IRS 8453-FE 2013 free printable template

Show details

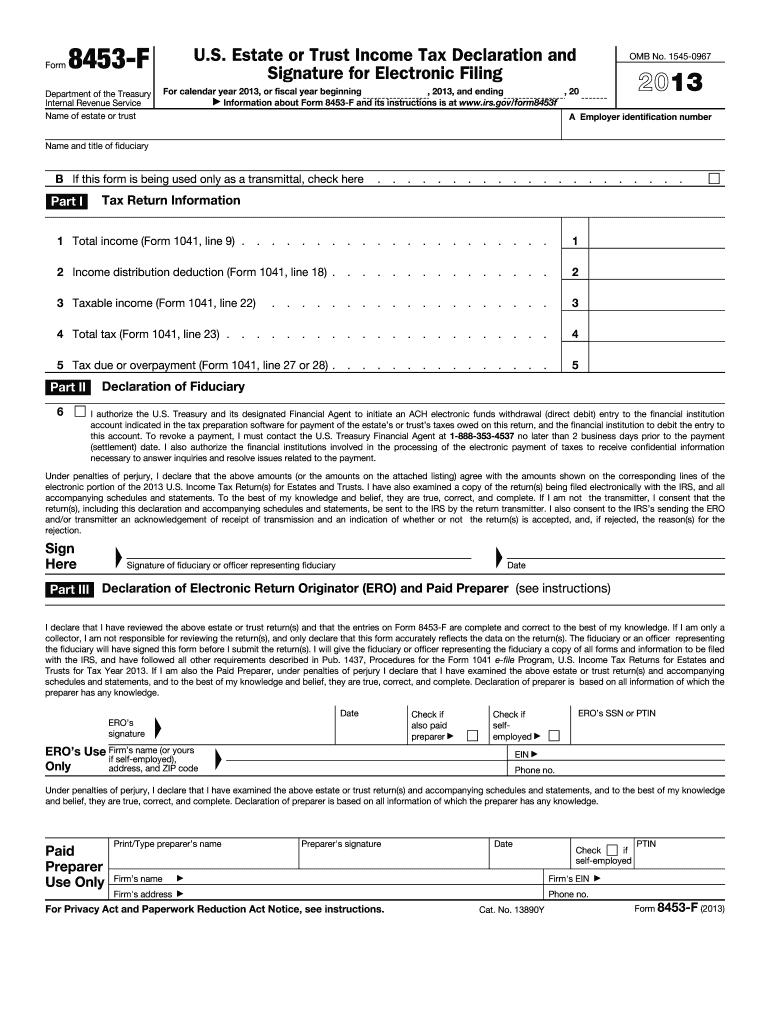

Do not enclose Form 8453-F with Form 1041-V. Mail Form 8453-F to the address shown under Where To File on this page. Can Form 8453-F Be Used Only as a Transmittal Yes if You used the PIN method to sign the e-filed Form 1041 and You must send accompanying paper payment schedules or Then Enter the estate s or trust s identifying information and the name and title of the fiduciary Check the box on line B and Attach Form 8453-F as a transmittal to the paper documents. Purpose of Form Use Form...8453-F to Authenticate the electronic Form 1041 U.S. Income Tax Return for Estates and Trusts Authorize the electronic filer to transmit via a third-party transmitter Authorize an electronic funds withdrawal for payment of federal taxes owed and Serve as a transmittal for any accompanying paper schedules or statements. 8453-F U.S. Estate or Trust Income Tax Declaration and Signature for Electronic Filing Department of the Treasury Internal Revenue Service Name of estate or trust For calendar...year 2013 or fiscal year beginning 2013 and ending Information about Form 8453-F and its instructions is at www.irs.gov/form8453f Form OMB No. 1545-0967 A Employer identification number Name and title of fiduciary B If this form is being used only as a transmittal check here Part I. Cat. No. 13890Y PTIN Form 8453-F 2013 Page 2 Future Developments For the latest information about developments related to Form 8453-F and its instructions such as legislation enacted after they were published go to...www.irs.gov/form8453f. Reminder If you used the PIN method to sign the e-filed Form 1041 and only want to use Form 8453-F to serve as a transmittal for any paper schedules or statements check the box at the end of line B. I also consent to the IRS s sending the ERO and/or transmitter an acknowledgement of receipt of transmission and an indication of whether or not the return s is accepted and if rejected the reason s for the rejection. Sign Here Signature of fiduciary or officer representing...fiduciary Date Part III Declaration of Electronic Return Originator ERO and Paid Preparer see instructions I declare that I have reviewed the above estate or trust return s and that the entries on Form 8453-F are complete and correct to the best of my knowledge. Line 6 electronic funds withdrawal direct debit. Otherwise leave the box blank. ERO and Paid Preparer The ERO is one who deals directly with the fiduciary and either prepares tax returns or collects prepared tax returns including Forms...8453-F for fiduciaries who wish to have the return of the by the IRS. A paid preparer who is also the ERO checks the box in the ERO s Use Only section labeled Check if also paid preparer. A space for Paid Preparer Use Only. Use of PTIN Paid preparers. Anyone who is paid to prepare the estate s or trust s return must enter their PTIN in Part III. The PTIN entered must have been issued after September 27 2010. For information on applying for and receiving a PTIN see Form W-12 IRS Paid Preparer Tax...Identification Number PTIN Application and Renewal or visit www.irs.gov/ptin. EROs who are not paid preparers.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8453-FE

How to edit IRS 8453-FE

How to fill out IRS 8453-FE

Instructions and Help about IRS 8453-FE

How to edit IRS 8453-FE

To edit IRS 8453-FE, first obtain a copy of the form, either as a downloadable PDF or a printed version. Use a PDF editing tool like pdfFiller to make necessary changes. Open the form in pdfFiller, select the fields you need to change, and enter the correct information. Upon completing your edits, save the form to preserve your changes.

How to fill out IRS 8453-FE

Filling out IRS 8453-FE is straightforward. Follow these steps:

01

Gather necessary information, including your taxpayer identification details.

02

Indicate your filing status and any applicable deductions.

03

Provide details about the return you are filing, including income and tax obligations.

04

Review your information for accuracy before finalizing the form.

About IRS 8453-FE 2013 previous version

What is IRS 8453-FE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8453-FE 2013 previous version

What is IRS 8453-FE?

IRS 8453-FE is the tax form titled “U.S. Estate and Trust Income Tax Return Electronic Filing Declaration.” It is primarily used by fiduciaries to certify that they wish to file their Form 1041 electronically. This form allows for the electronic submission of tax returns related to estates and trusts.

What is the purpose of this form?

The purpose of IRS 8453-FE is to verify the authenticity of an electronically filed estate or trust income tax return. By submitting this form, taxpayers confirm that the information presented is complete and accurate. This form serves as a declaration to the IRS that the electronically filed return corresponds with the paper version, if applicable.

Who needs the form?

IRS 8453-FE needs to be completed by any fiduciary who files Form 1041 electronically for estates or trusts. This includes trustees and executors who manage the estate or trust's financial matters. If you are responsible for filing income tax on behalf of an estate or trust and choose electronic filing, you must submit IRS 8453-FE.

When am I exempt from filling out this form?

You are exempt from filling out IRS 8453-FE if you are submitting a paper version of your tax return. Additionally, if you do not file Form 1041 electronically, you do not need this form. Exemptions also exist when the estate or trust does not meet the income thresholds requiring a return.

Components of the form

The components of IRS 8453-FE include personal identification information such as the name and taxpayer identification number of the fiduciary. It also contains sections to confirm that the electronic filing matches any forms submitted by paper. Furthermore, there are areas designated for tax year and type of return being filed.

What are the penalties for not issuing the form?

Failure to issue IRS 8453-FE when required can lead to penalties from the IRS. These could include fines or rejection of the electronically filed return, which may force the fiduciary to refile using paper forms. Accurate compliance ensures that your tax obligations are met without unnecessary complications.

What information do you need when you file the form?

When filing IRS 8453-FE, you need personal identification details of the fiduciary, income details for the entity (such as the estate or trust), any deductions or credits claimed, and confirmation of any payments made. Additionally, ensure that you have the requisite tax identification number on hand.

Is the form accompanied by other forms?

IRS 8453-FE may be required alongside Form 1041, as it serves as a declaration for the electronic submission of that return. When filing electronically, ensure all relevant forms are correctly submitted to maintain compliance.

Where do I send the form?

IRS 8453-FE does not get sent separately to the IRS. Instead, it must be submitted electronically to accompany the electronic filing of Form 1041. The IRS system will automatically process the declaration when the electronic return is filed.

See what our users say