Get the free CREDIT BUREAU REQUEST FORM

Show details

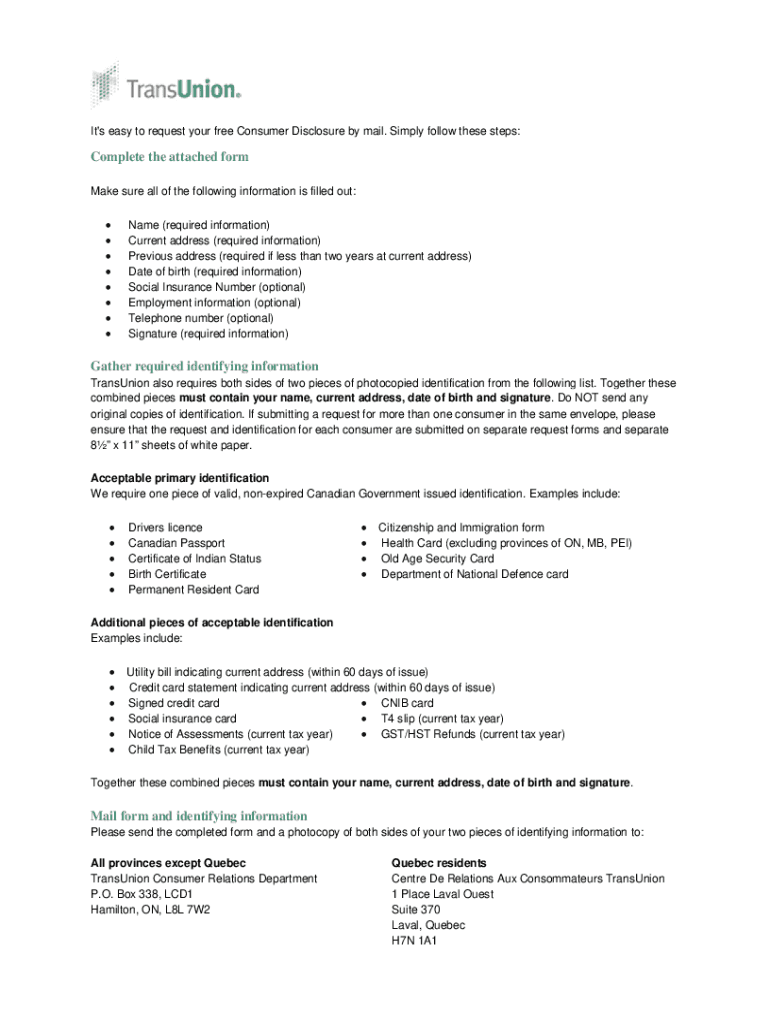

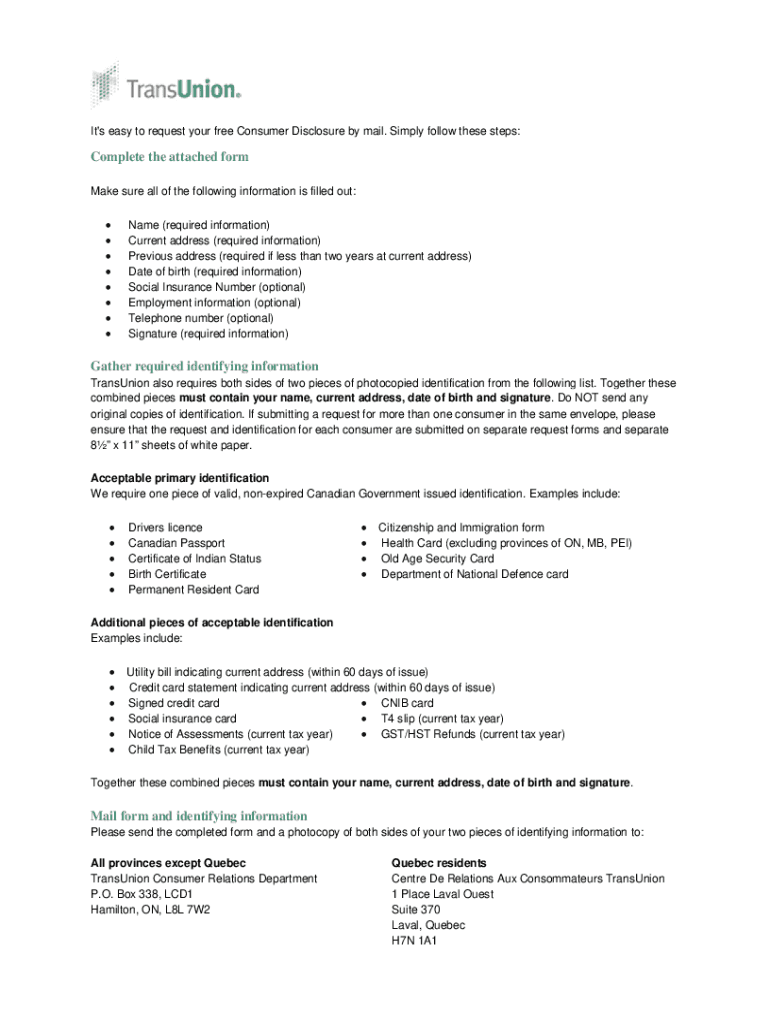

This document allows consumers to request their credit report from TransUnion by providing required personal identification and information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit bureau request form

Edit your credit bureau request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit bureau request form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit bureau request form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit bureau request form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit bureau request form

How to fill out CREDIT BUREAU REQUEST FORM

01

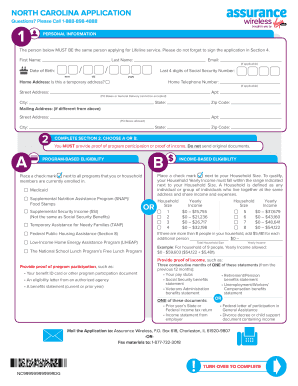

Obtain the CREDIT BUREAU REQUEST FORM from the relevant credit bureau's website or office.

02

Fill in your personal details, including your full name, address, date of birth, and Social Security number.

03

Specify the type of information you are requesting (e.g., credit report, dispute information).

04

Provide any necessary identification documents as required by the credit bureau.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form to authorize the request.

07

Send the form to the appropriate address provided by the credit bureau.

08

Keep a copy of the form and any correspondence for your records.

Who needs CREDIT BUREAU REQUEST FORM?

01

Individuals who want to check their credit report.

02

Consumers disputing inaccuracies in their credit report.

03

Those applying for loans or mortgages who need to verify their credit information.

04

Landlords or employers assessing potential tenants or employees.

Fill

form

: Try Risk Free

People Also Ask about

How to request a credit report from all three bureaus?

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Is it OK to request your own credit report?

Many people are afraid to request a copy of their credit reports – or check their credit scores – out of concern it may negatively impact their credit scores. Good news: Credit scores aren't impacted by checking your own credit reports or credit scores.

Is AnnualCreditReport a legit site?

Yes, it is the official site established by the 3 major credit bureaus to comply with the federal law requiring them to offer at least 1 free report annually (although now they are also voluntarily offering them weekly).

What is a credit request form?

A credit request form is a document that allows a person to ask for credit. It contains information about the customer, the amount requested, and other financial information.

Does an AnnualCreditReport hurt your credit?

It won't affect your credit score at all.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT BUREAU REQUEST FORM?

The CREDIT BUREAU REQUEST FORM is a document used to request an individual's credit report from credit bureaus.

Who is required to file CREDIT BUREAU REQUEST FORM?

Individuals seeking to access their own credit report or entities requiring a credit report for credit approval or assessment must file the CREDIT BUREAU REQUEST FORM.

How to fill out CREDIT BUREAU REQUEST FORM?

To fill out the CREDIT BUREAU REQUEST FORM, provide your personal information including name, address, Social Security number, and any necessary identification, and then submit the form as directed.

What is the purpose of CREDIT BUREAU REQUEST FORM?

The purpose of the CREDIT BUREAU REQUEST FORM is to facilitate the retrieval of a person's credit report for review, verification, or evaluation purposes.

What information must be reported on CREDIT BUREAU REQUEST FORM?

The information that must be reported on the CREDIT BUREAU REQUEST FORM typically includes the requester’s name, address, Social Security number, date of birth, and any relevant identification documents.

Fill out your credit bureau request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Bureau Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.