Get the free Tax effective SMSF borrowing structures

Show details

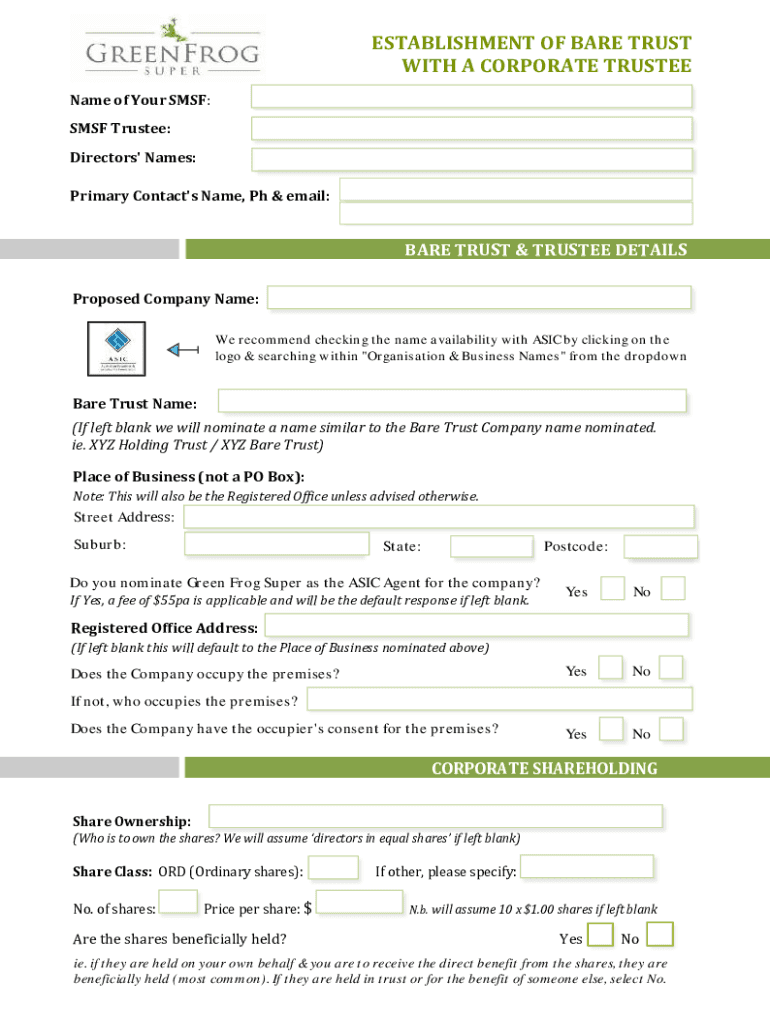

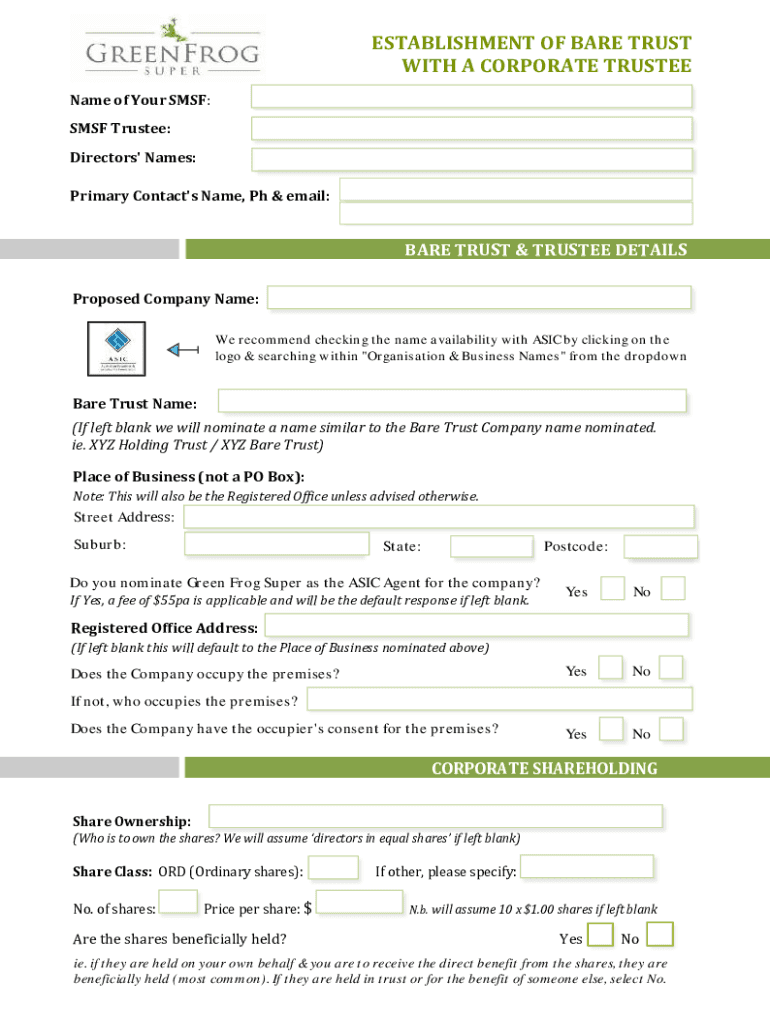

ESTABLISHMENT OF BARE TRUST

WITH A CORPORATE TRUSTEE

Name of Your SMS:

SMS Trustee:

Directors\' Names:

Primary Contact\'s Name, pH & email:BARE TRUST & TRUSTEE DETAILS

Proposed Company Name:

We recommend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax effective smsf borrowing

Edit your tax effective smsf borrowing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax effective smsf borrowing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax effective smsf borrowing online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax effective smsf borrowing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax effective smsf borrowing

How to fill out tax effective smsf borrowing

01

To fill out tax effective smsf borrowing, follow these steps:

02

Determine your borrowing capacity: Calculate how much you can borrow by considering your superannuation fund's assets and liabilities, as well as your overall financial situation.

03

Seek professional advice: Consult a financial advisor or tax accountant who is experienced in self-managed super funds (SMSFs) and borrowing arrangements. They can guide you through the process and help you understand the tax implications and legal requirements.

04

Set up an SMSF: If you don't already have an SMSF, you'll need to establish one. This involves drafting a trust deed, appointing trustees, and registering the fund with the Australian Taxation Office (ATO).

05

Create a borrowing arrangement: Determine the structure for your borrowing arrangement, such as establishing a limited recourse borrowing arrangement (LRBA) or using a bare trustee structure.

06

Choose a lender: Research and compare lenders who offer SMSF borrowing products. Consider factors such as interest rates, loan terms, borrowing conditions, and fees.

07

Complete loan application: Provide all necessary documentation to the chosen lender, such as financial statements, tax returns, and the borrowing agreement.

08

Obtain legal advice: Seek legal advice to ensure all legal requirements and documentation are properly prepared and executed, including the loan agreement, security documents, and any guarantees.

09

Arrange property purchase: If the funds will be used to purchase a property, coordinate the purchase process with the assistance of professionals, such as real estate agents and conveyancers.

10

Monitor and fulfill obligations: Once the borrowing arrangement is in place, make sure to meet all financial and legal obligations, such as making repayments on time, maintaining accurate records, and complying with tax regulations.

11

Regularly review the arrangement: Monitor the performance of the investment and regularly review your borrowing arrangement to ensure it aligns with your investment goals and remains tax-effective.

12

Remember, it is crucial to seek professional advice throughout the entire process to ensure compliance with regulations and maximize the benefits of tax-effective SMSF borrowing.

Who needs tax effective smsf borrowing?

01

Tax-effective SMSF borrowing is suitable for individuals who:

02

- Have a self-managed super fund (SMSF): To participate in SMSF borrowing, you must have an SMSF in place.

03

- Want to leverage their superannuation assets: SMSF borrowing allows you to use your superannuation fund's assets as collateral to acquire additional investments, such as properties or shares.

04

- Have sufficient borrowing capacity: Before considering SMSF borrowing, individuals should assess their borrowing capacity and ensure they can comfortably meet loan repayments and any associated costs.

05

- Seek tax advantages: Depending on personal circumstances, SMSF borrowing can provide potential tax advantages, such as deductibility of loan interest and capital gains tax concessions.

06

- Are willing to take on additional responsibilities: SMSF borrowing requires individuals to take on additional responsibilities as trustees of their fund, including compliance with borrowing laws and regulations.

07

- Have a long-term investment horizon: SMSF borrowing is generally considered a long-term investment strategy, so it is suitable for individuals who have a long-term investment horizon and are willing to hold investments within their SMSF for an extended period.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax effective smsf borrowing online?

pdfFiller has made it simple to fill out and eSign tax effective smsf borrowing. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the tax effective smsf borrowing form on my smartphone?

Use the pdfFiller mobile app to complete and sign tax effective smsf borrowing on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit tax effective smsf borrowing on an iOS device?

You certainly can. You can quickly edit, distribute, and sign tax effective smsf borrowing on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is tax effective smsf borrowing?

Tax effective SMSF borrowing refers to the strategy of using borrowed funds within a Self-Managed Superannuation Fund (SMSF) to acquire investment properties or assets while maximizing tax benefits.

Who is required to file tax effective smsf borrowing?

Trustees of Self-Managed Superannuation Funds (SMSFs) that engage in borrowing arrangements are required to file tax effective SMSF borrowing.

How to fill out tax effective smsf borrowing?

To fill out tax effective SMSF borrowing, trustees should complete the necessary forms provided by the Australian Taxation Office (ATO), ensuring accurate details regarding the borrowing arrangement and related investments are disclosed.

What is the purpose of tax effective smsf borrowing?

The purpose of tax effective SMSF borrowing is to allow SMSFs to leverage borrowed funds to invest in assets that can generate returns, aiming to enhance the overall performance and growth of the superannuation portfolio.

What information must be reported on tax effective smsf borrowing?

Trustees must report details including the amount borrowed, the purpose of borrowing, the asset acquired, terms of the loan, and any associated costs on tax effective SMSF borrowing.

Fill out your tax effective smsf borrowing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Effective Smsf Borrowing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.