRS CT-1040X and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get CT DRS CT-1040X?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CT DRS CT-1040X and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out CT DRS CT-1040X on an Android device?

Complete your CT DRS CT-1040X and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CT DRS CT-1040X?

CT DRS CT-1040X is the Connecticut Department of Revenue Services form used to amend an individual income tax return.

Who is required to file CT DRS CT-1040X?

Individuals who need to correct errors or changes in their previously filed Connecticut income tax returns are required to file CT DRS CT-1040X.

How to fill out CT DRS CT-1040X?

To fill out CT DRS CT-1040X, taxpayers need to provide their personal information, indicate the tax year being amended, explain the changes made, and report the corrected amounts in the appropriate sections of the form.

What is the purpose of CT DRS CT-1040X?

The purpose of CT DRS CT-1040X is to allow taxpayers to correct inaccuracies in their previously filed state income tax returns and ensure that the information reported is accurate.

What information must be reported on CT DRS CT-1040X?

CT DRS CT-1040X requires taxpayers to report their personal details, the original and corrected tax amounts, reasons for the amendment, and any supporting documentation for the changes made.

Fill out your CT DRS CT-1040X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-1040x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.