MO RD-100 2012-2026 free printable template

Show details

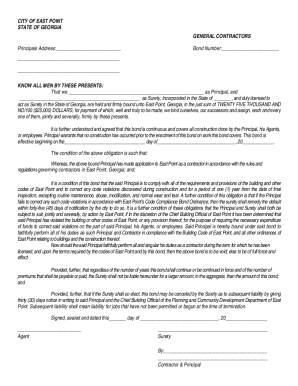

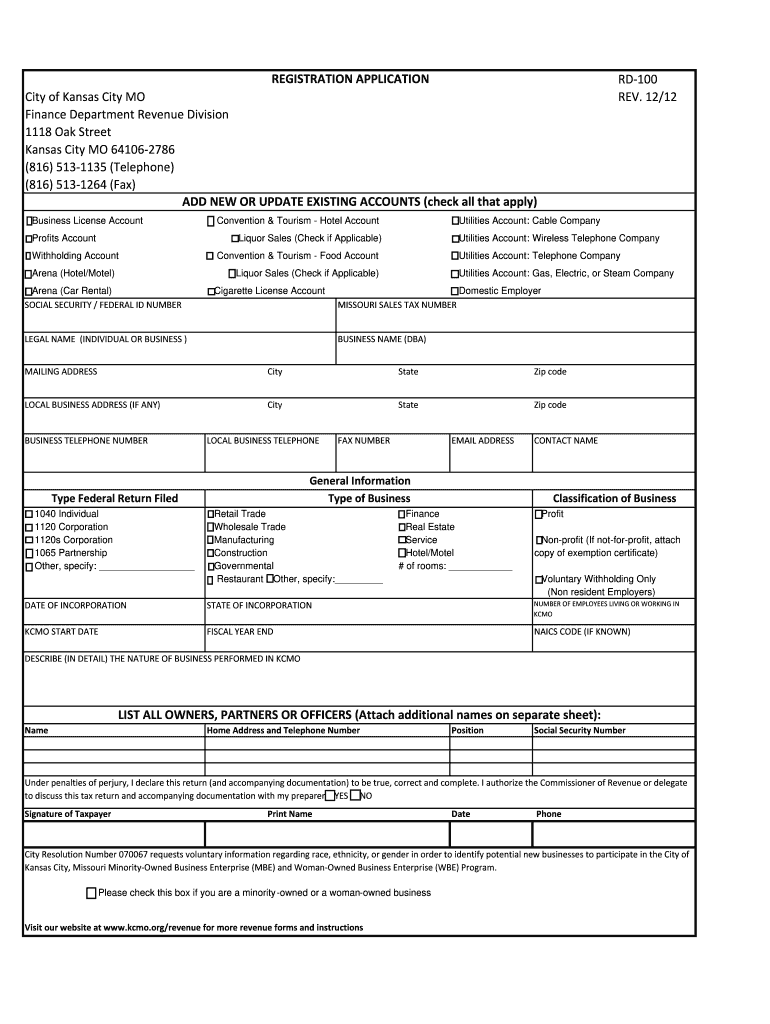

REGISTRATION APPLICATION City of Kansas City MO Finance Department Revenue Division 1118 Oak Street Kansas City MO 64106-2786 (816) 513-1135 (Telephone) (816) 513-1264 (Fax) ADD NEW OR UPDATE EXISTING

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO RD-100

Edit your MO RD-100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO RD-100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO RD-100 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MO RD-100. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO RD-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO RD-100

How to fill out MO RD-100

01

Obtain the MO RD-100 form from the appropriate state department website or office.

02

Fill out the general information section, including your name, address, and contact details.

03

Provide details about the specific request or information you are submitting.

04

If necessary, attach any required documents that support your request.

05

Review the completed form for accuracy and completeness.

06

Submit the form electronically or physically, based on the submission guidelines provided.

Who needs MO RD-100?

01

Individuals, businesses, or organizations seeking to obtain specific information or make a formal request to a government agency in Missouri.

Fill

form

: Try Risk Free

People Also Ask about

What is the Kansas City withholding tax?

All Kansas City, Missouri residents, regardless of where they are employed, and all non- residents who work within the city limits, are subject to a 1 percent tax on their gross earnings.

What is the hotel tax in Kansas City MO?

— Kansas City, Missouri, voters approved the city's plan to collect the 7.5% convention and tourism tax on short-term rentals as well as raise its lodging and tourism fee during Tuesday's primary election. The city will raise its lodging and tourism fee from $1.50 per bedroom per occupied night to a maximum of $3.

What is the 1% tax in Kansas City?

The earnings tax (sometimes referred to as “e-tax”) is a 1 percent tax on an individual's earned income such as salaries, wages, commissions, tips and other compensation. It generates revenue that pays for a wide variety of city services used by all those who live and work in Kansas City, Missouri.

What is the convention and tourism tax in Kansas City MO?

What is the convention and tourism tax for hotels? The City levies a tax of 7.5 percent of the amount of sales or charges for all sleeping rooms paid by the transient guests of hotels, motels and tourist courts situated within the City, and doing business within the City (excluding sales tax).

How much is the tax in Kansas City?

This is the total of state, county and city sales tax rates. The Missouri sales tax rate is currently 4.23%. The County sales tax rate is 1.38%. The Kansas City sales tax rate is 3.25%.

Does Kansas City have taxes?

Sales and Use Taxes The City does not administer the local component of the sales tax. Retailers remit sales taxes to the State of Missouri and the receipts are then distributed to the City.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MO RD-100 online?

The editing procedure is simple with pdfFiller. Open your MO RD-100 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the MO RD-100 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your MO RD-100 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit MO RD-100 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MO RD-100 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is MO RD-100?

MO RD-100 is a report form used in the state of Missouri to gather information related to certain financial transactions and activities for tax purposes.

Who is required to file MO RD-100?

Individuals, businesses, and organizations that engage in activities subject to the reporting requirements outlined by the state of Missouri are required to file the MO RD-100.

How to fill out MO RD-100?

To fill out the MO RD-100, follow the instructions provided with the form, ensuring that all required fields are completed accurately with the appropriate financial information.

What is the purpose of MO RD-100?

The purpose of the MO RD-100 is to ensure compliance with state tax regulations by collecting necessary data on financial transactions.

What information must be reported on MO RD-100?

The MO RD-100 requires reporting of various financial details, including income amounts, types of transactions, and any other relevant financial activities as specified in the form instructions.

Fill out your MO RD-100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO RD-100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.