Get the free 2014 Form 593-C -- Real Estate Withholding Certificate - California ...

Show details

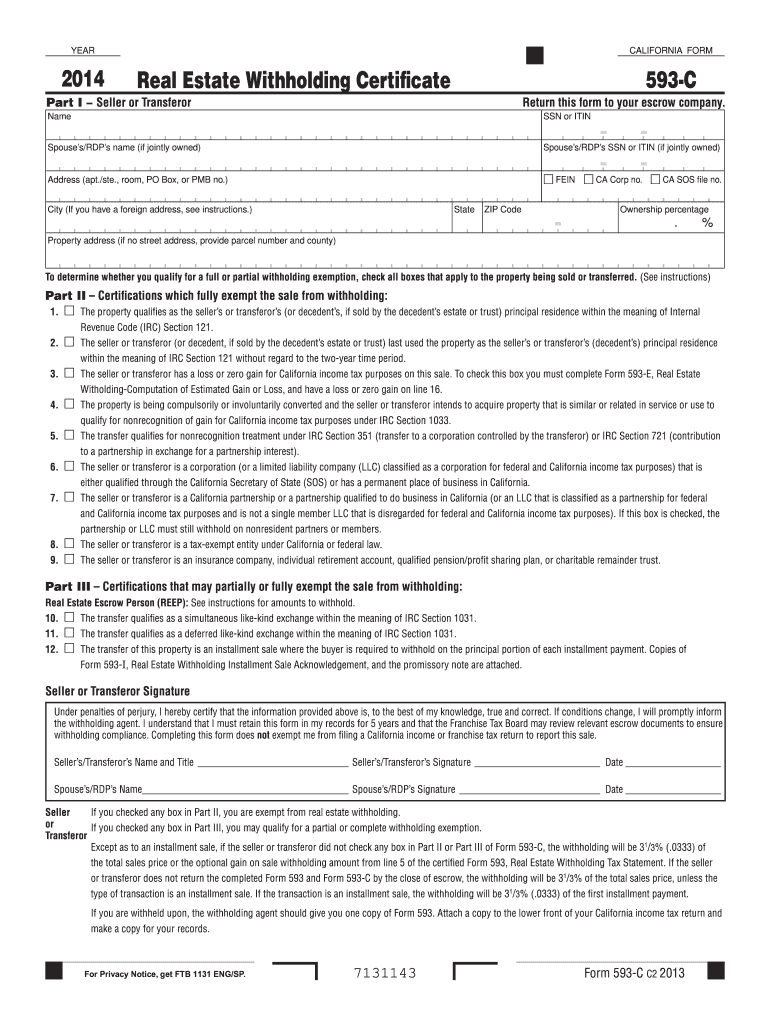

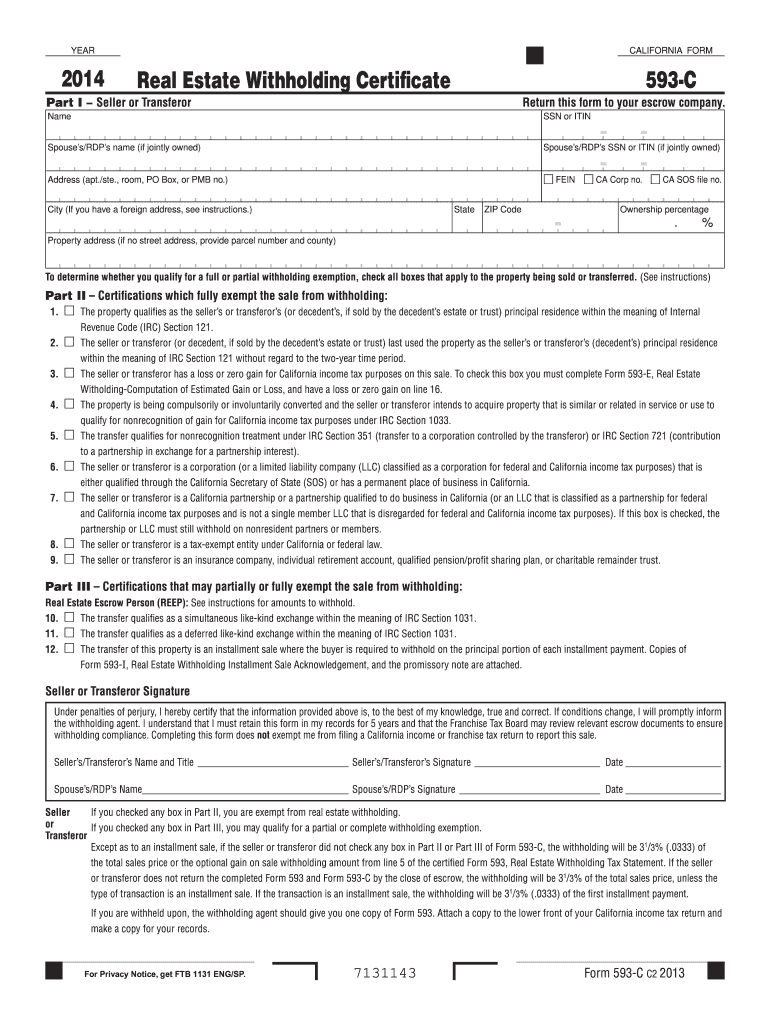

For Privacy Notice get FTB 1131 ENG/SP. 7131143 Form 593-C C2 2013 Instructions for Form 593-C References in these instructions are to the Internal Revenue Code IRC as of January 1 2009 and to the California Revenue and Taxation Code R TC. What s New Like-Kind Exchanges For taxable years beginning on or after January 1 2014 California Revenue Taxation Code R TC Sections 18032 and 24953 require California resident and non-resident taxpayers who defer gain on the sale or exchange of California...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2014 form 593-c

Edit your 2014 form 593-c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

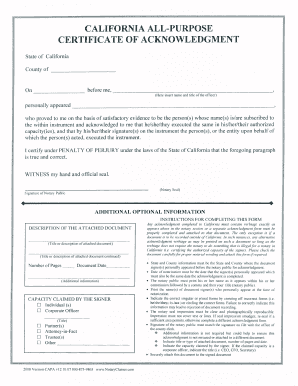

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 form 593-c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2014 form 593-c online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2014 form 593-c. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 form 593-c

How to fill out CA FTB 593-C

01

Begin by downloading Form FTB 593-C from the California Franchise Tax Board website.

02

Fill in your name and the tax identification number (TIN) at the top of the form.

03

Enter the date of the sale or exchange of property in the appropriate section.

04

Provide details about the property, including the address and description.

05

Input the amount received at the time of sale in the designated field.

06

Indicate any applicable adjustments to the sale amount.

07

Complete the seller's information, including their name, address, and TIN.

08

Review all entered data for accuracy and completeness.

09

Sign and date the form before submission.

Who needs CA FTB 593-C?

01

Anyone who sells or exchanges real property in California

02

Real estate agents and intermediaries involved in the transaction

03

Buyers or sellers involved in real estate transactions subject to withholding

Fill

form

: Try Risk Free

People Also Ask about

Does Form 593 need to be attached to tax return?

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form 592-B and/or 593). Attach one copy of Form(s) 593, to the lower front of your California tax return. Make a copy for your records.

Do I need to fill out 593 E?

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

Do I need to send a copy of my federal return with my California state return?

California Franchise Tax Board requires the federal return to be attached to the California return as follows: Form 540: Federal return is required if federal return includes supporting forms or schedules other than Schedule A or Schedule B. Form 540NR: Federal return is required for all Form 540NR returns.

Who is exempt from CA real estate withholding?

You do not have to withhold tax if the CA real property is: $100,000 or less. In foreclosure. Seller is a bank acting as a trustee.

Who is the remitter on Form 593?

During escrow, the remitter would be the REEP as they are the one submitting the payment and Form 593. The remitter is the person who will remit the tax withheld on any disposition from the sale or exchange of CA real estate and file the prescribed forms on the buyer's/transferee's behalf.

What is the tax withholding requirement in California?

Your payer must take 7% from your California income. Backup withholding: Replaces all other types of withholding.

What is the tax withholding on real estate sales in California?

Buyers must withhold 3 1/3 percent of the gross sales price on sales of California real property interests from both individuals (e.g., "natural" persons) and non-individuals (e.g., corporations, trusts, estates) and pay this amount to the Franchise Tax Board (FTB).

What is the California income tax withholding rule for all sales of real property in California?

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my 2014 form 593-c in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2014 form 593-c directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit 2014 form 593-c straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 2014 form 593-c right away.

How do I edit 2014 form 593-c on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2014 form 593-c from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is CA FTB 593-C?

CA FTB 593-C is a form used by the California Franchise Tax Board for reporting foreign partners' distributive share of California source income.

Who is required to file CA FTB 593-C?

Partnerships and limited liability companies (LLCs) that have foreign partners must file CA FTB 593-C.

How to fill out CA FTB 593-C?

To fill out CA FTB 593-C, you need to provide the partnership's details, the foreign partner's information, and the amount of California source income, among other required details.

What is the purpose of CA FTB 593-C?

The purpose of CA FTB 593-C is to report the income that foreign partners earn from partnerships or LLCs that is sourced to California.

What information must be reported on CA FTB 593-C?

Information that must be reported includes the partnership's name and FEIN, the foreign partner's name and identifying number, and the amount of distributive share allocated to each foreign partner.

Fill out your 2014 form 593-c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Form 593-C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.