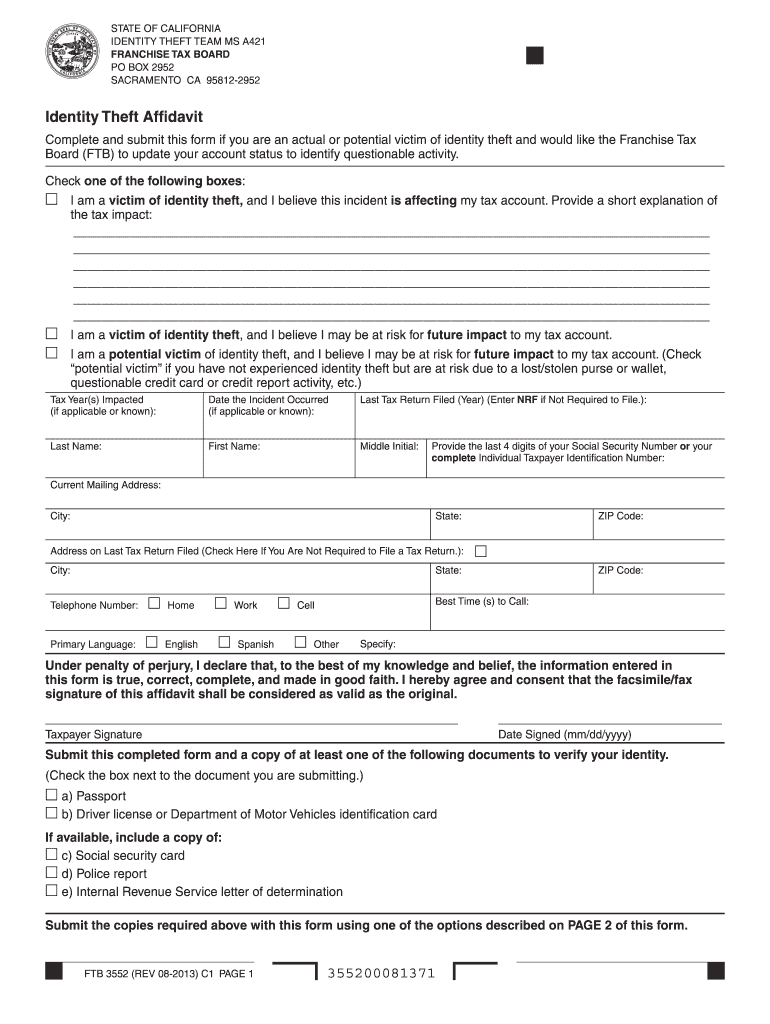

Who needs form FT 3552?

This is a form for those who have been a victim of identity theft or suspect unusual activity in this regard and would like to report it to Franchise Tax Board in California. It can be requested by FT, if they are the first to notice an unusual activity on your account, or it can be used by any taxpayer as a self-reporting standard form.

What is form FT 3552 for?

With FT 2552, or the Identity Theft Affidavit, you can report identity theft or inform the FT that you might be a potential victim of identity thieves. Either way, the process begins with a ?verification process in your account and will probably result in changing, adding or upgrading your account security.

Is it accompanied by other forms?

There are a few documents to attach to your affidavit including a copy of your passport, driver’s license, or Department of Motor Vehicles Identification Card to verify your identity. If available, you should also include a copy of your social security card, police report or Internal Revenue Service letter of determination.

When is form FT 3552 due?

You should file it with the FT as soon as possible to minimize the damage and prevent other negative consequences.

How do I fill out form FT 3552?

Check the following boxes if you are a victim of identity theft, and it’s affecting your account, if you are a victim and report of a risk of future impact on your account, or if you are a potential victim. In the first case you must briefly describe what happened. Fill in the table with general information about you and the tax years impacted, provide the date the incident occurred and a copy of the last tax return filed. Add your signature and check the boxes to inform the FT officials of the documents that must be attached to this form.

Where do I send it?

If you are self-reporting, you can send this copy to the following address:

Identity Theft Team MS A232

Franchise Tax Board

PO Box 2952

Sacramento CA 95812-2952

Or, alternatively, fax it to 916.843.0561