Get the free California 540NR Nonresident or Part-Year Resident Booklet. Forms ...

Show details

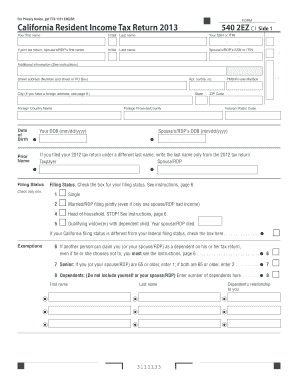

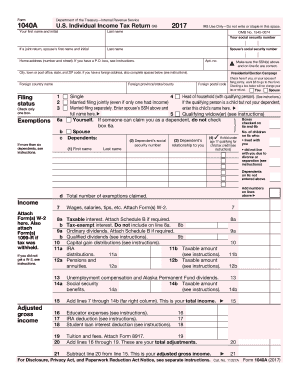

94 This space reserved for 2D barcode Form 540 C1 2013 Side 3 Use 95 Use Tax. This is not a total line. Do not send cash. Write your SSN or ITIN and 2013 Form 540 as applicable on the check or money order. 7 Schedule D 540 2013 Side 1 8 Combine line 4 and line 7. If a loss go to line 9. If a gain go to line 10. Ca.gov. If you have a tax liability for 2013 or owe any of the following taxes for 2013 you must file Form 540. If you filed Form 540 2EZ for 2013 do not use the Form 540 2EZ...instructions to figure amounts on this worksheet. Do I Have to File. What s New and Other Important Information for 2013. Which Form Should I Use. Instructions for Form 540. Instead get the 2013 California 540 Personal 1. Complete the Record of Estimated Tax Payments on the next page for your files. 6667. 19a b Enter the sum of line 48 line 61 and line 62 from your 2013 Form 540 or the sum of line 63 line 71 and line 72 from your Long Form 540NR.. Nonrefundable Renter s Credit Qualification...Record. Additional Information. Frequently Asked Questions. Credit Chart. Voluntary Contribution Fund Descriptions. Form 540 California Resident Income Tax Return. Schedule CA 540 California Adjustments Residents. FTB 3885A Depreciation and Amortization Adjustments. 45 FTB 3519 Payment for Automatic Extension for Individuals. 47 Form 540-ES Estimated Tax for Individuals. 48 FTB 3506 Child and Dependent Care Expenses Credit. 53 2013 California Tax Table. 59 How To Get California Tax Information....66 Privacy Notice. 66 Automated Phone Service. 67 When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day. April 15 2014 Last day to file and pay the 2013 amount you owe to avoid penalties and interest. See form FTB 3519 on page 47 for more information* If you are living or traveling outside the United States on April 15 2014 the dates for filing your tax return and paying your tax are different. See form FTB 3519 on page...47 for more information* October 15 2014 June 16 2014 September 15 2014 January 15 2015 The dates for 2014 estimated tax payments. Generally you do not have to make estimated tax payments if your California withholding in each payment period totals 90 of your required annual payment. Also you do not have to make estimated tax payments if you will pay enough through withholding to keep the amount you owe with your tax return under 500 250 if married/registered domestic partner RDP filing...separately. However if you do not pay enough tax either through withholding or by making estimated tax payments you may have an underpayment penalty. You may qualify if You earned less than 46 227 51 567 if married filing jointly and have qualifying children* You have no qualifying children and you earned less than 14 340 19 680 if married filing jointly. Call the Internal Revenue Service IRS at 800. 829. 4477 when instructed enter topic 601 see the federal income tax booklet or go to the IRS...website at irs. gov and search for eitc assistant. Currently no comparable state credit exists. Health Insurance Coverage The Affordable Care Act ACA or health care law includes new health insurance coverage and financial assistance options including the federal premium tax credit for individuals and families.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540540A BK

How to edit CA FTB 540540A BK

How to fill out CA FTB 540540A BK

Instructions and Help about CA FTB 540540A BK

How to edit CA FTB 540540A BK

To edit the CA FTB 540540A BK form, you can utilize pdfFiller's tools. Simply upload your form to the platform, and then make any necessary changes using the editing features provided. Ensure that all new information is accurate, as any discrepancies may lead to complications during processing.

How to fill out CA FTB 540540A BK

Filling out the CA FTB 540540A BK form requires careful attention to detail. First, gather all necessary financial documents, including income statements and any relevant identification numbers. Proceed by entering your information accurately in each designated field, making sure to follow any specific instructions outlined on the form.

About CA FTB 540540A BK 2013 previous version

What is CA FTB 540540A BK?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540540A BK 2013 previous version

What is CA FTB 540540A BK?

The CA FTB 540540A BK is a tax form used by California residents to report adjustments to their California Personal Income Tax returns. This form is typically utilized by individuals who are claiming certain credits or deductions that require further clarification or detail beyond standard filing procedures.

What is the purpose of this form?

The primary purpose of the CA FTB 540540A BK form is to provide a means for taxpayers to report additional information that may impact their tax liability. This form helps ensure accurate reporting, allows for the consideration of specific adjustments, and can be critical for compliance with California tax laws.

Who needs the form?

Taxpayers who have filed their California Personal Income Tax return but need to report additional information may require the CA FTB 540540A BK. This typically includes individuals claiming certain adjustments, credits, or deductions that are not covered in the initial return.

When am I exempt from filling out this form?

If your original tax return is complete and accurate without needing any adjustments for credits or deductions, you may not need to fill out the CA FTB 540540A BK form. Additionally, if you do not meet specific thresholds for reporting or are using a simplified filing method, this form may not apply to you.

Components of the form

The CA FTB 540540A BK form includes various sections that capture specific taxpayer information, adjustments claimed, and supporting details. Sections typically include personal identification, taxable income, adjustments for deductions and credits, and a declaration statement to confirm accuracy of the information provided.

What are the penalties for not issuing the form?

Failure to issue the CA FTB 540540A BK when necessary may result in penalties, including fines or additional interest on unpaid taxes. The California Franchise Tax Board may assess these penalties depending on the circumstances surrounding the late or omitted filing.

What information do you need when you file the form?

When preparing to file the CA FTB 540540A BK, gather all pertinent financial records and identification numbers, such as your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). You may also need documentation supporting any deductions or credits claimed to ensure accuracy and compliance.

Is the form accompanied by other forms?

In many cases, the CA FTB 540540A BK form may need to be accompanied by supporting documentation or additional related forms, depending on the adjustments or credits being claimed. It is crucial to check the guidelines provided with the form to ensure you include all necessary paperwork for proper processing.

Where do I send the form?

The completed CA FTB 540540A BK form should be sent to the California Franchise Tax Board at the address specified in the form's instructions. Ensure that you mail it to the correct location based on your circumstances to avoid delays in processing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.