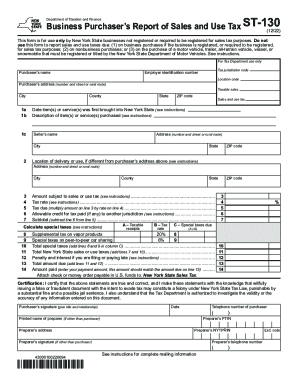

NY DTF ST-130 2013 free printable template

Get, Create, Make and Sign ny form use 2013

How to edit ny form use 2013 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-130 Form Versions

How to fill out ny form use 2013

How to fill out NY DTF ST-130

Who needs NY DTF ST-130?

Instructions and Help about ny form use 2013

Hello this is stamp and welcome to a Minecraft let's play video another video inside stamp's lovely world and today in this video I am going to be joined by Ella lee emerging from the Mona Lisa, and I'm also going to be joined by Amy Lee who's here hiding through the little letterbox I can see you I can just see your eyes poking through, and I can just about see a petal poking through the door as well hello Amy and yeah I've got some lovely bubbly love petals, and hopefully I'm also about to have a cake I can see you Lee I can see the cherry of the cake painting through the Mona Lisa there can I have my cake and I have my breakfast I always tease me always leave me waiting don't you number Mummy Mummy thank you for that Lee that was very delightful, but I know what I do about you Lee I tried making the cakes myself and I just couldn't do it is just wasn't the same maybe there's a secret ingredient Lee uses that I don't know about, or maybe I don't know I just do it in the wrong order, but mainly I think it's just because I'm lazy, and I can't be bothered to make them, so it's always nice to have Lee making the other cakes at the beginning of the video yeah anyway I'm here inside my love guarded and this is a place where I add down a sing I was someone's name on, and I say thank you to them for something and give them a little of a shout-out, and today I am adding a Miss pink mermaid to someone that you should relate to Amy seen as they are a fellow mermaid, and she's a friend of mine I've played with her for about five months or so and she's um yes she's been subscribed to me for a long time, and again she's helped me out in a few of my videos and as she'll send me a video the other day when she just basically said a really nice message and I thought it was really nice, and I wanted to say thank you so miss ping mermaid thank you very much for everything you've done for me and welcome to my love garden and if you want to be added to my love garden and there's no real way around which I add people and I had people for sending me fan art or just like leaving funny comments, but there's no one way in which I add people's basically if ever I want to say thank you to someone for some reason the way I do it is by putting down a sign of my love garden anyway so now as I always do this all my videos is picking a dog to take with me and who should I take with me today haha I saw you over Heavy I saw a little glimpse of your gamertag in this area do you want to be my dog companion today do you don't you take another dog as well I want it to be just you right you come ready ants that way okay do you want me to take another dog as well you do how you want to freckle who'd you want me to take with you go stand next to the dog you want me to take with you uh always feel he's looking he's thinking very carefully stir on a pig which dog to take with him, he's going for Benji and Benji is the Warner over here who has his head slightly tilted up, so that's where...

People Also Ask about

Which NYS tax form do I use?

What form do I use for NY part-year resident?

What is the part-year resident form for NY?

What form do I use for New York City nonresident income tax?

Can you be a part-year NYC resident?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ny form use 2013?

How do I make edits in ny form use 2013 without leaving Chrome?

How do I complete ny form use 2013 on an iOS device?

What is NY DTF ST-130?

Who is required to file NY DTF ST-130?

How to fill out NY DTF ST-130?

What is the purpose of NY DTF ST-130?

What information must be reported on NY DTF ST-130?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.