Get the free pdffiller

Show details

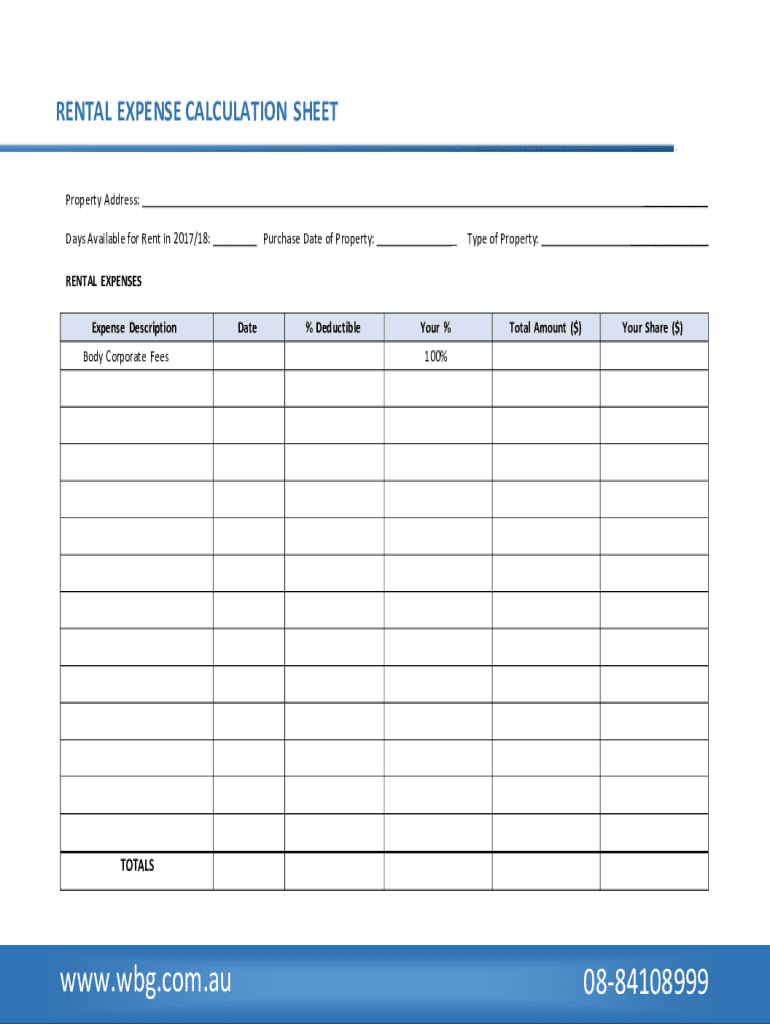

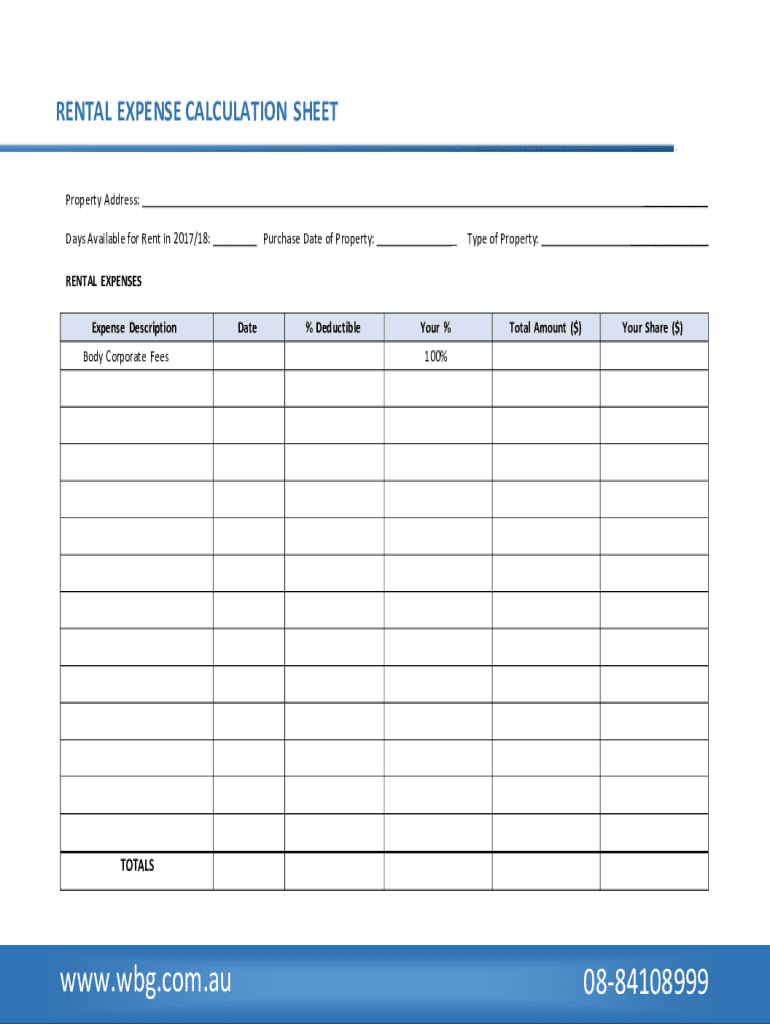

RENTAL EXPENSE CALCULATION SHEET

Property Address:___Days Available for Rent in 2017/18:Purchase Date of Property:_Type of Property:___RENTAL EXPENSES

Expense Description

Body Corporate Teesdale DeductibleYour

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out rental expenses calculation sheet

01

To fill out the rental expenses calculation sheet, follow these steps:

02

Start by entering the rental property information, such as the address, type of property, and date of purchase or rental agreement.

03

Next, list all the expenses incurred related to the rental property. This may include mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, utilities, property management fees, and any other expenses directly associated with the rental property.

04

Categorize each expense and provide detailed descriptions to ensure clarity and accuracy.

05

Calculate the total amount spent on each expense category and enter it in the designated columns.

06

Sum up all the expenses to get the total rental expenses for a specific period, such as a month, a quarter, or a year.

07

If there are any rental income sources, subtract them from the total expenses to calculate the net rental income.

08

Finally, review the filled-out rental expenses calculation sheet for any errors or omissions before finalizing it.

09

Remember to keep all supporting documents and receipts as they may be required for auditing or tax purposes.

Who needs rental expenses calculation sheet?

01

A rental expenses calculation sheet is necessary for:

02

- Landlords or property owners who want to track and manage their rental property expenses.

03

- Accountants or tax professionals who need accurate information to prepare tax returns for rental properties.

04

- Investors or real estate professionals who analyze the profitability and financial performance of rental properties.

05

- Similarly, property management companies or organizations responsible for managing multiple rental properties benefit from using rental expenses calculation sheets to assess the overall financial health of their portfolio.

06

In summary, anyone involved in rental property management, accounting, or taxation can benefit from using a rental expenses calculation sheet.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pdffiller form?

With pdfFiller, it's easy to make changes. Open your pdffiller form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit pdffiller form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pdffiller form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit pdffiller form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share pdffiller form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is rental expenses calculation sheet?

A rental expenses calculation sheet is a financial document used to track and detail the expenses associated with renting properties, helping landlords and property owners to organize and report their expenses accurately for tax purposes.

Who is required to file rental expenses calculation sheet?

Landlords or property owners who earn rental income and want to claim deductions for related expenses are required to file a rental expenses calculation sheet.

How to fill out rental expenses calculation sheet?

To fill out a rental expenses calculation sheet, you need to gather all relevant financial documents, list your rental income, and itemize your expenses such as maintenance, utility bills, repairs, property management fees, and other costs, ensuring that all figures are accurate.

What is the purpose of rental expenses calculation sheet?

The purpose of the rental expenses calculation sheet is to organize and report the expenses incurred from rental properties, allowing property owners to accurately assess their tax liabilities and claim eligible deductions.

What information must be reported on rental expenses calculation sheet?

The information that must be reported includes the total rental income, a breakdown of various expenses (e.g., mortgage interest, repairs, property taxes, insurance), and other relevant financial details that pertain to the management of rental properties.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.