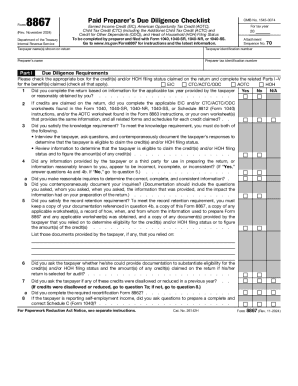

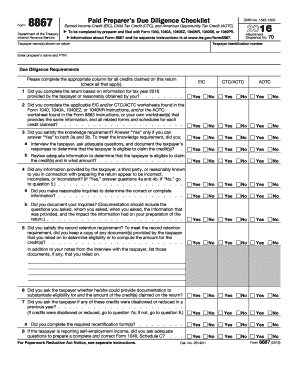

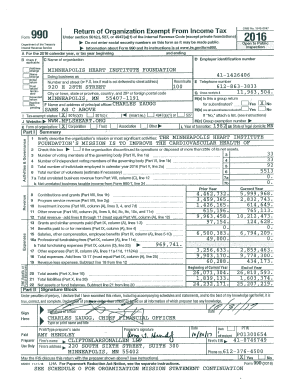

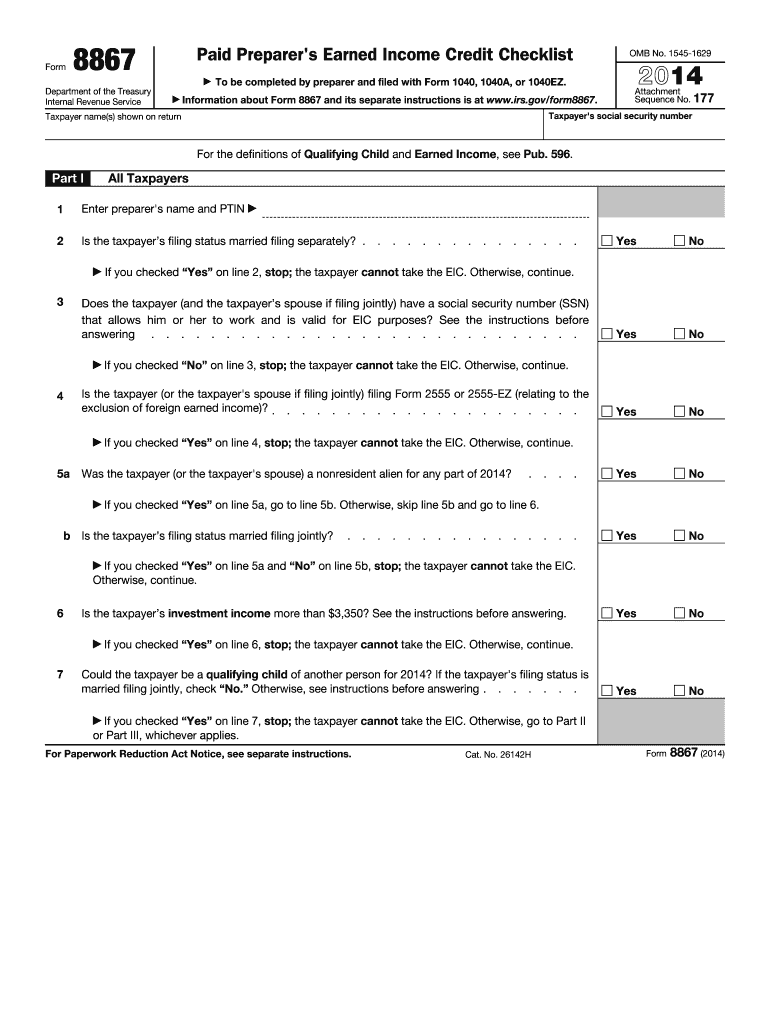

IRS 8867 2014 free printable template

Instructions and Help about IRS 8867

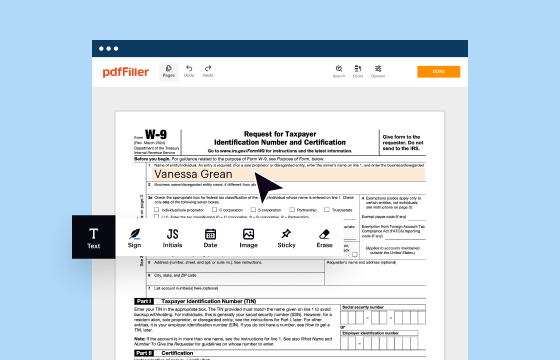

How to edit IRS 8867

How to fill out IRS 8867

About IRS 8 previous version

What is IRS 8867?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

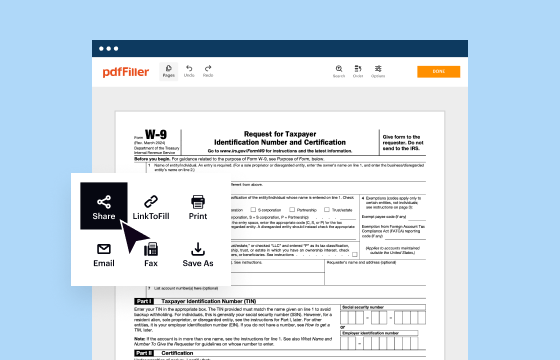

Where do I send the form?

FAQ about IRS 8867

What should I do if I discover an error after filing the 2014 form 8867?

If you find an error in your filed 2014 form 8867, you should file an amended return as soon as possible. This involves submitting a corrected form along with an explanation of the changes made. Ensure you keep copies of all communications and filings for your records.

How can I verify the status of my submitted 2014 form 8867?

You can verify the status of your 2014 form 8867 by checking the IRS 'Where's My Refund?' tool online if you are awaiting a refund. Alternatively, you may also contact the IRS directly for updates on processing times or to inquire if any issues occurred during the filing.

What issues might lead to the rejection of my e-filed 2014 form 8867?

Common e-file rejection codes for the 2014 form 8867 include missing information, discrepancies in Social Security Numbers, or failure to match IRS records. Be sure to carefully review any error messages provided by your e-filing software to address these issues before resubmitting.

How should I handle a notice from the IRS regarding my 2014 form 8867?

If you receive a notice from the IRS about your 2014 form 8867, promptly read the document for specific instructions. Prepare any required documentation and ensure you respond by the deadline provided in the notice to avoid further complications.

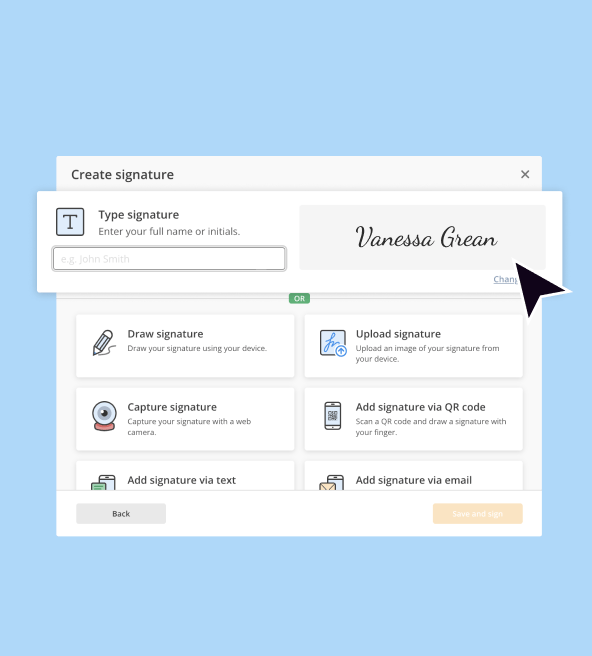

Is e-signature acceptable for submitting the 2014 form 8867?

Yes, e-signatures are generally acceptable for the 2014 form 8867 when filed electronically. Ensure that your e-filing software meets IRS compliance for e-signatures to maintain valid submission.

See what our users say