Get the free form nj 2010 - state nj

Show details

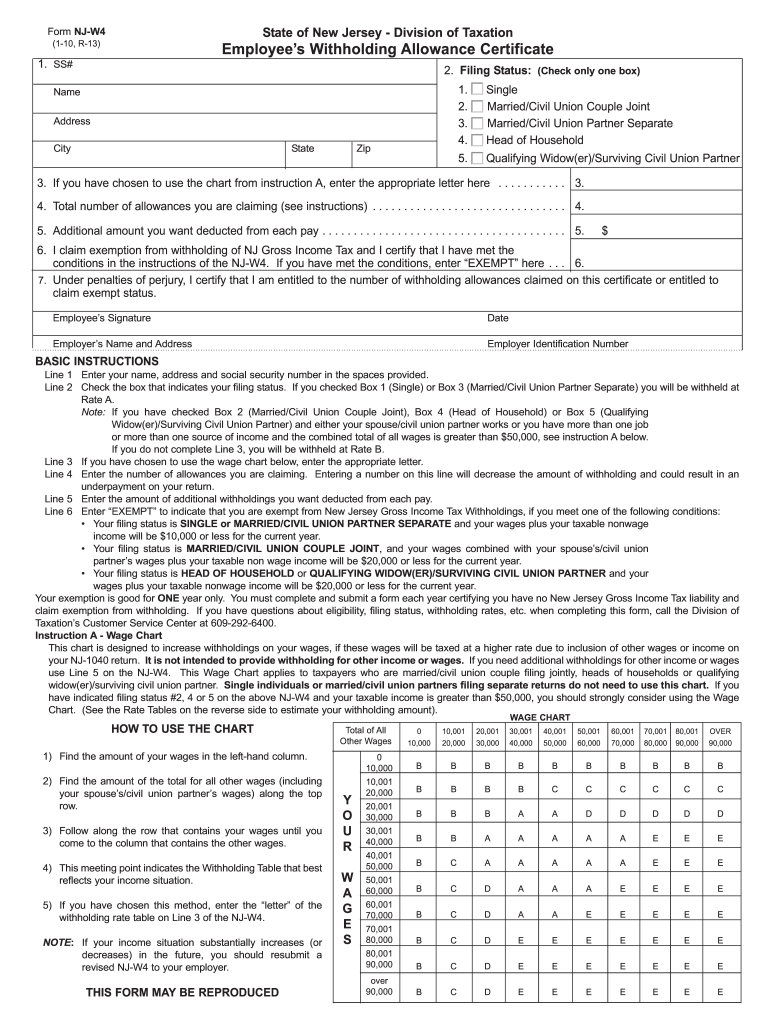

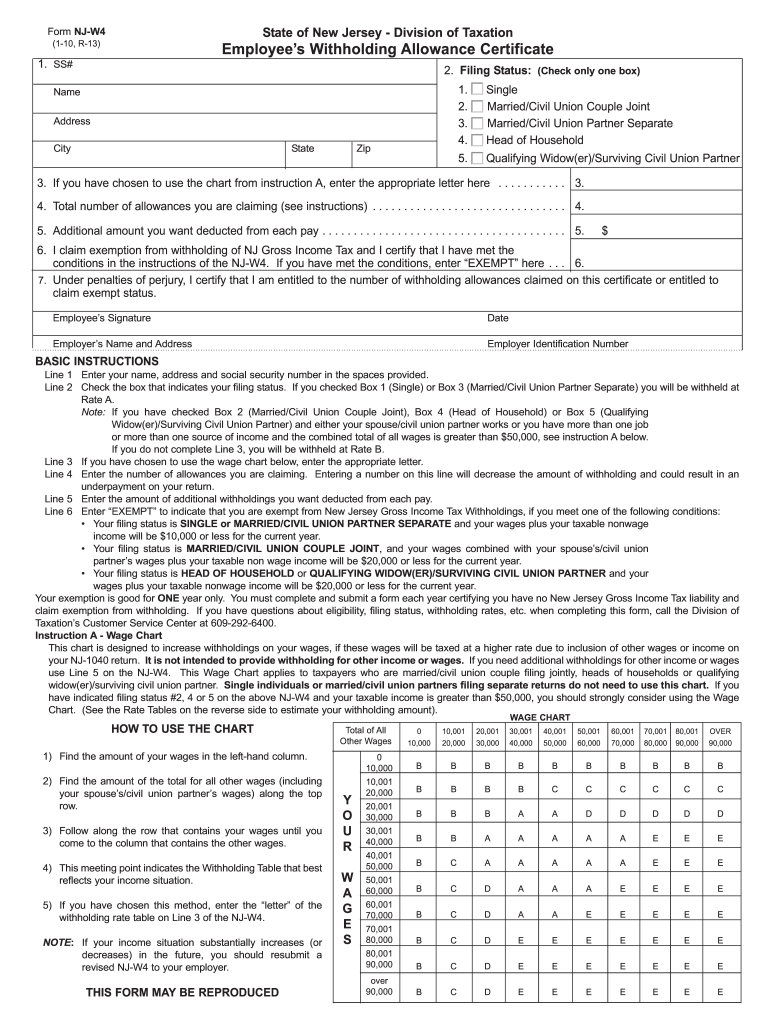

Form NJ-W4 State of New Jersey - Division of Taxation 1-10 R-13 Employee s Withholding Allowance Certificate 1. NOTE If your income situation substantially increases or decreases in the future you should resubmit a revised NJ-W4 to your employer. THIS FORM MAY BE REPRODUCED Y O U R W G S RATE TABLES FOR WAGE CHART The rate tables listed below correspond to the letters in the Wage Chart on the front page. If you have questions about eligibility filing status withholding rates etc. when...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form nj 2010

Edit your form nj 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nj 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form nj 2010 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form nj 2010. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form nj 2010

How to fill out NJ DoT NJ-W4

01

Obtain the NJ DoT NJ-W4 form from the official New Jersey Department of Transportation website or your employer.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box for Single, Married, or Head of Household.

04

Complete the allowance section, which determines how much tax to withhold. Refer to the instructions for guidance on how many allowances you may claim.

05

If applicable, specify any additional amount you want withheld from your paycheck in the designated section.

06

Review the form to ensure all information is correct and complete.

07

Sign and date the form at the bottom.

08

Submit the completed NJ-W4 form to your employer's human resources or payroll department.

Who needs NJ DoT NJ-W4?

01

Employees who work in New Jersey and have a job that requires them to fill out a tax withholding form.

02

Individuals who want to ensure the correct amount of state income tax is withheld from their paychecks.

03

New hires at companies operating in New Jersey to set up their tax withholding correctly.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

Do I have to pay NJ exit tax?

In actuality, the New Jersey “Exit Tax”, as it's referred to, has been likened more to urban legend than fact by CPAs. The law requires sellers of New Jersey homes to pay the state tax in advance of moving, of either 8.97% of the profit on the sale of their home or 2% of the total selling price – whichever is higher.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How do I check my NJ resale certificate?

You may validate any certificate that is issued by the Division and that contains a validation number under the printed seal of the State of New Jersey. For validation of a Certificate of Authority you will need to use the Document Locator Number.

Do you need a resale certificate in NJ?

When a business purchases inventory to resell, they can do so without paying sales tax. In order to do so, the retailer will need to provide a state of New Jersey Resale Certificate to their vendor. Learn more about what a resale certificate is, how to get one, and more.

What is a NJ sales tax certificate of Authority?

If you identified that you will be collecting sales tax on your NJ-REG form, you will receive a Certificate of Authority to Collect Sales Tax from the State. This document must be displayed at your business location.

Does NJ tax you if you sell your house and move out of state?

Resident Taxpayers: New Jersey residents who sell their New Jersey home and move outside of this state are considered nonresidents for the purpose of the sale. New Jersey may require an estimated tax payment at closing, and the seller will need to file a nonresident tax return to report any gain or loss.

Do I have to pay taxes if I sell my house in NJ?

NJ Income Tax - Sale of a Residence Your capital gain is calculated the same way as it is for federal purposes. Any amount that is taxable for federal purposes is taxable for New Jersey purposes. Single filers can qualify to exclude up to $250,000. Joint filers can qualify to exclude up to $500,000.

How long do you have to stay in NJ to avoid exit tax?

Furthermore, New Jersey residents who have occupied their primary residence for at least two of the last five years can exclude up to $250,000 of the gain (for single tax filers) and up to $500,000 of the gain (for those filing jointly).

How do I get a tax certificate in NJ?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

How does NJ tax non residents?

As a nonresident, you must calculate your tax on income from all sources as if you were a resident, and then prorate your tax based on your New Jersey source income. For more information on completing the nonresident return, see instructions for Form NJ-1040NR.

How can I avoid exit tax?

In order to even be subject to the IRS covered expatriate and exit tax rules, a person must be a U.S citizen or long-term legal permanent resident. Therefore, the easiest way to avoid the long-term resident exit tax trap it is to simply avoid becoming a legal permanent resident.

Who Must File NJ nonresident return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Where can I get NJ state tax forms?

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office.

Who files a NJ-1040NR?

E-file NJ Taxes and Get Your Tax Refund Fast. Form NJ-1040 must be filed by residents who are filing NJ taxes and nonresidents or partial-year residents must file Form NJ-1040NR. New Jersey tax returns can be filed electronically or mailed to the address indicated on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form nj 2010 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form nj 2010 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send form nj 2010 to be eSigned by others?

To distribute your form nj 2010, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit form nj 2010 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing form nj 2010 right away.

What is NJ DoT NJ-W4?

NJ DoT NJ-W4 is a state tax form used in New Jersey for employees to designate their withholding allowances.

Who is required to file NJ DoT NJ-W4?

Employees in New Jersey who wish to adjust their state income tax withholding are required to file NJ DoT NJ-W4.

How to fill out NJ DoT NJ-W4?

To fill out NJ DoT NJ-W4, employees must provide their name, address, Social Security number, calculate the number of allowances based on personal circumstances, and sign the form.

What is the purpose of NJ DoT NJ-W4?

The purpose of NJ DoT NJ-W4 is to inform employers of the correct amount of state tax to withhold from employees' paychecks.

What information must be reported on NJ DoT NJ-W4?

Information that must be reported on NJ DoT NJ-W4 includes the employee's name, address, Social Security number, and the number of allowances claimed.

Fill out your form nj 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Nj 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.