Who needs TN IFTA 56 form?

The given form is the International Fuel Tax Agreement (IFTA) Tax Return. It must be submitted by each licensee holding a license under the International Fuel Tax Agreement operating in the State of Tennessee. The Agreement obliges the IFTA carriers to report and pay fuel taxes for motor vehicles used, designed, or maintained for transportation of persons or property when the following conditions are also met:

-

The vehicle has two-axle power unit and its gross weight exceeds 26,000 pounds;

-

The vehicle has three-axle power unit;

-

The vehicle is used in a combination the overall weight of which exceeds 26,000 pounds.

What is the purpose of the Fuel Tax Return?

The form aims to summarize the tax amount of the various types of fuel used and to determine the total amount or overpayment due, including any appropriate penalty.

Is the form accompanied by any other documents?

To properly file the IFTA tax return, it is necessary to provide the following documents:

Form 56-101 and its supplements;

Form 56-102.

When is the form due?

The tax return must be submitted once a quarter. The due date is the last day of the month following the quarter’s end.

How do I fill out the form?

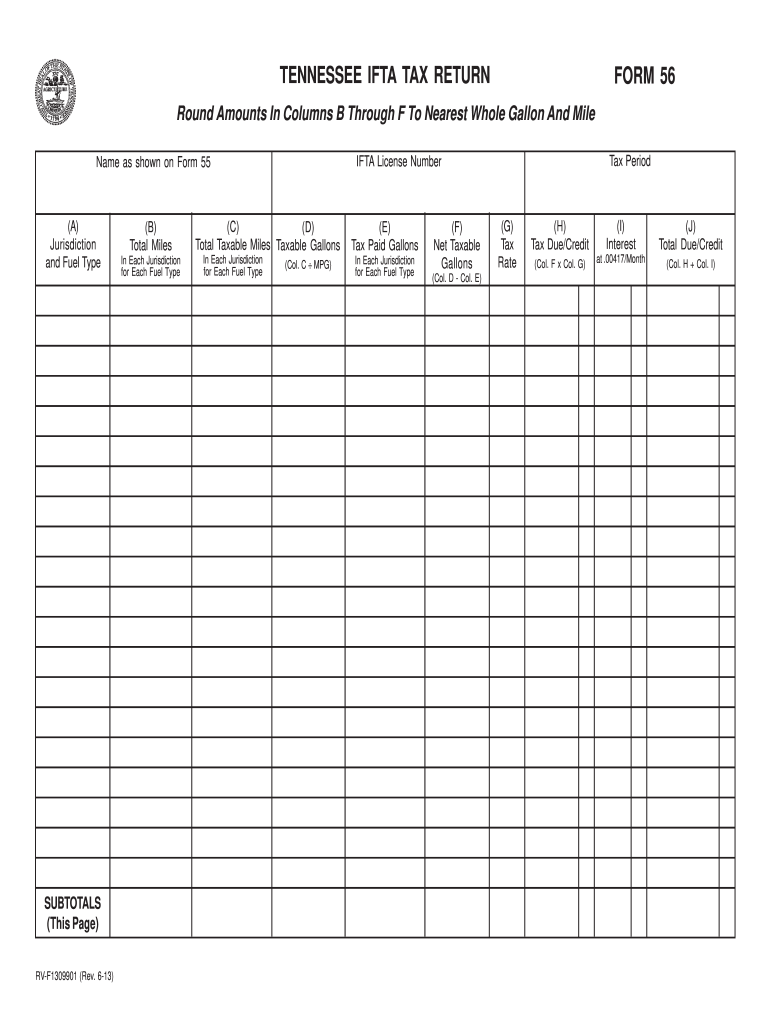

The TN IFTA 56 form is a one-page form that does not require indicating much information except for the following details:

-

Name of the licensee;

-

License number;

-

Tax period;

-

Jurisdiction and type of fuel;

-

Total and total taxable miles;

-

Taxable, tax paid and net taxable gallons;

-

Tax rate;

-

Tax due or credit;

-

Interest;

-

Total amount due or credit.

The bottom line of the table requires computing subtotals of all the explained characteristics. More details on form’s completion can be found in these instructions.

Where do I send the completed IFTA 56 Tax Return?

The filled out form should be directed to the Tennessee Department of Revenue, Taxpayer and Vehicle Services Division, Motor Carrier Section, 301 Plus Park, Suite 100, Nashville TN 37217-1036.