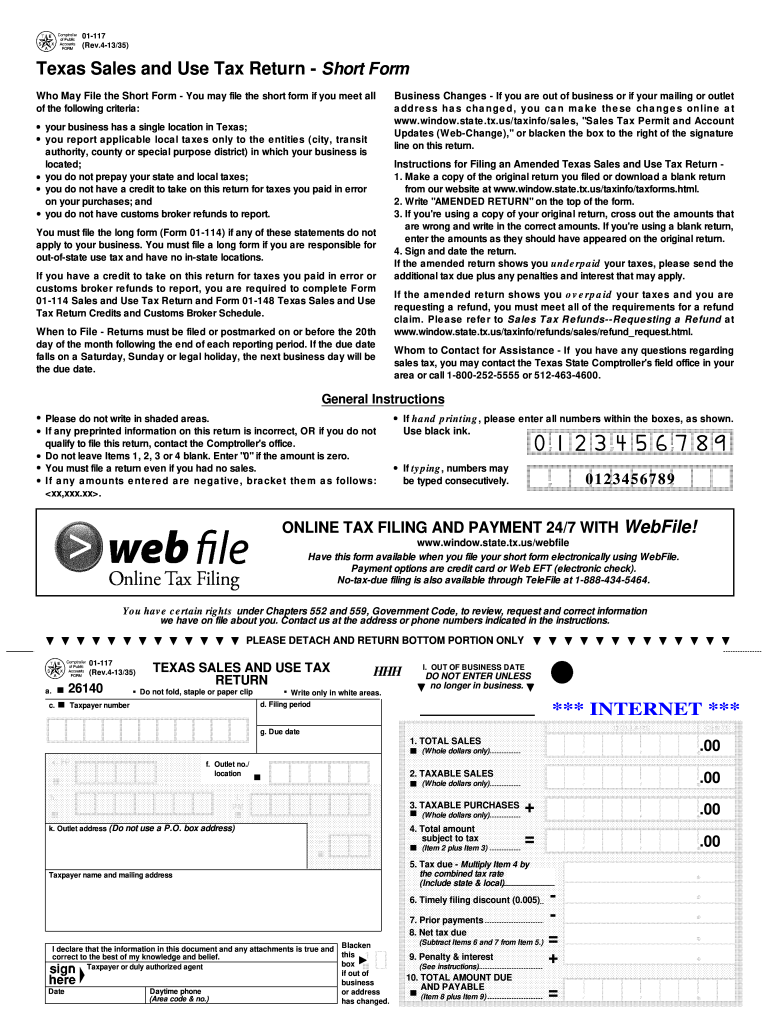

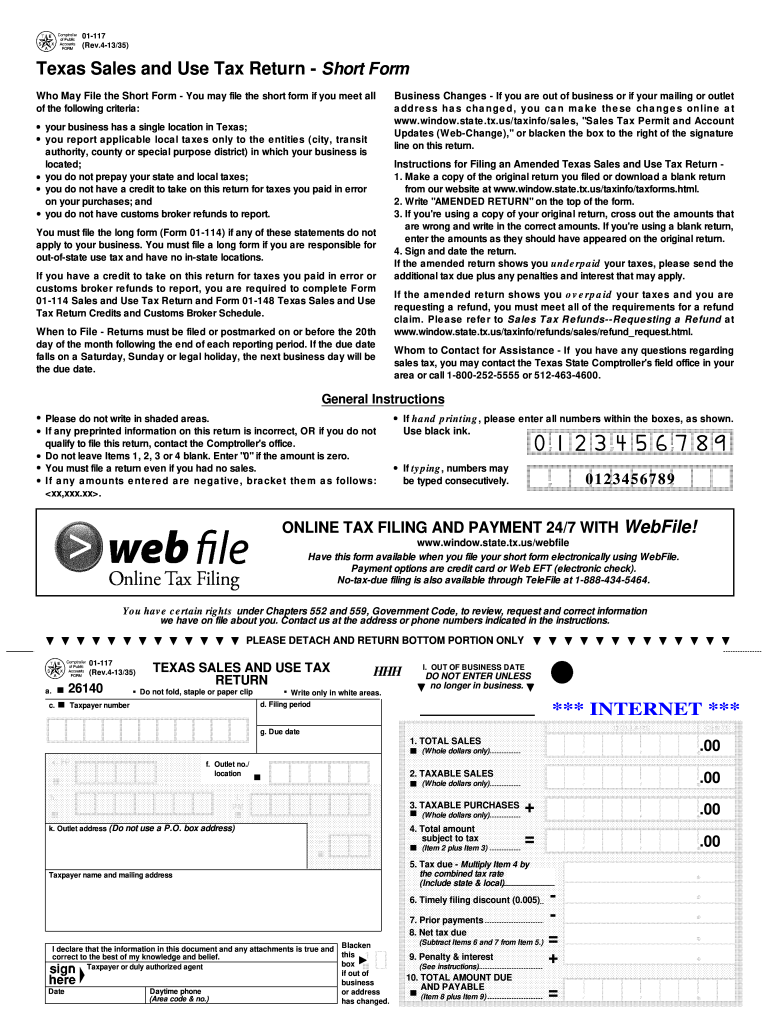

TX Comptroller 01-117 2013 free printable template

Show details

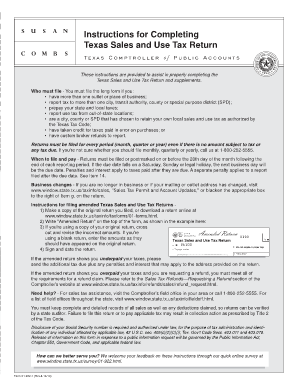

If you have a credit to take on this return for taxes you paid in error or customs broker refunds to report you are required to complete Form 01-114 Sales and Use Tax Return and Form 01-148 Texas Sales and Use Tax Return Credits and Customs Broker Schedule. Has changed. Subtract Items 6 and 7 from Item 5. 9. Penalty interest See instructions 10. TOTAL AMOUNT DUE AND PAYABLE Form 01-117 Back Rev.4-13/35 continued Item c. Enter the taxpayer number shown on your sales tax permit. You must file a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 01-117

Edit your TX Comptroller 01-117 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 01-117 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 01-117 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 01-117. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 01-117 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 01-117

How to fill out TX Comptroller 01-117

01

Gather documentation on the sales or use tax you are reporting.

02

Obtain a copy of the TX Comptroller 01-117 form from the Texas Comptroller's website.

03

Fill in your name, address, and other business identification information at the top of the form.

04

Specify the reporting period for which you are filing the form.

05

Detail the total sales and taxable sales amounts in the appropriate sections.

06

Calculate the total tax due based on your reported sales.

07

Include any exemptions or adjustments applicable to your tax situation.

08

Sign and date the form to certify the information provided is accurate.

09

Submit the completed form along with any payment due to the Texas Comptroller.

Who needs TX Comptroller 01-117?

01

Any business or individual who has collected or owes sales or use tax in Texas.

02

Entities seeking to report tax exemptions or adjustments related to sales or use tax.

03

Businesses that need to reconcile their tax obligations for the specified reporting period.

Fill

form

: Try Risk Free

People Also Ask about

What is Texas special district sales tax?

The special purpose district sales and use tax will be increased to 1 1/2 percent as permitted under Chapter 775 of the Texas Health and Safety Code, effective October 1, 2022 in the special purpose district listed below.

What is TX ST sales tax?

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

Is Texas sales tax based on destination or origin?

Marketplace providers that are engaged in business in Texas must collect and remit tax on all third-party sales. The tax is based on the shipping destination.

What is DFW sales tax?

What is the sales tax rate in Dallas, Texas? The minimum combined 2023 sales tax rate for Dallas, Texas is 8.25%. This is the total of state, county and city sales tax rates.

How to fill out a Texas sales and use tax exemption certification?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How to fill Texas resale certificate?

Common details listed on the Texas resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Texas sales tax number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX Comptroller 01-117 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your TX Comptroller 01-117 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in TX Comptroller 01-117 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your TX Comptroller 01-117, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out the TX Comptroller 01-117 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign TX Comptroller 01-117 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is TX Comptroller 01-117?

TX Comptroller 01-117 is a form used by businesses in Texas to report their franchise tax and to comply with state tax regulations.

Who is required to file TX Comptroller 01-117?

Entities that are subject to the Texas franchise tax, including corporations and limited liability companies (LLCs), are required to file TX Comptroller 01-117.

How to fill out TX Comptroller 01-117?

To fill out TX Comptroller 01-117, businesses must provide their legal name, address, and taxpayer identification number, along with financial details such as total revenue and allowable deductions.

What is the purpose of TX Comptroller 01-117?

The purpose of TX Comptroller 01-117 is to collect necessary tax information from businesses in Texas to ensure compliance with state tax laws and to calculate the amount of franchise tax owed.

What information must be reported on TX Comptroller 01-117?

On TX Comptroller 01-117, businesses must report their gross receipts, total revenue, any applicable deductions, and other financial data related to their business operations.

Fill out your TX Comptroller 01-117 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 01-117 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.