Canada T2220 2012 free printable template

Show details

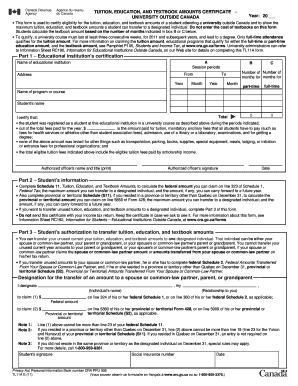

We have received which we will credit to the account of to the instructions in Section I. according Privacy Act Personal Information Bank number CRA PPU 005 T2220 E 12 Vous pouvez obtenir ce formulaire en fran ais www. Protected B Transfer from an RRSP RRIF or SPP to Another RRSP RRIF or SPP on Breakdown of Marriage or Common-Law Partnership when completed A transfer of property that is not made under a decree order or judgment of a competent tribunal or under a written separation agreement...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2220

Edit your Canada T2220 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2220 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T2220 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada T2220. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2220 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2220

How to fill out Canada T2220

01

Start by downloading the Canada T2220 form from the official Canada Revenue Agency website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Insurance Number (SIN).

03

Provide the details of the property for which you are claiming the tax deduction.

04

Indicate the total cost of the property and any expenditures related to it.

05

Complete the sections related to ownership and the manner in which you use the property, e.g., personal use, rental, or other.

06

Double-check all the information for accuracy and ensure that all required fields are filled.

07

Sign and date the form.

08

Submit the completed T2220 form along with your tax return to the Canada Revenue Agency.

Who needs Canada T2220?

01

Individuals or businesses in Canada who are claiming a deduction for capital cost allowance (CCA) on property they own.

02

Taxpayers who want to classify property as eligible for CCA under the Income Tax Act.

Fill

form

: Try Risk Free

People Also Ask about

What is a transfer under section 60l?

Section 60(L) is a Transfer of refund of premiums under an RRSP. Taxcycle has a section called “RRSP Transfers” in the middle section of the “RRSP Contributions Worksheet”

Can a LIRA be transferred?

You may transfer your non locked-in funds out of the FPP into an RRSP at a financial institution. A Locked-In Retirement Account (LIRA) is an RRSP that receives locked-in funds from a provincially registered pension plan. You may transfer your locked-in funds out of the FPP into a LIRA at a financial institution.

What is the form for RRSP to RRIF transfer?

You can use Form T2220, Transfer from an RRSP, RRIF, PRPP or SPP to Another RRSP, RRIF, PRPP or SPP on Breakdown of Marriage or Common-law Partnership for transfers to a RRIF or an SPP transfer. For transfers to an RRSP, Form T2220 must be filled out. Do not send us a copy of the form.

What is a t220 marriage breakdown?

Marriage breakdown involves dividing up the funds within the registered plans of both partners. A T2220 (Transfer from an RRSP or a RRIF to another RRSP or RRIF on marriage breakdown or common-law partnership) is required to be completed and sent to Head Office.

Can you transfer lira to TFSA?

Generally, transfers between registered accounts like RRSPs, LIRAs, RRIFs, LIFs, RESPs, and TFSAs do not have tax implications. The funds transfer over on a tax-free (for TFSAs) or tax-deferred (for other accounts) basis.

How do I get my money out of a LIRA?

Getting money out of your LIRA For that reason, typically the only way to unlock a LIRA is to retire, and the earliest age you can do that is 55. To get income from a LIRA in retirement, you'll need to transfer the funds to a life income fund (LIF) or a life annuity. Money that's moved into a LIRA can be self-managed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada T2220?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Canada T2220 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit Canada T2220 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Canada T2220 right away.

Can I edit Canada T2220 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Canada T2220 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Canada T2220?

Canada T2220 is a form used for the purpose of reporting the transfer of certain amounts, including funds from a registered plan to a registered retirement savings plan (RRSP) in Canada.

Who is required to file Canada T2220?

Individuals who are transferring funds from a registered plan to an RRSP or other similar plan are required to file Canada T2220.

How to fill out Canada T2220?

To fill out Canada T2220, individuals must provide their personal information, details of the plan from which the transfer is occurring, and the amounts being transferred. It is important to follow the instructions provided by the Canada Revenue Agency (CRA) for accurate completion.

What is the purpose of Canada T2220?

The purpose of Canada T2220 is to document and report the transfer of registered amounts to ensure that it complies with tax regulations and to facilitate the appropriate tax treatment of the transferred funds.

What information must be reported on Canada T2220?

Information that must be reported on Canada T2220 includes the individual's identification details, details of the plan being transferred from, the amount being transferred, and the receiving registered plan's information.

Fill out your Canada T2220 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2220 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.