NM TRD CIT-1 2013 free printable template

Show details

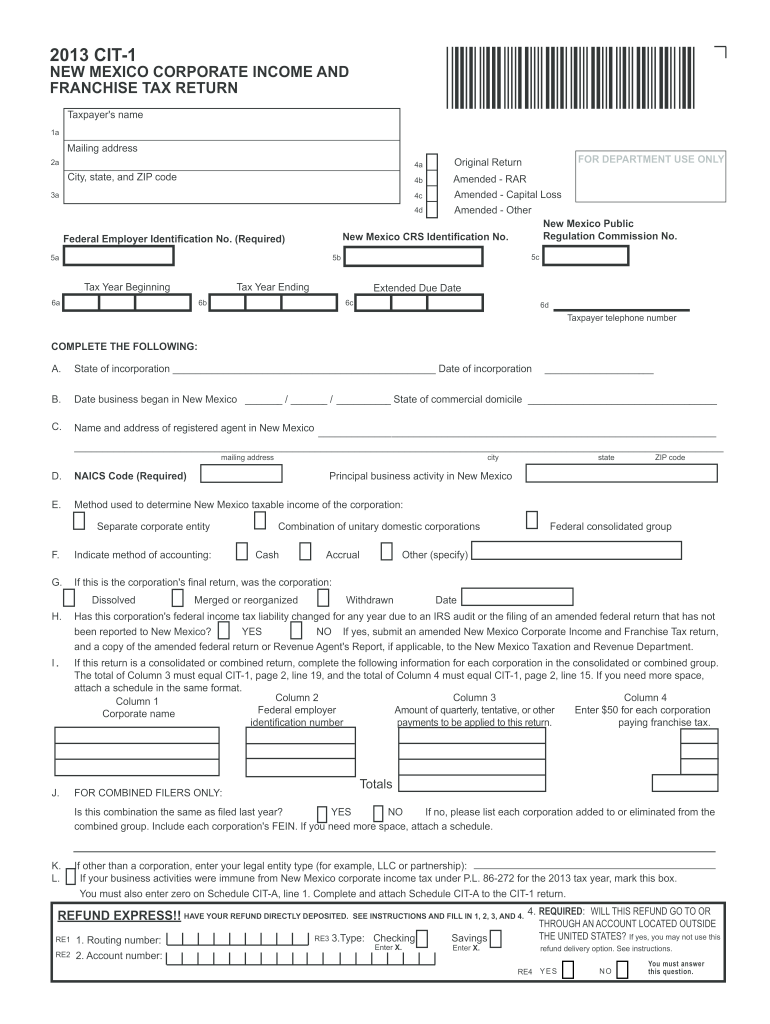

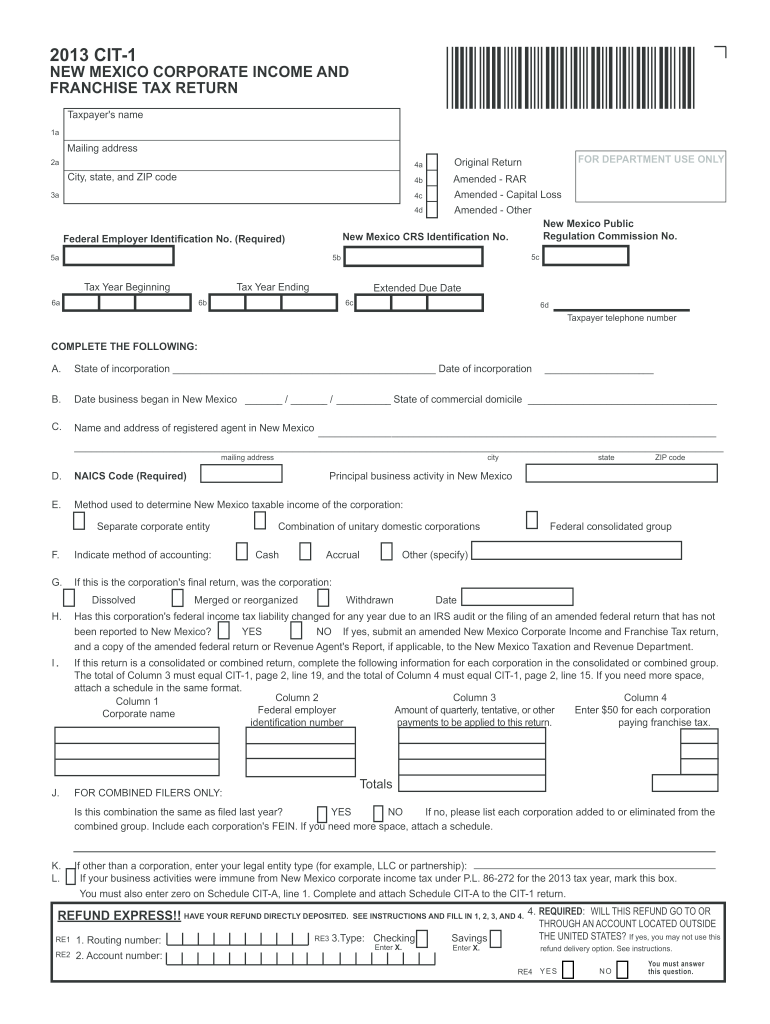

RE4 Y E S NO You must answer this question. 2013 CIT-1 page 2 1. Taxable income before federal NOL and special deductions from federal Form 1120. L. 86-272 for the 2013 tax year mark this box. You must also enter zero on Schedule CIT-A line 1. Complete and attach Schedule CIT-A to the CIT-1 return. Totals REFUND EXPRESS HAVE YOUR REFUND DIRECTLY DEPOSITED. 2013 CIT-1 136080200 NEW MEXICO CORPORATE INCOME AND FRANCHISE TAX RETURN Taxpayer s name 1a Mailing address 2a 4a City state and ZIP code...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign corporatefranchise tax fyi

Edit your corporatefranchise tax fyi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporatefranchise tax fyi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporatefranchise tax fyi online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporatefranchise tax fyi. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD CIT-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out corporatefranchise tax fyi

How to fill out NM TRD CIT-1

01

Obtain the NM TRD CIT-1 form from the New Mexico Taxation and Revenue Department website or office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) and provide details about your income during the year.

04

Report any deductions you are eligible for, such as business expenses, educational expenses, or mortgage interest.

05

Calculate your tax liability based on the provided income and deductions using the tax tables or formulas provided.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submitting it either electronically or by mail to the specified address.

Who needs NM TRD CIT-1?

01

Individuals or businesses operating in the State of New Mexico who are required to file an income tax return.

02

Taxpayers who have income sources within New Mexico that must be reported for state tax purposes.

03

Residents of New Mexico who need to report their federal adjusted gross income and calculate their state tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a franchise tax?

A franchise tax is a state tax imposed on businesses or for-profit corporations doing business in the state. Because the primary purpose of a franchise tax is to raise revenue for the state, a franchise tax is distinct from federal taxes, such as income or excise tax.

What are two types of corporate tax?

Federal corporate income tax There are two types of corporations for federal income tax purposes—“Subchapter C” or “C corporations” and “Subchapter S” or “S corporations.” A C corporation must file a federal tax return and pay federal taxes on income it earned.

What is NM tax form RPD 41083?

Form RPD-41083 is to be used to claim a refund of New Mexico tax on behalf of a deceased taxpayer. Who Must File. If you are a court-appointed or certified personal representative, you must include Form RPD-41083 with the taxpayer's refund claim (New Mexico income tax return).

How do I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

What is a RPD 41359 form?

Annual statements of withholding should not be submitted to the Department, but must be submitted to the taxpayer using form RPD-41359, Annual Statement of Pass-Through Entity Withholding, or 1099-Misc.

What is the difference between franchise tax and corporate tax?

There are two different types of taxes that can be assessed on businesses: corporate income taxes and franchise taxes. The difference is found in looking at what exactly is being taxed. Income taxes apply to profit. Franchise taxes do not apply to profit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my corporatefranchise tax fyi in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your corporatefranchise tax fyi and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify corporatefranchise tax fyi without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your corporatefranchise tax fyi into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I edit corporatefranchise tax fyi on an Android device?

With the pdfFiller Android app, you can edit, sign, and share corporatefranchise tax fyi on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NM TRD CIT-1?

NM TRD CIT-1 is a tax form used in New Mexico for reporting Corporate Income Tax liabilities.

Who is required to file NM TRD CIT-1?

Corporations doing business in New Mexico and earning income are required to file NM TRD CIT-1.

How to fill out NM TRD CIT-1?

To fill out NM TRD CIT-1, provide the required financial information, including income, deductions, and tax calculations as per the guidelines outlined by the New Mexico Taxation and Revenue Department.

What is the purpose of NM TRD CIT-1?

The purpose of NM TRD CIT-1 is to calculate and report the Corporate Income Tax owed by corporations in New Mexico.

What information must be reported on NM TRD CIT-1?

NM TRD CIT-1 requires reporting of gross receipts, deductions, taxable income, and the amount of tax due, among other relevant financial information.

Fill out your corporatefranchise tax fyi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporatefranchise Tax Fyi is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.