IRS 8822-B 2014 free printable template

Show details

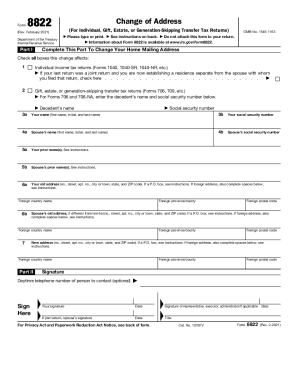

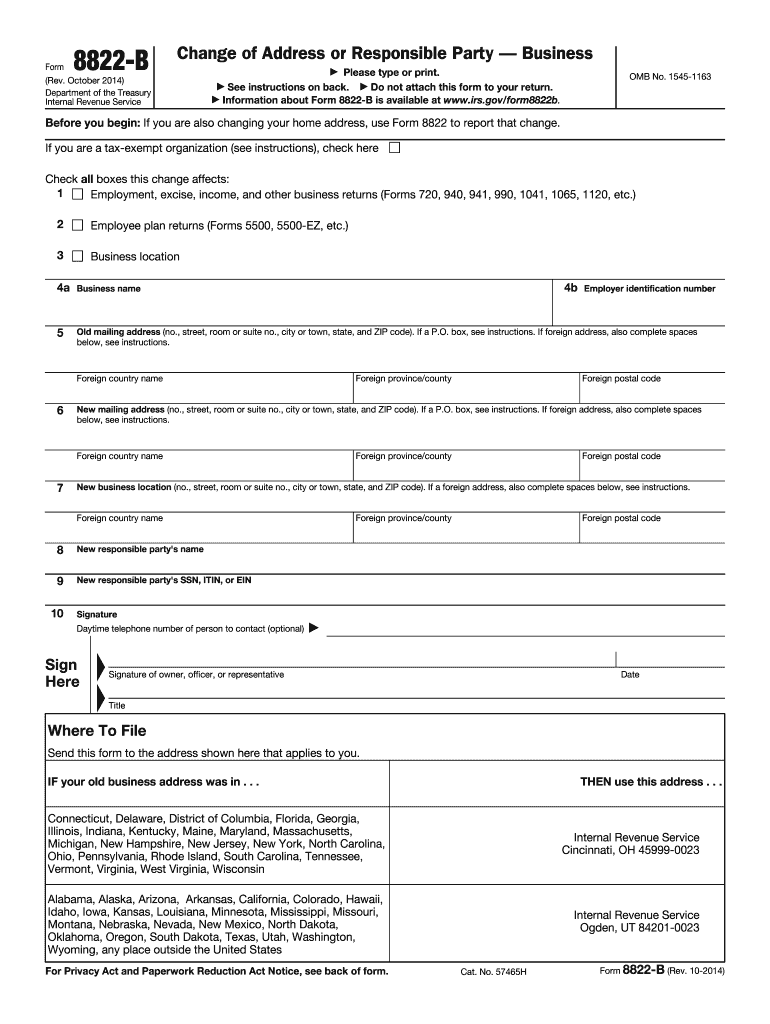

Do not attach this form to your return. Information about Form 8822-B is available at www.irs.gov/form8822b. If you are a representative signing for the taxpayer attach to Form 8822-B a copy of your power of attorney. 8822-B Form Rev. October 2014 Department of the Treasury Internal Revenue Service Change of Address or Responsible Party Business Please type or print. See instructions on back. See Responsible Party later for more information. Purpose of Form Use Form 8822-B to notify the...Internal business mailing address your business location or the identity of your change their address or identity of their whether or not they are engaged in a trade or business. An officer owner general partner or LLC member manager plan administrator fiduciary or an authorized representative must sign. An officer is the president vice president treasurer chief accounting officer etc. If you are a representative signing on behalf of the taxpayer you must attach to Form 8822-B a CAUTION copy of...your power of attorney. IF your old business address was in. THEN use this address. Connecticut Delaware District of Columbia Florida Georgia Illinois Indiana Kentucky Maine Maryland Massachusetts Michigan New Hampshire New Jersey New York North Carolina Ohio Pennsylvania Rhode Island South Carolina Tennessee Vermont Virginia West Virginia Wisconsin Cincinnati OH 45999-0023 Alabama Alaska Arizona Arkansas California Colorado Hawaii Idaho Iowa Kansas Louisiana Minnesota Mississippi Missouri...Montana Nebraska Nevada New Mexico North Dakota Oklahoma Oregon South Dakota Texas Utah Washington Wyoming any place outside the United States Ogden UT 84201-0023 For Privacy Act and Paperwork Reduction Act Notice see back of form. Cat. No. 57465H Form 8822-B Rev. 10-2014 Future Developments developments affecting Form 8822-B such as legislation enacted after we release it will be posted at www.irs.gov/ form8822b. What s New Change of responsible party. Any entity with an EIN is now required to...report a change in its responsible party by a completing Form 8822-B as appropriate including entering the new responsible party s name on line 8 and the new responsible party s SSN ITIN or EIN on line 9 and b filing the completed form with the Internal Revenue Service within 60 days of the change. To do this you can use Form 2848. The address or responsible party change from an unauthorized third party. Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to...carry out the Internal Revenue laws of the United States. Our legal right to ask for information is and 6011 which require you to file a statement with us for any tax for which you are liable. OMB No* 1545-1163 Before you begin If you are also changing your home address use Form 8822 to report that change. If you are a tax-exempt organization see instructions check here Check all boxes this change affects Employment excise income and other business returns Forms 720 940 941 990 1041 1065 1120...etc* Employee plan returns Forms 5500 5500-EZ etc* Business location 4b 4a Business name Old mailing address no.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8822-B

How to edit IRS 8822-B

How to fill out IRS 8822-B

Instructions and Help about IRS 8822-B

How to edit IRS 8822-B

To edit IRS 8822-B, you typically need to print the form and make corrections manually. If you are using an electronic version, you may have the option to adjust the text directly. After making the necessary changes, ensure that the updated form is signed and dated where required before submission. Utilizing a tool like pdfFiller can streamline the process by allowing easy edits to the form online.

How to fill out IRS 8822-B

To fill out IRS 8822-B, follow these steps:

01

Begin by providing your identifying information. This includes your name, Social Security number, and address.

02

Indicate the reason for filing the form, such as a business address change.

03

Complete the necessary sections regarding your business entity, if applicable.

04

Sign and date the form to certify the information is correct.

Make sure to review the completed form for accuracy to avoid delays in processing your submission.

About IRS 8822-B 2014 previous version

What is IRS 8822-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8822-B 2014 previous version

What is IRS 8822-B?

IRS 8822-B is a tax form used to notify the Internal Revenue Service of a change in address for a business entity. This is important for ensuring that all correspondence, tax documents, and notices are correctly directed. The adjustment can apply to both your business location and your mailing address.

What is the purpose of this form?

The primary purpose of IRS 8822-B is to inform the IRS about an address change for specific business entities. Accurate address information is crucial for tax compliance and receiving essential documents, including notices or refunds from the IRS.

Who needs the form?

Any business entity that has changed its address must file IRS 8822-B to ensure that the IRS has updated records. This includes partnerships, corporations, and limited liability companies (LLCs) that are subject to federal taxation. Individual taxpayers typically do not use this form unless their business is registered separately.

When am I exempt from filling out this form?

You are exempt from filling out IRS 8822-B if your address change does not affect a registered business entity. Additionally, if you are a sole proprietor who files taxes using your personal Social Security number instead of an Employer Identification Number (EIN), changes to your personal address can be covered using Form 8822 instead.

Components of the form

IRS 8822-B consists of several key components. These include sections for entering your name, Social Security number or EIN, old address, new address, and the reason for the change. There is also a signature section to confirm the information provided is accurate.

What are the penalties for not issuing the form?

While there are no direct penalties solely for failing to submit IRS 8822-B, failing to notify the IRS of an address change can lead to missed tax notices, potential offsets, and complications in communication. Accurate address records help in avoiding misunderstandings or misfiled documents.

What information do you need when you file the form?

When filing IRS 8822-B, you need your legal business name, the old and new addresses, your Social Security number or EIN, and a signature. Ensure that all names and addresses match with IRS records to prevent issues during processing.

Is the form accompanied by other forms?

IRS 8822-B is generally a standalone form. However, if the address change is linked to other tax-related changes, you may need to file additional forms, such as those for business entity updates with state authorities, depending on your situation.

Where do I send the form?

The completed IRS 8822-B form should be sent to the address specified in the instructions on the form itself. Typically, this is the service center corresponding to your old business address. Double-check the latest IRS guidelines on mailing addresses before sending your form to ensure proper processing.

See what our users say