NY DTF ST-330 2013 free printable template

Show details

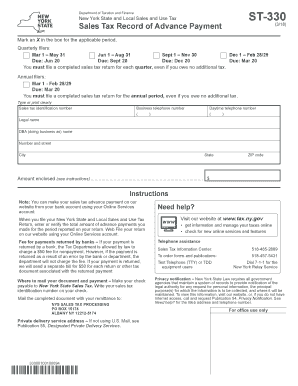

ST-330 (4/13) New York State Department of Taxation and Finance For internal use only Period designator Sales Tax Record of Advance Payment For the quarterly return due: June 20 September 20 December

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-330

Edit your NY DTF ST-330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF ST-330 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF ST-330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-330

How to fill out NY DTF ST-330

01

Download the NY DTF ST-330 form from the New York Department of Taxation and Finance website.

02

Fill in the name and address of the organization or individual claiming the exemption.

03

Indicate the type of exemption you are applying for by checking the appropriate box.

04

Provide any necessary additional information requested on the form, such as tax ID number.

05

Sign and date the form at the bottom.

06

Submit the completed form to the appropriate vendor or business from whom you are claiming the exemption.

Who needs NY DTF ST-330?

01

Organizations or individuals who are exempt from sales tax in New York State.

02

Businesses that qualify for an exemption to purchase goods or services without paying sales tax.

03

Non-profit organizations and governmental entities may also need this form for exemption purposes.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What is the statute of limitations on sales tax in NY?

The Statute of Limitations on a New York sales tax audit is three (3) years unless the Tax Department has your written consent to the contrary. The three (3) year rule does not apply if you have removed sales tax returns or filed a false or fraudulent return.

What form do I use to get my sales tax refund in New York?

Form AU-11, Application for Credit or Refund of Sales or Use Tax, is the most commonly used refund form. You may submit this form using Sales Tax Web File if you have an Online Services account for your business.

Who is required to file a sales tax return in NY?

If you are registered for sales and use tax purposes in New York State, you must file sales and use tax returns. This bulletin explains the sales tax filing requirements for quarterly, part-quarterly (monthly), and annual filers, including the E-file mandate.

Who must register for sales tax in New York?

Every person who sells taxable tangible personal property or taxable services (even if you make sales from your home, are a temporary vendor, or only sell once a year) must register with the Tax Department through New York Business Express before beginning business.

Who is responsible for sales tax in New York?

8 Both State and local sales taxes are administered by the New York State Department of Taxation and Finance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY DTF ST-330 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NY DTF ST-330 right away.

How do I fill out the NY DTF ST-330 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NY DTF ST-330 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete NY DTF ST-330 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NY DTF ST-330. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NY DTF ST-330?

NY DTF ST-330 is a form used in New York State for reporting and remitting sales tax on sales of tangible personal property and certain services.

Who is required to file NY DTF ST-330?

Businesses that sell tangible personal property or certain services in New York State and collect sales tax from customers are required to file NY DTF ST-330.

How to fill out NY DTF ST-330?

To fill out NY DTF ST-330, you need to provide details such as your business information, sales figures, and the amount of sales tax collected during the reporting period, and then calculate the total sales tax due.

What is the purpose of NY DTF ST-330?

The purpose of NY DTF ST-330 is to report sales tax collected from customers and to remit the total sales tax due to the New York State Department of Taxation and Finance.

What information must be reported on NY DTF ST-330?

NY DTF ST-330 requires reporting business name, address, sales amount, sales tax collected, and any applicable exemptions or deductions.

Fill out your NY DTF ST-330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.