IRS 5305-S 2002 free printable template

Show details

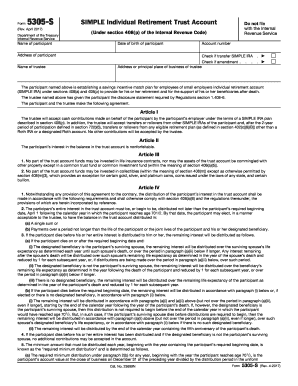

Form 5305-S (Rev. March 2002) SIMPLE Individual Retirement Trust Account Do not file with the Internal Revenue Service (Under section 408(p) of the Internal Revenue Code) Department of the Treasury

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 5305-S

How to edit IRS 5305-S

How to fill out IRS 5305-S

Instructions and Help about IRS 5305-S

How to edit IRS 5305-S

Editing IRS 5305-S requires careful attention to detail. You can use pdfFiller to modify text and ensure correct data entry. Simply upload the form to pdfFiller, make your changes, and save the updated version for submission.

How to fill out IRS 5305-S

Filling out IRS 5305-S involves several steps to ensure accuracy. First, gather all necessary information that includes your name, address, and tax identification number. Then, follow these steps:

01

Download the IRS 5305-S form from the official IRS website or utilize pdfFiller for easy access.

02

Fill in the applicant's information accurately in the specified fields.

03

Review all entries for correctness to avoid any errors that could delay processing.

04

Sign and date the form before submission.

About IRS 5305-S 2002 previous version

What is IRS 5305-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 5305-S 2002 previous version

What is IRS 5305-S?

IRS 5305-S is a form used by employers to establish Section 125 cafeteria plans, granting employees a choice between certain benefits. This earlier version of the form outlines how to set up a flexible benefits plan that allows employees to select benefits that best suit their needs.

What is the purpose of this form?

The primary purpose of IRS 5305-S is to provide a standardized method for employers to offer their employees a variety of pre-tax benefits. This structure can help both employees and employers save on taxes while maximizing benefit flexibility.

Who needs the form?

Employers who wish to implement a Section 125 cafeteria plan must complete and submit IRS 5305-S. This includes businesses of all sizes looking to provide employees with options for health insurance, dependent care assistance, and other benefits.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 5305-S if your business does not provide flexible employee benefits or if you are not an employer offering any pre-tax benefits. Additionally, organizations that already have established cafeteria plans may not need to submit this specific form.

Components of the form

IRS 5305-S comprises several key components that need to be completed accurately. These include sections for employer information, details about the cafeteria plan, and signature lines for validation. Each component ensures the legality and structuring of the benefits offered.

What are the penalties for not issuing the form?

Failure to properly issue IRS 5305-S can result in penalties from the IRS. Employers may face fines for non-compliance or failure to provide employees with the benefits and flexibility outlined in their cafeteria plans. It's essential to adhere to the guidelines to avoid potential financial repercussions.

What information do you need when you file the form?

When filing IRS 5305-S, you will need specific information such as your business name, address, employer identification number (EIN), and detailed descriptions of the benefits being offered under the cafeteria plan. Accurate information is crucial for compliance.

Is the form accompanied by other forms?

IRS 5305-S may need to be submitted with other documentation depending on your specific benefits plan. Check IRS requirements and consult with a tax professional to ensure that all necessary forms are included and thoroughly completed.

Where do I send the form?

After completing IRS 5305-S, submission instructions vary based on the nature of your business and the type of benefits offered. Generally, forms should be kept on file with your business records and not necessarily sent to the IRS unless specifically required for audits or compliance checks.

See what our users say