Get the free Make a personal contribution

Show details

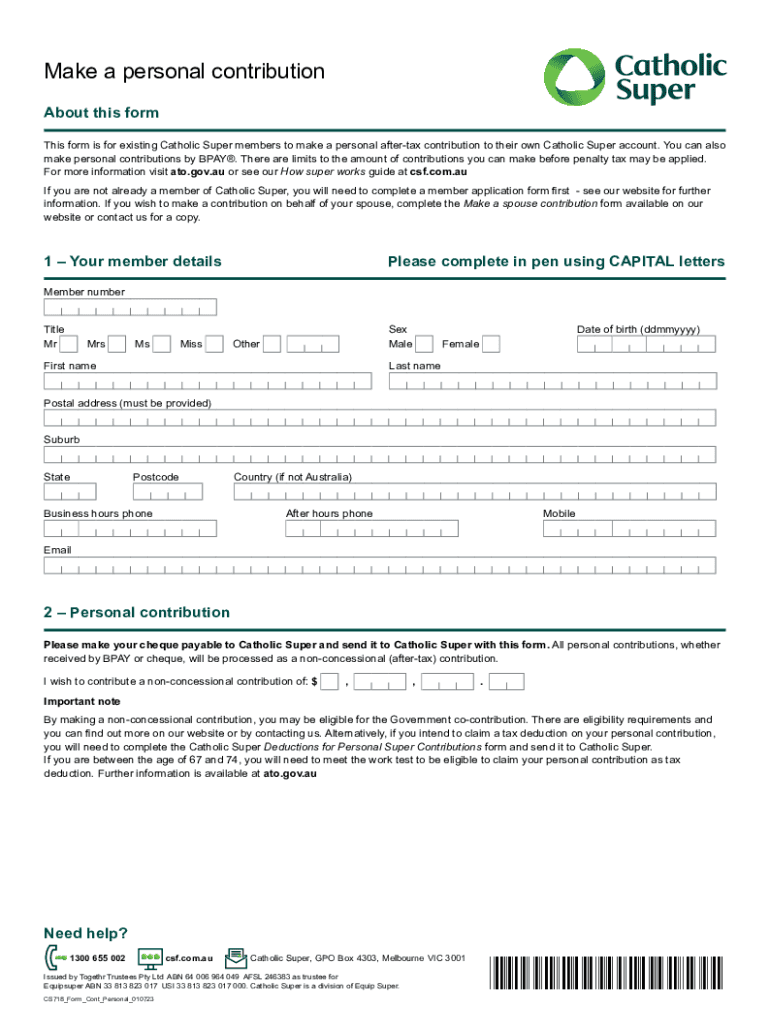

Make a personal contribution About this form is for existing Catholic Super members to make a personal after tax contribution to their own Catholic Super account. You can also make personal contributions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign make a personal contribution

Edit your make a personal contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your make a personal contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit make a personal contribution online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit make a personal contribution. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out make a personal contribution

How to fill out make a personal contribution

01

Start by determining the cause or organization you want to make a personal contribution to.

02

Research the organization's mission, values, and programs to ensure they align with your own interests and beliefs.

03

Find out how the organization accepts personal contributions, whether it's through donations, volunteering, or other forms of support.

04

Determine the amount or type of contribution you wish to make, whether it's a one-time donation, a recurring donation, or a specific skill or service you can offer.

05

Contact the organization directly to inquire about their contribution process and any specific requirements or guidelines they may have.

06

Follow the organization's instructions for making a personal contribution, which may involve filling out a donation form, attending an orientation or training session, or submitting relevant documentation.

07

Make the personal contribution as planned, ensuring that you provide any necessary information or documentation required by the organization.

08

If desired, keep track of your personal contribution for personal records or for tax purposes, depending on the applicable laws and regulations in your country.

09

Consider staying connected with the organization by attending events, participating in their programs, or sharing your personal contribution experience with others.

10

Reflect on the impact of your personal contribution and how it aligns with your personal values and goals.

Who needs make a personal contribution?

01

Anyone who wishes to support a cause or organization they believe in can make a personal contribution.

02

Individuals who want to make a positive impact on society, whether it's through financial donations, volunteering their time and skills, or providing resources or services, can benefit from making a personal contribution.

03

People who want to be actively involved in creating change or addressing social issues can also find personal fulfillment and a sense of purpose through making a personal contribution.

04

Organizations or causes that rely on the support of individuals to achieve their missions or goals often encourage and appreciate personal contributions from those who believe in their cause.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find make a personal contribution?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific make a personal contribution and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute make a personal contribution online?

pdfFiller makes it easy to finish and sign make a personal contribution online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my make a personal contribution in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your make a personal contribution and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is make a personal contribution?

Making a personal contribution refers to the act of an individual providing funds or assets to a specific cause, organization, or fund, often for charitable purposes or personal savings.

Who is required to file make a personal contribution?

Individuals who decide to contribute to certain funds, such as retirement accounts or charitable organizations, may be required to document and file their contributions for tax purposes.

How to fill out make a personal contribution?

Filling out a personal contribution typically involves completing a designated form provided by the organization or fund to which you are contributing, detailing the amount, date of contribution, and your personal information.

What is the purpose of make a personal contribution?

The purpose of making a personal contribution can include supporting charitable organizations, enhancing personal savings, reducing taxable income, or fulfilling legal obligations related to funding certain accounts.

What information must be reported on make a personal contribution?

Information that must be reported includes the contributor's name, address, the amount contributed, the date of contribution, and potentially the purpose or designation of the contribution.

Fill out your make a personal contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Make A Personal Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.