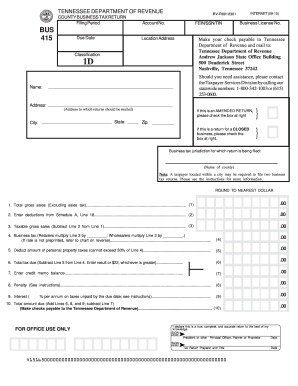

TN DoR BUS 415 2014 free printable template

Show details

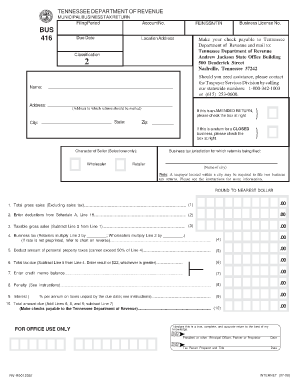

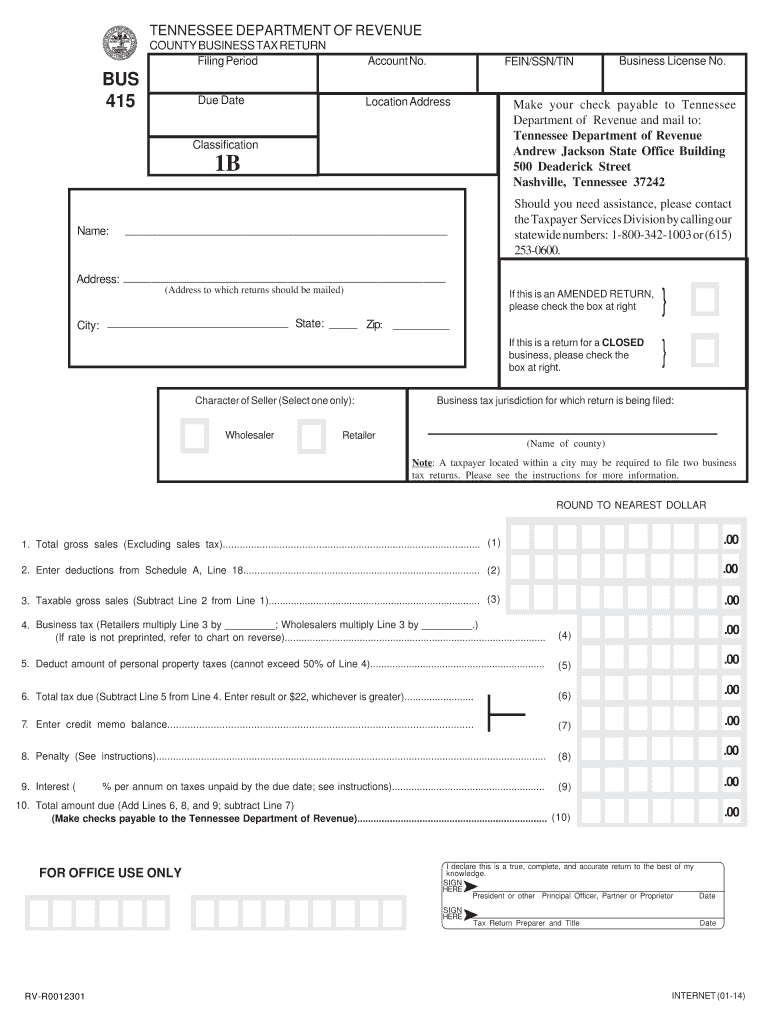

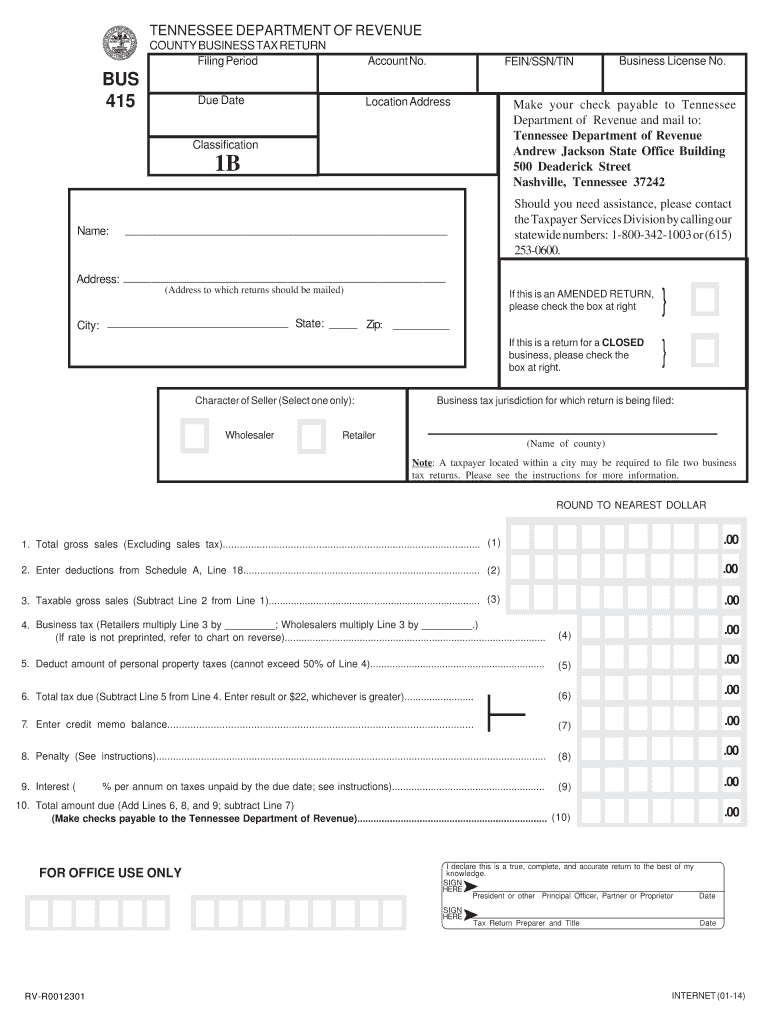

TENNESSEE DEPARTMENT OF REVENUE COUNTY BUSINESS TAX RETURN Filing Period BUS Account No. Due Date FEIN/SSN/TIN Location Address Make your check payable to Tennessee Department of Revenue and mail to Tennessee Department of Revenue Andrew Jackson State Office Building 500 Deaderick Street Nashville Tennessee 37242 Classification 1B Name Business License No. Should you need assistance please contact the Taxpayer Services Division by calling our sta...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN DoR BUS 415

Edit your TN DoR BUS 415 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN DoR BUS 415 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN DoR BUS 415 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TN DoR BUS 415. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN DoR BUS 415 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN DoR BUS 415

How to fill out TN DoR BUS 415

01

Obtain the TN DoR BUS 415 form from the official Tennessee Department of Revenue website.

02

Fill in your business name and address in the designated fields.

03

Indicate the type of business and provide the federal employer identification number (EIN).

04

Complete the sections related to business activities and sales tax information.

05

Calculate the total gross sales and any applicable exemptions.

06

Review the form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form by the specified deadline as directed on the form.

Who needs TN DoR BUS 415?

01

Businesses operating within Tennessee that are required to report and remit sales tax.

02

Any entity that has registered for a sales tax permit and conducts taxable sales in Tennessee.

Fill

form

: Try Risk Free

People Also Ask about

Does TN have a state tax form?

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

How do I get a copy of my 1095-B form online?

IRS Form 1095-B If you are filing taxes for an individual mandate state and do not have a copy of your 1095B, you may download one immediately from your member website or request one by calling the number on your ID card or other member materials.

How to file Tennessee franchise and excise tax?

Registration of Franchise Tax & Excise Taxes is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to the Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business.

Does Tennessee have an e-file authorization form?

The State of Tennessee has an e-file mandate for TN forms FAE170, FAE 174, FAE 172, FAE 173, FAE 183, INC 250 and INC 251. Payments must be made electronically by Direct Debit (EFW) or EFT. Electronic funds withdrawal (EFW) payment information should be included with the electronic file.

How do I get a tax form for TennCare?

You can ask us to send you one for each person in your household who had coverage with us last tax year. How to ask for a 1095-B tells you how. The Frequently Asked Questions has answers to other questions you may have about the 1095-B health care tax document. CALL: TennCare Connect for free at 855-259-0701.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TN DoR BUS 415 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your TN DoR BUS 415 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the TN DoR BUS 415 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my TN DoR BUS 415 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your TN DoR BUS 415 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is TN DoR BUS 415?

TN DoR BUS 415 is a form used by businesses in Tennessee to report various tax obligations and business-related information to the state.

Who is required to file TN DoR BUS 415?

Any business entity operating in Tennessee that meets certain criteria for tax obligations is required to file TN DoR BUS 415.

How to fill out TN DoR BUS 415?

To fill out TN DoR BUS 415, businesses must provide their identification information, details about their business structure, and financial figures as required by the form.

What is the purpose of TN DoR BUS 415?

The purpose of TN DoR BUS 415 is to ensure that businesses comply with state tax regulations and report accurate financial information to the state of Tennessee.

What information must be reported on TN DoR BUS 415?

The information that must be reported includes business identification details, income and revenue figures, tax liability calculations, and other relevant financial data.

Fill out your TN DoR BUS 415 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN DoR BUS 415 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.