IRS 1098-C 2014 free printable template

Show details

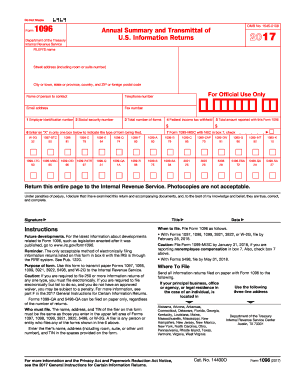

526. Future developments. For the latest information about developments related to Form 1098-C and its instructions such as legislation enacted after they were published go to www.irs.gov/form1098c. Copy D For Donee To complete Form 1098-C use Certain Information Returns and the 2014 Instructions for Form To order these instructions and additional forms go to www.irs.gov/ form1098c or call 1-800-TAX-FORM 1-800-829-3676. OMB No. 1545-1959 1 Date of contribution Contributions of Motor Vehicles...Boats and Airplanes 2a Odometer mileage Form 1098-C 2b Year DONEE S federal identification number 2c Make 2d Model 3 Vehicle or other identification number DONOR S identification DONOR S name 4a Street address including apt. no. 4b Date of sale City or town state or province country and ZIP or foreign postal code 4c Gross proceeds from sale see instructions Donee certifies that vehicle was sold in arm s length transaction to unrelated party Copy A For Internal Revenue Service Center 5a...improvements or significant intervening use 5b donee s charitable purpose File with Form 1096. 6a Did you provide goods or services in exchange for the vehicle. Yes No For Privacy Act and Paperwork Reduction Act Notice see the 2014 General Instructions for Certain Information Returns. Attention This form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* Do not file copy A downloaded from this website. The official printed version of this IRS...form is scannable but the online version of it printed from this website is not. A penalty may be imposed for filing forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns for more information about penalties. To order official IRS forms call 1-800-TAX-FORM 1-800-829-3676 or Order Information Returns and Employer Returns Online and we ll mail you the scannable forms and other products. See IRS Publications 1141 1167 1179 and other IRS...resources for information about printing these tax forms. VOID CORRECTED DONEE S name street address city or town state or province country ZIP or foreign postal code and telephone no. OMB No* 1545-1959 1 Date of contribution Contributions of Motor Vehicles Boats and Airplanes 2a Odometer mileage Form 1098-C 2b Year DONEE S federal identification number 2c Make 2d Model 3 Vehicle or other identification number DONOR S identification DONOR S name 4a Street address including apt* no* 4b Date of...sale City or town state or province country and ZIP or foreign postal code 4c Gross proceeds from sale see instructions Donee certifies that vehicle was sold in arm s length transaction to unrelated party Copy A For Internal Revenue Service Center 5a improvements or significant intervening use 5b donee s charitable purpose File with Form 1096. 6a Did you provide goods or services in exchange for the vehicle. Yes No For Privacy Act and Paperwork Reduction Act Notice see the 2014 General...Instructions for Certain Information Returns.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1098-C

How to edit IRS 1098-C

How to fill out IRS 1098-C

Instructions and Help about IRS 1098-C

How to edit IRS 1098-C

To edit IRS 1098-C, utilize a PDF editor that allows for modifications. Ensure that all entries reflect accurate information regarding the qualified vehicle donation and related deductions. It is important to save the document after making changes to avoid losing data.

How to fill out IRS 1098-C

To fill out IRS 1098-C, follow these steps:

01

Provide the taxpayer's information, including name, address, and tax identification number.

02

Include details about the organization receiving the vehicle, such as its name and address.

03

Document the description of the vehicle, including make, model, and year.

04

Indicate the date of the vehicle donation.

05

State the vehicle's fair market value as determined by applicable guidelines.

About IRS 1098-C 2014 previous version

What is IRS 1098-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1098-C 2014 previous version

What is IRS 1098-C?

IRS 1098-C, also known as "Contributions of Motor Vehicles, Boats, and Airplanes," is a tax form used by charities to report donations of vehicles or other transportation items. The form is crucial for donors to substantiate their claims for tax deductions on their income tax returns.

What is the purpose of this form?

The purpose of IRS 1098-C is to provide the IRS with information about donated vehicles, helping ensure compliance with tax laws. It allows the donor to claim a deduction based on the fair market value of the vehicle, provided certain conditions are met.

Who needs the form?

Individuals who donate motor vehicles, boats, or airplanes to a qualified charitable organization must receive IRS 1098-C from the charity to claim a tax deduction. Donors need to ensure that the charity is recognized by the IRS as a nonprofit to utilize the form benefits.

When am I exempt from filling out this form?

A donor may be exempt from filling out IRS 1098-C if the gross proceeds from the sale of the vehicle are less than $500 or if the donation is made in exchange for goods or services. In these cases, other documentation may suffice for tax reporting purposes.

Components of the form

IRS 1098-C comprises several essential components, including the donor's identification information, details of the donated vehicle, its value, and the charity's identification. The form ensures that all parties have necessary information regarding the donation for tax and legal purposes.

Due date

IRS 1098-C must be issued by the charitable organization to the donor by January 31 of the year following the vehicle donation. It is crucial for timely reporting to avoid potential disputes during tax filing.

What are the penalties for not issuing the form?

Charities that fail to issue IRS 1098-C may face penalties from the IRS. These can include fines ranging from $50 to $260 per form depending on how late the form is provided, with maximum penalties applicable based on the size of the organization.

What information do you need when you file the form?

When filing IRS 1098-C, you will need accurate information about the vehicle, the donating party, and the receiving charity. This includes the vehicle's make, model, year, and fair market value, as well as the identification numbers of both the donor and the charity.

Is the form accompanied by other forms?

IRS 1098-C is typically filed alongside the donor's tax return. In some instances, a charitable contribution deduction may require additional forms, such as Schedule A for itemized deductions, to complete the tax filing process effectively.

Where do I send the form?

Donors do not send IRS 1098-C to the IRS. Instead, they keep it for their records and use it when preparing their tax returns. The charitable organization, however, is responsible for filing the form with the IRS.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

So far the limited need I have to fill out forms has been totally satisfied with this application.

good

easy to use

I've only used the site briefly and it seems user friendly.

Thank you so very very much for the…

Thank you so very very much for the prompt assistance. Am stressed due to deadline I have to meet today to Labor Law requirement in my country for my foreign workers.

I will try d payment issues later as it is more complicated matters involved

The app and customer support is great!

The app itself is great, no doubt. Recently I encountered some problems with logging in and contacted the support team and they resolve my problem in 10 minutes. Outstanding customer support! 10/10

SO far, so good...with some aggravations for navigating what I want to do.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.