CA FTB 3557 LLC 2013 free printable template

Show details

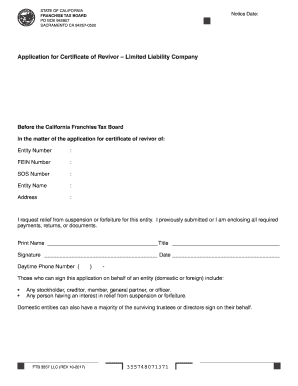

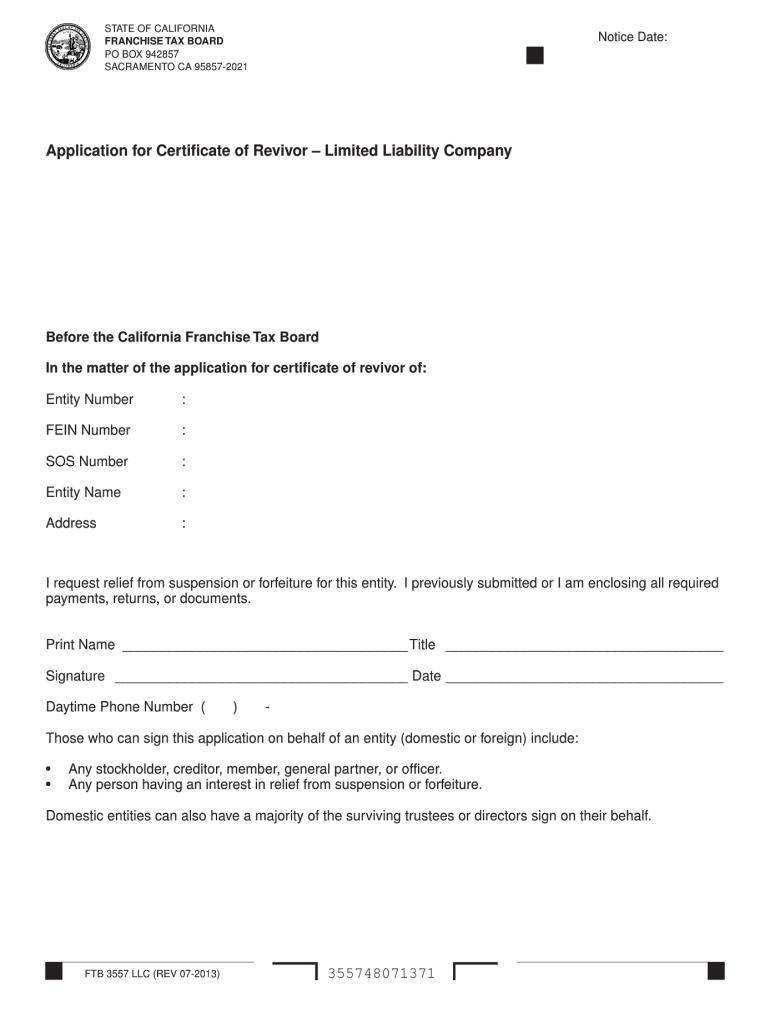

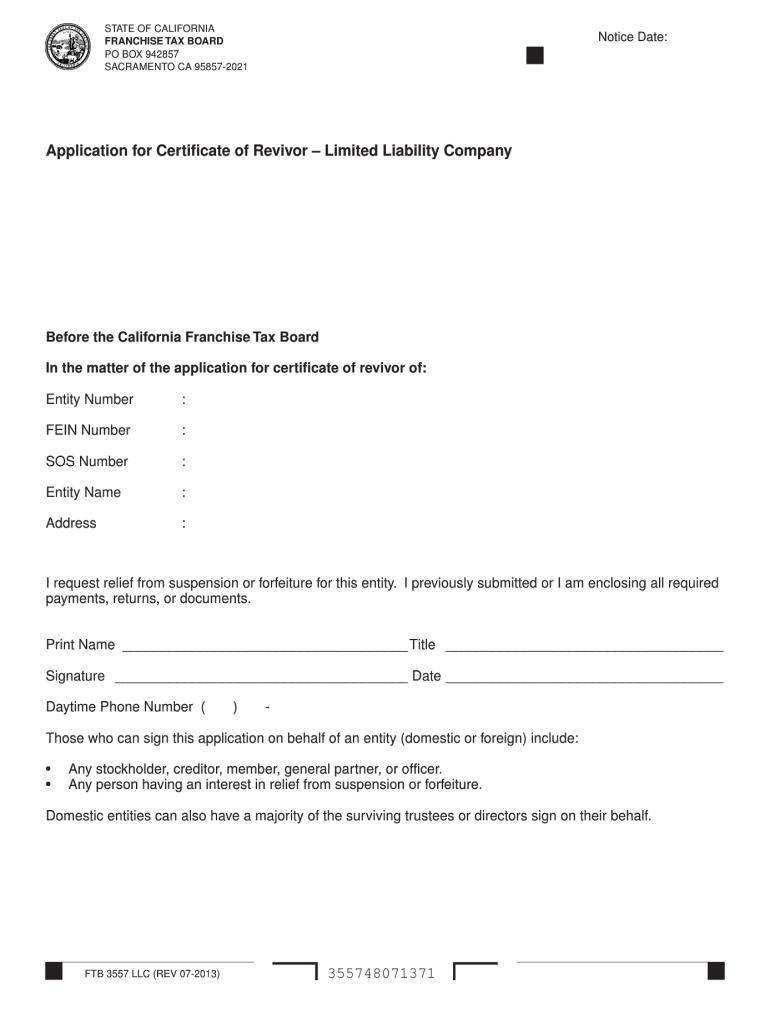

Print and Reset Form STATE OF CALIFORNIA FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA 95857-2021 Reset Form Notice Date Application for Certificate of Revivor Limited Liability Company Before the California Franchise Tax Board In the matter of the application for certificate of revivor of Entity Number FEIN Number SOS Number Address I request relief from suspension or forfeiture for this entity. I previously submitted or I am enclosing all required payments returns or documents. Print...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3557 LLC

Edit your CA FTB 3557 LLC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3557 LLC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3557 LLC online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FTB 3557 LLC. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3557 LLC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3557 LLC

How to fill out CA FTB 3557 LLC

01

Obtain the CA FTB 3557 form from the California Franchise Tax Board website.

02

Fill in your LLC's name and California Secretary of State file number at the top of the form.

03

Provide the tax year for which you are filing the form.

04

Indicate the type of LLC (single-member, multi-member, or other) in the designated section.

05

Fill out the income and deductions section based on your LLC’s financial statements.

06

Calculate the total income and the total deductions to find the net income.

07

Provide any other necessary information, including the LLC's principal business activity and its address.

08

Sign and date the form at the bottom to certify that the information is accurate.

09

Submit the completed form to the CA Franchise Tax Board by the due date.

Who needs CA FTB 3557 LLC?

01

Any Limited Liability Company (LLC) that is doing business in California, has income from California sources, or is classified as a partnership must file CA FTB 3557 to report its income and pay any applicable taxes.

Fill

form

: Try Risk Free

People Also Ask about

What happens if your LLC is suspended?

When a California LLC is suspended, the LLC has lost all its rights and privileges and cannot legally operate until the California LLC has been revived (reinstated or brought back to Active status).

Do you have to pay the $800 California Corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Is first year LLC fee waived for California?

California LLCs after Assembly Bill 85: California LLCs don't pay an $800 fee for their 1st year (if the LLC is formed after January 1st, 2021).

How do I pay a $800 LLC fee?

If you start to operate an LLC business in California, you need to pay the first $800 fee in the 4th month after the approval of your LLC. After that, you will also need to pay another $800 in annual tax due date on April 15th every year. To pay that, you need to file Form 3522, called the annual LLC Tax Voucher.

What is form 3557?

3557, Application for Certificate of Revivor - Limited Liability Company.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 3557 LLC?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific CA FTB 3557 LLC and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the CA FTB 3557 LLC in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your CA FTB 3557 LLC and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit CA FTB 3557 LLC on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share CA FTB 3557 LLC from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is CA FTB 3557 LLC?

CA FTB 3557 LLC is a California Franchise Tax Board form specifically designed for Limited Liability Companies (LLCs) to report their income and pay their annual tax obligations in the state of California.

Who is required to file CA FTB 3557 LLC?

All Limited Liability Companies (LLCs) that are doing business in California, are organized in California, or are registered to conduct business in California are required to file CA FTB 3557 LLC.

How to fill out CA FTB 3557 LLC?

To fill out CA FTB 3557 LLC, you need to provide your LLC's name, address, and Federal Employer Identification Number (FEIN), along with reporting your total income, deductions, and calculating the annual tax due, according to the instructions provided with the form.

What is the purpose of CA FTB 3557 LLC?

The purpose of CA FTB 3557 LLC is to collect information regarding the income and tax obligations of LLCs in California, ensuring compliance with state tax laws and enabling the Franchise Tax Board to assess the proper tax amounts.

What information must be reported on CA FTB 3557 LLC?

CA FTB 3557 LLC requires reporting the LLC's name, address, FEIN, gross income, net income, deductions, and the total tax amount owed to the California Franchise Tax Board.

Fill out your CA FTB 3557 LLC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3557 LLC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.