TX TDI FIN507 2014 free printable template

Show details

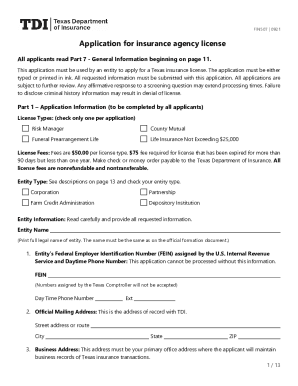

Tdi. texas. gov Application for Insurance Agency License All applicants read the General Information beginning on page 10. 1 The individual holds an active TDI license and has already submitted fingerprints to TDI with another license application or Association of Insurance Commissioner s Producer Database or 3 The applicant nonresident entity holds an active entity license that is similar to the license requested on this application in the resident state. All nonresident individuals who do...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TDI FIN507

Edit your TX TDI FIN507 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TDI FIN507 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX TDI FIN507 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit TX TDI FIN507. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TDI FIN507 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TDI FIN507

How to fill out TX TDI FIN507

01

Obtain the TX TDI FIN507 form from the Texas Department of Insurance website.

02

Fill in your personal information, including your name, address, and contact information.

03

Provide details about your insurance coverage, including policy numbers and effective dates.

04

If applicable, include information about any claims you have filed.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated areas.

07

Submit the form to the Texas Department of Insurance as instructed.

Who needs TX TDI FIN507?

01

Individuals or entities that are required to report their insurance coverage to the Texas Department of Insurance.

02

Workers' compensation insurance policyholders.

03

Employers who need to provide evidence of their insurance status.

Instructions and Help about TX TDI FIN507

Fill

form

: Try Risk Free

People Also Ask about

How do I become a licensed adjuster in Texas?

Pre-Licensing With State Exam. Students need only complete our Texas All-lines pre-licensing course and pass the included state adjuster exam for licensure. No additional coursework or testing is required.

How much can you make a month selling life insurance?

While ZipRecruiter is seeing monthly salaries as high as $12,708 and as low as $1,708, the majority of LIFE Insurance Agent salaries currently range between $4,625 (25th percentile) to $8,333 (75th percentile) across the United States.

Which of the following is a requirement for an applicant to receive an agent license in Virginia?

§ 38.2-1820. Each applicant who is at least 18 years of age and who has satisfied the Commission that he is of good character, has a good reputation for honesty, and has complied with the other requirements of this article is entitled to and shall receive a license in the form the Commission prescribes.

How long does it take to get a Texas adjuster license?

The Online Texas All Lines Adjuster Licensing course is a 40 hour course.

Can you make a living as an insurance agent?

Actually, hard-working insurance agents regularly earn over $100,000 in their first year. Life insurance agents enjoy a lucrative career, but it does involve a constant hustle, networking, and sales in evenings and on weekends and general hard work. And there can be a lot of rejection before each sale.

How do I get my insurance license in Texas?

How to Get Your Texas Insurance License Complete an Insurance Prelicensing Course. Pass Your Texas Licensing Exam. Get Fingerprinted. Apply for a Texas Insurance License. Plan to Complete Required Insurance Continuing Education (CE) Credits.

What are the requirements for obtaining a Texas insurance agents license?

How to Get Your Texas Insurance License Complete an Insurance Prelicensing Course. Pass Your Texas Licensing Exam. Get Fingerprinted. Apply for a Texas Insurance License. Plan to Complete Required Insurance Continuing Education (CE) Credits.

Which of the following is a requirement for obtaining a Texas insurance agents license?

To get a Texas insurance license you first have to pass the state exam. Next you submit your fingerprints for a background check. If you pass the exam and the check, submit your license application.

How long is Texas adjuster license good for?

To keep your license in good standing, you must take 24 hours of continuing education every two years. Three hours must be in ethics / consumer protection (if your license expired on or before August 31, 2022, you need only two hours of ethics).

What is an MGA in Texas?

MGA | Managing General Agency | Texas.

How hard is the Texas adjuster test?

Yes, the insurance adjuster exam test is pretty difficult. Although, Texas' insurance exam is significantly easier than most states. This comprehensive exam covers types of insurance policies, provisions, options, exclusions, application completion, underwriting, and more.

Which of the following is a requirement for obtaining a Texas insurance agent's license quizlet?

Explanation: All you have to do is pass your exam, apply for your license and pay the required non-refundable fees.

Can I take the Texas insurance exam online?

Get certified from your home or office Take your Texas Department of Insurance exam conveniently from home through OnVUE online proctoring. A live proctor will monitor you through the webcam on your workstation to provide a secure exam experience.

How do I get my MGA license in Texas?

If you want to apply for an agent license: You must complete your fingerprints and then submit an application within one year of passing the exam or you will need to retake the exam. You must apply online by using Sircon or the National Insurance Producer Registry. The application fee is $50.

What are some of the key requirements to become a licensed insurance agent or broker?

To pursue a career as an insurance broker, it's best to start by earning a degree in insurance, business, economics, or finance. Additionally, states require brokers to have an insurance license via the National Insurance Producer Registry to sell insurance.

Which insurance agents make the most money?

Here are the top 10 highest-paying jobs in the insurance industry, ing to the company's calculations. Consulting actuary. Annual salary range: $93,000 to $173,000. Life insurance actuary. Pricing actuary. Actuary. Automotive finance manager. Underwriting manager. Casualty underwriter. Health actuary.

How much does a licensed insurance agent make in Texas?

The average salary for a licensed insurance agent in Texas is $35,000 per year. Licensed insurance agent salaries in Texas can vary between $17,500 to $69,500 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How do I become an MGA in USA?

How to become an MGA Complete your education. To become an MGA, you will need a high school diploma or GED. Pick an area of focus. MGAs specialize in certain topics or areas, and they often sell or provide certain insurance products. Complete licensing regulations. Apply for a license. Consider employment options.

How much insurance agent makes Texas?

The average salary for a insurance agent in Texas is $42,000 per year. Insurance agent salaries in Texas can vary between $18,500 to $96,000 and depend on various factors, including skills, experience, employer, bonuses, tips, and more.

How much does it cost to get an adjusters license in Texas?

Use Sircon and choose “New Adjuster License.” Attach a copy of your fingerprint receipt from IdentoGO. The application fee is $75.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX TDI FIN507 to be eSigned by others?

When you're ready to share your TX TDI FIN507, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find TX TDI FIN507?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the TX TDI FIN507 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the TX TDI FIN507 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your TX TDI FIN507 in minutes.

What is TX TDI FIN507?

TX TDI FIN507 is a form used by the Texas Department of Insurance to report specific financial information related to insurance companies operating in Texas.

Who is required to file TX TDI FIN507?

Insurance companies that are licensed in Texas and are required to submit financial statements and reports to the Texas Department of Insurance must file TX TDI FIN507.

How to fill out TX TDI FIN507?

To fill out TX TDI FIN507, insurers must provide accurate financial data as per the guidelines set by the Texas Department of Insurance, following the specific instructions provided with the form.

What is the purpose of TX TDI FIN507?

The purpose of TX TDI FIN507 is to ensure that the Texas Department of Insurance has the necessary financial information to monitor the financial health and regulatory compliance of insurance companies operating within the state.

What information must be reported on TX TDI FIN507?

TX TDI FIN507 requires reporting of various financial data such as assets, liabilities, revenues, expenses, and other financial metrics pertinent to the insurer's operations.

Fill out your TX TDI FIN507 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TDI fin507 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.