Canada CA-90-V 2023-2026 free printable template

Show details

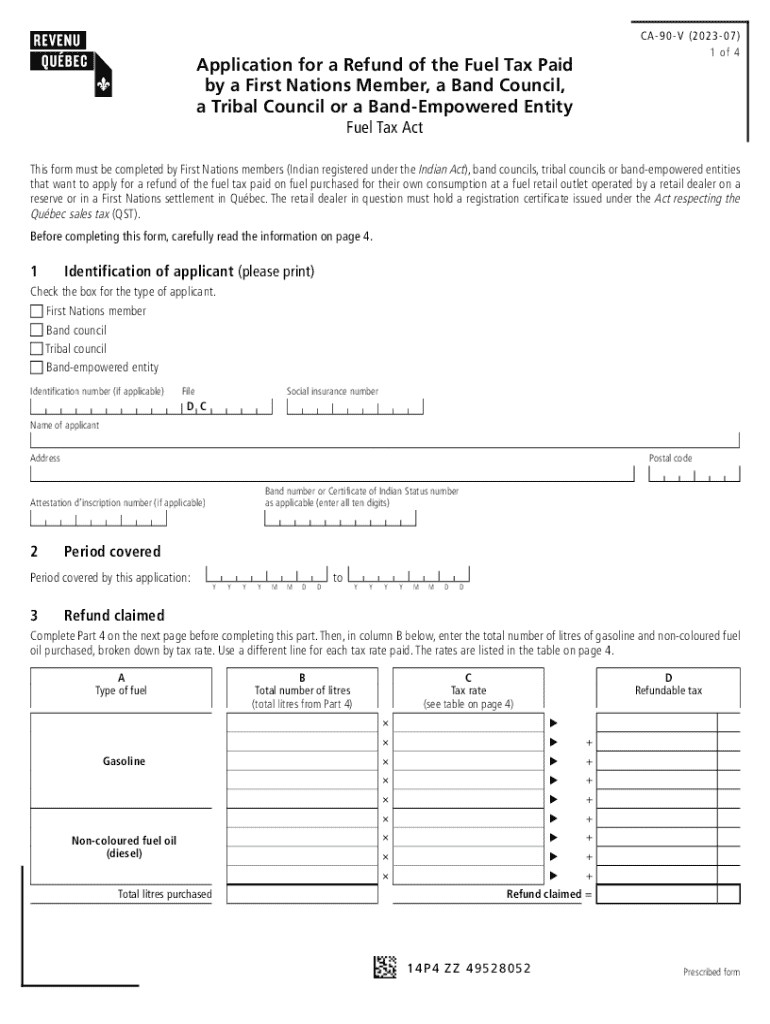

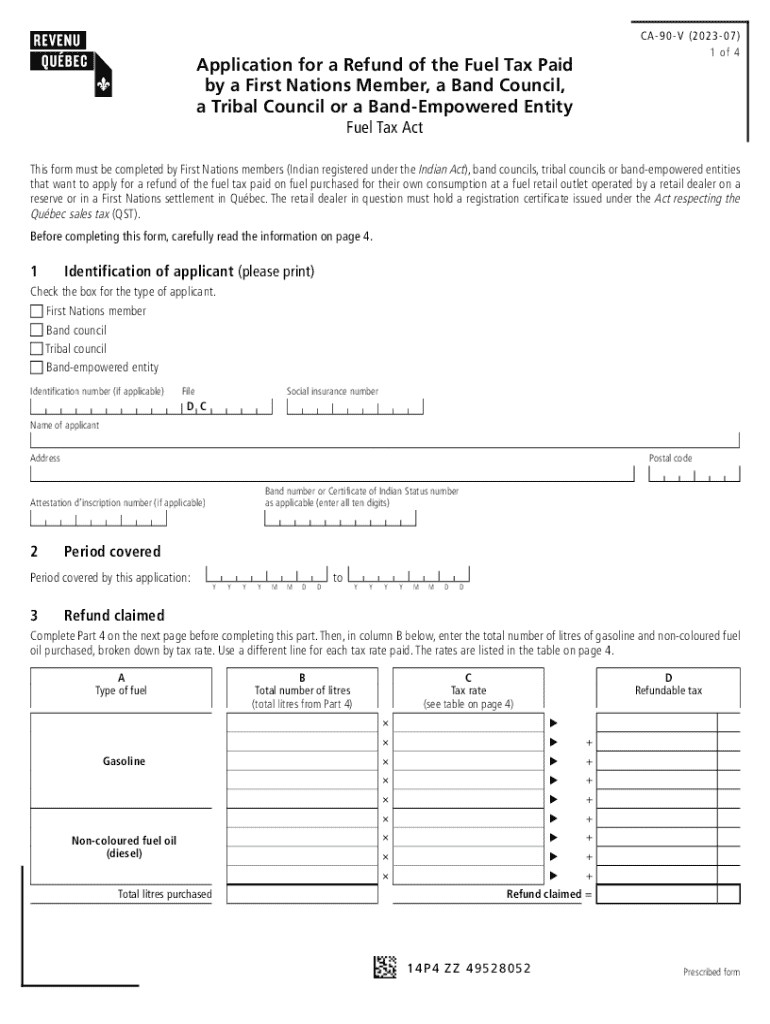

This form must be completed by First Nations members (Indian registered under the Indian Act), band councils, tribal councils or band-empowered entities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada CA-90-V

Edit your Canada CA-90-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CA-90-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada CA-90-V online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada CA-90-V. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CA-90-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CA-90-V

How to fill out application for a refund

01

Obtain the refund application form from the relevant institution or website.

02

Carefully read the instructions provided with the application form.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide the details of the transaction for which you are requesting a refund, including dates and amounts.

05

State the reason for requesting a refund clearly and concisely.

06

Attach any necessary supporting documents, such as receipts or proof of purchase.

07

Review your application to ensure all information is accurate and complete.

08

Submit the application via the required method (online, by mail, or in person) as instructed.

Who needs application for a refund?

01

Anyone who has made a purchase and is dissatisfied with the product or service may need to apply for a refund.

02

Consumers who experience a defective item, cancellation of services, or billing errors might require a refund application.

03

Businesses or freelancers who have paid for services that were not rendered also need to submit refund applications.

Fill

form

: Try Risk Free

People Also Ask about

What is the main form for Quebec tax return?

The documents listed on this page contain instructions for filing your income tax return for the 2022 taxation year. Note about electronic signatures. This form can be signed electronically.

Where can I get revenue Quebec tax forms?

Paper forms To get one: Pick one up from one of our offices or from a Services Québec office (starting at the end of February 2023). Use the online service for ordering forms and publications (starting at the end of January 2023). Print the documents you need from the Income Tax Return, Schedules and Guide page.

What document do you fill out to receive a tax refund or tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What documents do I need to submit with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

What documents do I need to complete my tax return?

In addition to proof of your identity, and the identities of your family members, documents you should bring to a tax preparer include: Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.

What is the equivalent of T2200 in Quebec?

If employees live in Québec, the equivalent form to the T2200 is called TP-64.3-V (General Employment Conditions). It's also important to note that Revenu Québec maintains its own unique list of eligible employment expenses for workers in that province.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada CA-90-V for eSignature?

When you're ready to share your Canada CA-90-V, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit Canada CA-90-V online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Canada CA-90-V and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the Canada CA-90-V in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your Canada CA-90-V in seconds.

What is application for a refund?

An application for a refund is a formal request made to a relevant authority, often a government agency or a service provider, to return money that was previously paid. This can occur due to various reasons such as overpayment, errors in billing, or eligibility for refunds based on specific criteria.

Who is required to file application for a refund?

The individual or entity that has overpaid or qualifies for a refund is required to file the application. This usually includes taxpayers, consumers, or organizations that have paid more than the owed amount or meet specific conditions stipulated by the refund policy.

How to fill out application for a refund?

To fill out an application for a refund, one typically needs to obtain the specific form from the relevant authority's website or office. The application must be completed by providing necessary personal information, the reason for the refund, the amount being requested, and any supporting documentation that validates the claim.

What is the purpose of application for a refund?

The purpose of an application for a refund is to formally request the return of funds that were mistakenly or unnecessarily paid. It serves as a mechanism for individuals and organizations to rectify billing errors, claim deductions, or recover overpayments.

What information must be reported on application for a refund?

The information typically required on an application for a refund includes the applicant's name and contact details, the payment details (such as date and amount), the reason for the refund request, any relevant account numbers, and copies of documents that support the claim, such as receipts or invoices.

Fill out your Canada CA-90-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada CA-90-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.