IRS 1120S - Schedule M-3 2013 free printable template

Show details

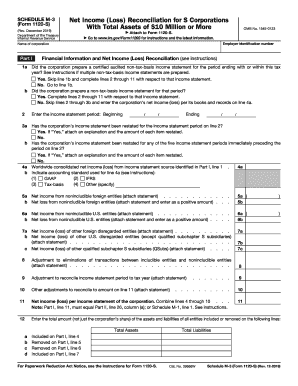

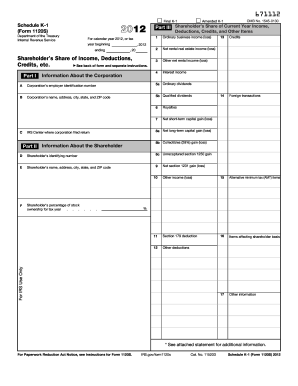

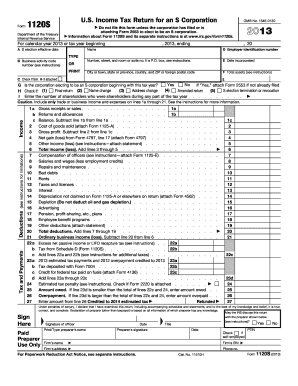

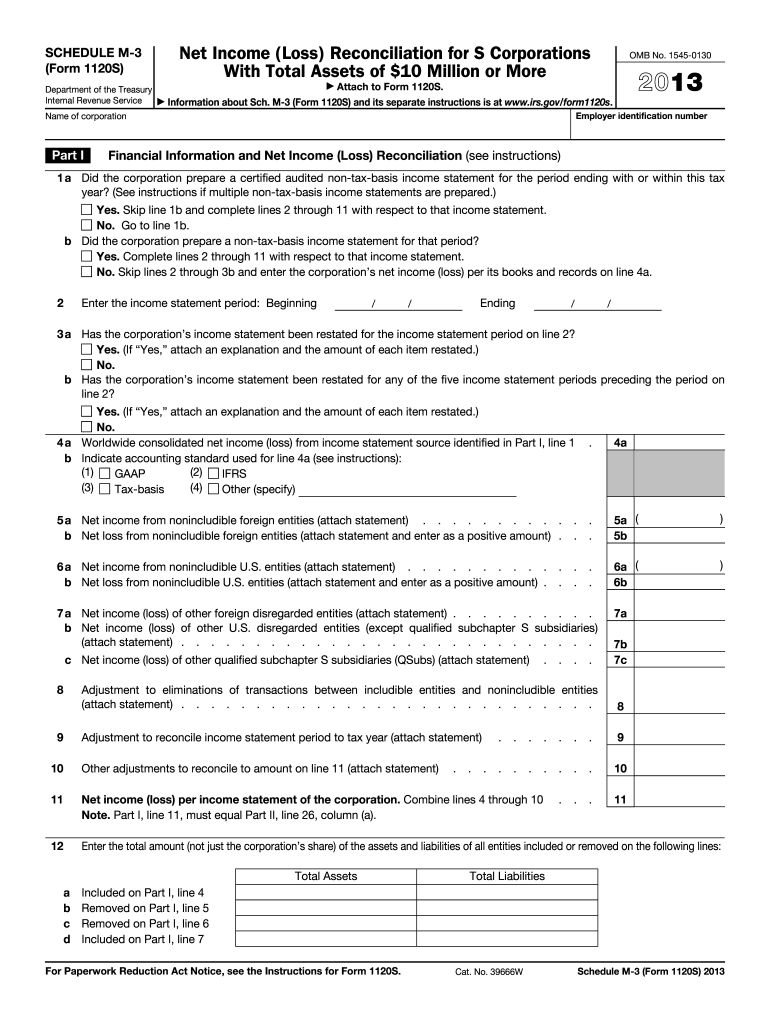

Part I line 11 must equal Part II line 26 column a. Enter the total amount not just the corporation s share of the assets and liabilities of all entities included or removed on the following lines a b c d Total Liabilities Included on Part I line 4 Removed on Part I line 5 For Paperwork Reduction Act Notice see the Instructions for Form 1120S. Cat. No. 39666W Schedule M-3 Form 1120S 2013 Page Reconciliation of Net Income Loss per Income Statement of the Corporation With Total Income Loss per...Return see instructions Income Loss per Income Statement Income Loss Items Income loss from equity method corporations attach statement. SCHEDULE M-3 Form 1120S Net Income Loss Reconciliation for S Corporations With Total Assets of 10 Million or More OMB No* 1545-0130 Attach to Form 1120S* Department of the Treasury Internal Revenue Service Information about Sch* M-3 Form 1120S and its separate instructions is at www*irs*gov/form1120s. Employer identification number Name of corporation Part I...Financial Information and Net Income Loss Reconciliation see instructions 1 a Did the corporation prepare a certified audited non-tax-basis income statement for the period ending with or within this tax year See instructions if multiple non-tax-basis income statements are prepared* Yes. Skip line 1b and complete lines 2 through 11 with respect to that income statement. No* Go to line 1b. Yes. Complete lines 2 through 11 with respect to that income statement. No* Skip lines 2 through 3b and enter...the corporation s net income loss per its books and records on line 4a* Enter the income statement period Beginning / Ending 3 a Has the corporation s income statement been restated for the income statement period on line 2 Yes. If Yes attach an explanation and the amount of each item restated* No* line 2 4 a Worldwide consolidated net income loss from income statement source identified in Part I line 1 b Indicate accounting standard used for line 4a see instructions GAAP IFRS Tax-basis Other...specify. 4a 5 a Net income from nonincludible foreign entities attach statement. b Net loss from nonincludible foreign entities attach statement and enter as a positive amount. 5a 5b 6a 6b 7 a Net income loss of other foreign disregarded entities attach statement. attach statement. 7a 7b 7c Adjustment to eliminations of transactions between includible entities and nonincludible entities Other adjustments to reconcile to amount on line 11 attach statement Note. Temporary Difference Permanent Tax...Return Gross foreign dividends not previously taxed. Subpart F QEF and similar income inclusions attach statement U*S* dividends not eliminated in tax consolidation. statement. Items relating to reportable transactions attach 21a foreign. Interest income attach Form 8916-A. Total accrual to cash adjustment. Hedging transactions. Mark-to-market income loss. Cost of goods sold attach Form 8916-A. Sale versus lease for sellers and/or lessors. Section 481 a adjustments. Unearned/deferred revenue....Income recognition from long-term contracts. Original issue discount and other imputed interest. abandonment worthlessness or other disposition of assets other than inventory and pass-through entities Gross capital gains from Schedule D excluding amounts from pass-through entities.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S - Schedule M-3

How to edit IRS 1120S - Schedule M-3

How to fill out IRS 1120S - Schedule M-3

Instructions and Help about IRS 1120S - Schedule M-3

How to edit IRS 1120S - Schedule M-3

To edit the IRS 1120S - Schedule M-3 form, ensure you have the most current version of the form downloaded. Use pdfFiller's editing tools to add or modify information directly on the form. After making changes, save the updated version for your records or further processing.

How to fill out IRS 1120S - Schedule M-3

Filling out the IRS 1120S - Schedule M-3 involves several steps:

01

Gather financial statements and necessary tax documentation.

02

Enter your business's identifying information at the top of the form.

03

Complete sections regarding income, deductions, and other adjustments as instructed.

04

Review entries for accuracy before submission.

About IRS 1120S - Schedule M-3 2013 previous version

What is IRS 1120S - Schedule M-3?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120S - Schedule M-3 2013 previous version

What is IRS 1120S - Schedule M-3?

IRS 1120S - Schedule M-3 is a tax form used by S corporations to report income, deductions, and other adjustments to reconcile financial statements and tax returns. This schedule is required for certain S corporations that must provide additional financial data to the IRS.

What is the purpose of this form?

The primary purpose of IRS 1120S - Schedule M-3 is to enhance transparency in reporting by summarizing financial information from the corporation's financial statements. This form helps the IRS assess tax compliance and ensure that the income and deductions reported align with financial reporting standards.

Who needs the form?

Corporations must file IRS 1120S - Schedule M-3 if they meet specific asset thresholds or if the IRS mandates more detailed reporting based on their financial activities. Generally, S corporations with total assets exceeding $10 million must complete this schedule.

When am I exempt from filling out this form?

You may be exempt from completing IRS 1120S - Schedule M-3 if your S corporation has total assets below the $10 million threshold or if it qualifies for specific exceptions outlined by the IRS. Always consult IRS guidelines to determine your eligibility.

Components of the form

The IRS 1120S - Schedule M-3 consists of three main parts: Part I focuses on income and deductions, Part II addresses reconciliation of financial statement income, and Part III details additional information about tax adjustments. Each section has distinct reporting requirements tailored to facilitate IRS review.

Due date

The due date for filing IRS 1120S - Schedule M-3 coincides with the due date of the IRS Form 1120S, typically March 15 for calendar year filers. Corporations can request a six-month extension if more time is needed to complete the forms accurately.

What payments and purchases are reported?

IRS 1120S - Schedule M-3 requires the reporting of various payments and purchases, including but not limited to compensation expenses, interest income, and depreciation costs. Corporations should consistently account for all relevant transactions within the reporting period.

How many copies of the form should I complete?

You typically need to file one copy of IRS 1120S - Schedule M-3 along with the main Form 1120S. Keep a copy for your records and be prepared to furnish it if requested by the IRS.

What are the penalties for not issuing the form?

Failure to file IRS 1120S - Schedule M-3 as required may result in substantial penalties. The IRS may impose fines for late filings or inaccuracies, which could significantly affect the corporation's financial standing. Adhering to filing requirements is essential for maintaining compliance.

What information do you need when you file the form?

When filing IRS 1120S - Schedule M-3, gather essential information, including financial statements, detailed income and expense records, and documentation supporting deductions. Accurate and complete records streamline the filing process and minimize the risk of errors.

Is the form accompanied by other forms?

IRS 1120S - Schedule M-3 is typically submitted alongside Form 1120S. Other supporting documentation may also be required, such as federal and state tax returns or forms relating to specific deductions. Ensure all necessary forms are included in your submission to prevent delays.

Where do I send the form?

The completed IRS 1120S - Schedule M-3 should be sent to the address specified in the IRS Form 1120S instructions. Be sure to check which processing center applies to your state to ensure timely processing of your return.

See what our users say