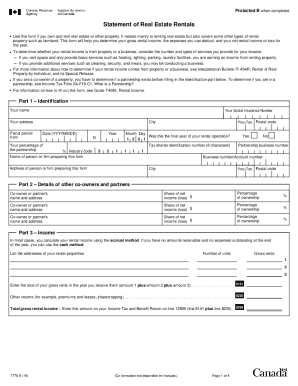

What is Form T776?

Form T776 is known as the Statement of Real Estate Rentals. It must be completed by the real estate or property owners. This form also refers to some other types of leasing property. The owners of farmland may also file this form. You must submit this T776 if you provide lots of useful additional services (such as parking, cleaning, security, etc.) or if you rent out some dwelling and provide only some basic services.

What is Form T776 for?

This form may be used for determining the gross rental income, loss, all expenses that you may deduct during the calendar year. Moreover, the form helps determine if the rental income comes from your business or some property and consider the kinds and amount of services provided to the tenants.

When is Form T776 Due?

This Statement of Real Estate Rentals is not limited by a due date.

Is Form T776 Accompanied by Other Documents?

Generally, you do not need to attach any additional documents. However, if you need some help when completing the form, you may check the Interpretation Bulletin IT-434 that includes detailed instructions.

What Information do I Include in Form T776?

The form includes several blocks. They are the following:

-

Identification. In this part you must indicate your name, SSN, the period of filing, address, business number of partnership, etc.

-

Information about the partners and co-owners: provide the names, net income shares, addresses, ownership percentage;

-

Income: indicate in this part the addresses of rental dwelling, total gross rental income, units number and gross rents;

-

Expenses: in this section describe such expenses as insurance, advertising, travel, utilities, property taxes, office expenses, interest, salaries, wages, and benefits, etc.

Where do I Send Form T776?

You must send this form to the Canada Revenue Service for processing.