OK STS-20002-A 2014 free printable template

Show details

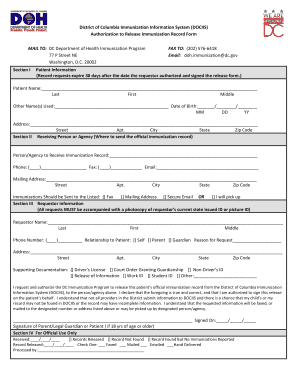

New address in Item G. NOTE Changes to location address must be submitted on the Notification of Business Address Change Form BT-115-C-W available at www. tax. ok. gov. ITEM H - Enter the total number of pages enclosed to the right of the word of. ITEM I - Informational Only This line should only include sales for low point off-premises consumption. It should not be used by bars and restaurants. STS 20002 -Office Use Only- Revised 7-2014 A. Taxpayer Oklahoma Sales Tax Return FEIN check one...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK STS-20002-A

Edit your OK STS-20002-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK STS-20002-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK STS-20002-A online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK STS-20002-A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK STS-20002-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK STS-20002-A

How to fill out OK STS-20002-A

01

Obtain the OK STS-20002-A form from the appropriate source.

02

Fill in the date at the top of the form.

03

Enter your full name in the designated field.

04

Provide your contact information including phone number and email.

05

Indicate the purpose for completing the form in the specified section.

06

Include any relevant case or reference numbers if required.

07

Review the instructions on the form carefully for any additional requirements.

08

Sign and date the form at the bottom.

09

Submit the form to the appropriate department or agency.

Who needs OK STS-20002-A?

01

Individuals or organizations required to report certain information to regulatory agencies.

02

Persons seeking permits or approvals related to specific activities.

03

Entities engaging in regulated business practices that necessitate formal documentation.

Fill

form

: Try Risk Free

People Also Ask about

How much is it to get a sales tax permit in Oklahoma?

How much does it cost to apply for a sales tax permit in Oklahoma? It costs $20 to apply for an Oklahoma sales tax permit. There's also a convenience fee of $3.95 for paying with a Visa Debit card and a convenience fee of 2.5% for paying with any other type of card.

What is Oklahoma form 511?

File as Oklahoma married filing separate. The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.

How do I report sales tax in Oklahoma?

You have three options for filing and paying your Oklahoma sales tax: File online – File online at OK Tap. You can remit your payment through their online system. File by mail – You can use form STS-20002 to file on paper and by mail. AutoFile – Let TaxJar file your sales tax for you.

Is a sales tax permit the same as a resale certificate in Oklahoma?

An Oklahoma sales tax permit is not the same as an Oklahoma resale certificate. The former allows a company to make sales inside a state and collect/remit sales tax for those sales.

What is the Oklahoma sales tax return STS 20002?

Oklahoma Tax Commission Form STS-20002-A Oklahoma Sales Tax Return for Filing Returns After July 1 2017. Also include amounts for purchases for which you are paying the sales tax directly to the Oklahoma Tax Commission OTC. This form is used to file Oklahoma sales tax returns AFTER July 1 2017.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the OK STS-20002-A electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your OK STS-20002-A in seconds.

Can I create an electronic signature for signing my OK STS-20002-A in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your OK STS-20002-A and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit OK STS-20002-A straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing OK STS-20002-A.

What is OK STS-20002-A?

OK STS-20002-A is a state tax form used in Oklahoma for reporting sales tax transactions.

Who is required to file OK STS-20002-A?

Businesses and individuals who sell taxable goods or services in Oklahoma are required to file OK STS-20002-A.

How to fill out OK STS-20002-A?

To fill out OK STS-20002-A, gather your sales data, enter total sales amounts, calculate the tax due, and provide business identification information.

What is the purpose of OK STS-20002-A?

The purpose of OK STS-20002-A is to report sales tax collected by businesses in Oklahoma and to remit that tax to the state.

What information must be reported on OK STS-20002-A?

Information required includes total sales, the amount of sales tax collected, the business identification number, and relevant sales period.

Fill out your OK STS-20002-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK STS-20002-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.