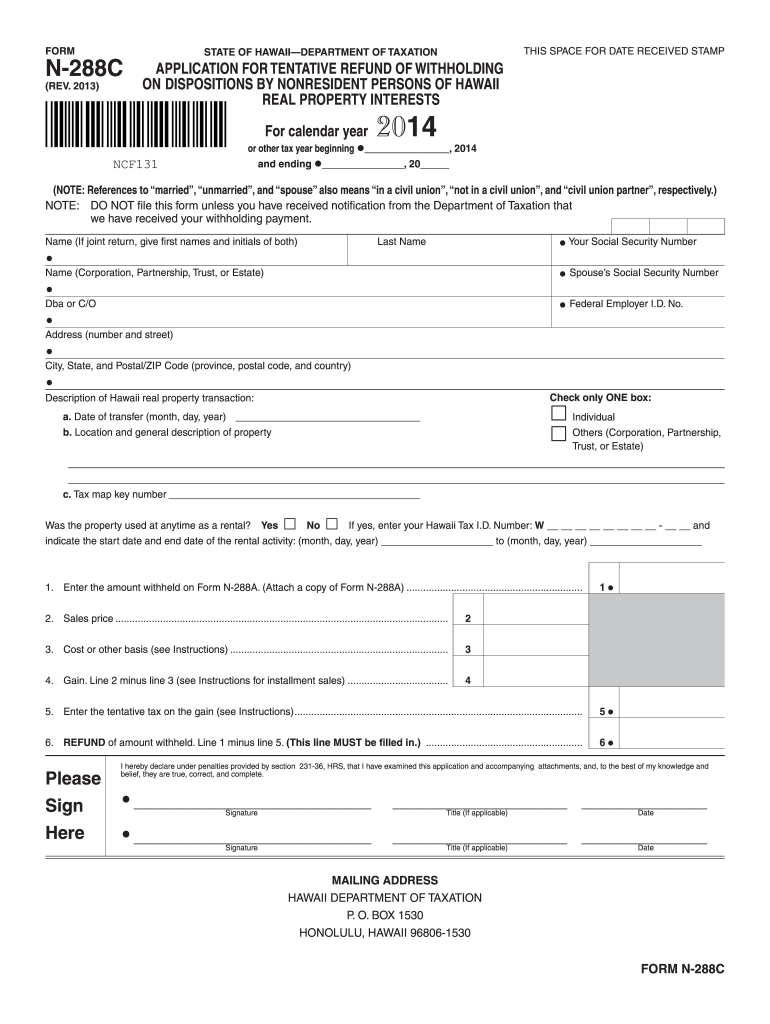

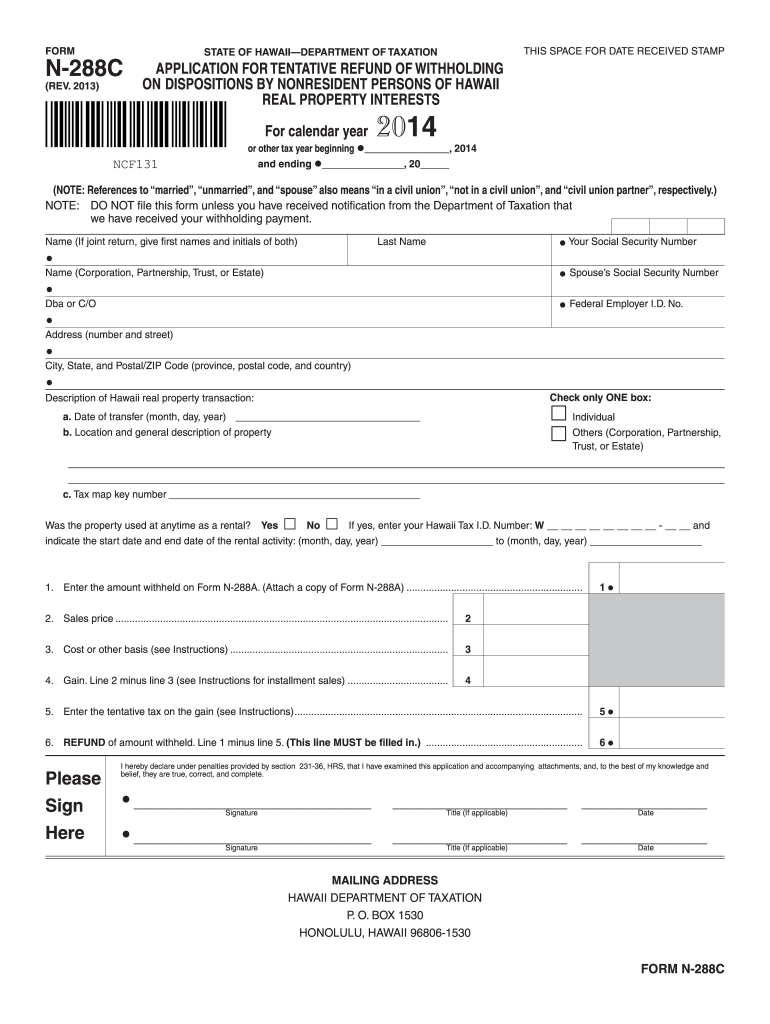

HI DoT N-288C 2014 free printable template

Get, Create, Make and Sign 2014 form n 288c

How to edit 2014 form n 288c online

Uncompromising security for your PDF editing and eSignature needs

HI DoT N-288C Form Versions

How to fill out 2014 form n 288c

How to fill out HI DoT N-288C

Who needs HI DoT N-288C?

Instructions and Help about 2014 form n 288c

2 1 go all right autonomous mode 7232 moving forward in autonomous mode as eighty-two empires off for quick shots two going in and a fourth shot we got four in four blue in this autonomous period a fifth one singing off the time is so close looks like advantage blue three two one go blue with the ten point bonus from the autonomous mode wind every point counts a lot of close matches here on the engineering field already in this first round of qualifying look at this 7232 moving up dropping in 3 quick scores for before the red alliance as the blue lines bouncing them off the rim 82 m gathering from the floor a team coming all the way from China and another score and another score 288 playing defense on the red line on the blue Alliance 82 am bouncing them off the rim as 1670 again driving all the way back and a 180-degree turn by the blue Alliance 1670 dropping in for more balls the field nearly devoid of balls only one free ball on the field with 52 seconds left on the clock as both teams move back for the human player loaded section of the game again the blue Alliance look they found their mark pretty quickly high arcing shots slowly loading two robots firing as balls bounced around the field as an um what moves out to collect strays and their partners continues to fire continuing to fire 7232 now in rapid fire mode at least one ball per second coming out of that 7232 machine as both teams fill the gold to capacity looks like red is moving into the lead with only 14 seconds left on the clock as 7232 again taking stray balls from the field in the final seconds we've got seven seconds left on the clock now both teams trying to make a final scoring attempt we got 21 and that's it for match number

People Also Ask about

What is Form N-288C?

Does Hawaii have a separate capital gains tax?

How do I avoid capital gains tax in Hawaii?

What is the exclusion for selling a house in Hawaii?

What is the maximum exclusion on sale of home?

What is Form N 288A in Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2014 form n 288c in Gmail?

How do I edit 2014 form n 288c in Chrome?

Can I create an electronic signature for signing my 2014 form n 288c in Gmail?

What is HI DoT N-288C?

Who is required to file HI DoT N-288C?

How to fill out HI DoT N-288C?

What is the purpose of HI DoT N-288C?

What information must be reported on HI DoT N-288C?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.