IRS 8879-PE 2014 free printable template

Show details

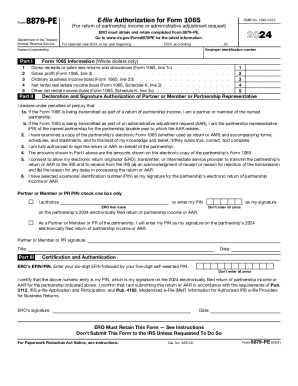

Information about Form 8879-PE and its instructions is at www.irs.gov/form8879pe. Department of the Treasury Internal Revenue Service For calendar year 2014 or tax year beginning 2014 and ending. Cat. No. 48314D Form 8879-PE 2014 Page 2 Future Developments For the latest information about developments related to Form 8879-PE and its instructions such as legislation enacted after they were published go to www.irs.gov/form8879pe. Liability Company Member Manager Responsibilities The general...partner or limited liability company member manager will Purpose of Form Verify the accuracy of the partnership s return of partnership income Form 8879-PE when the general partner or limited liability company member manager wants to use a personal identification number PIN to electronically sign a partnership s not use Form 8879-PE must use Form 8453-PE U.S. Partnership Declaration for an IRS e-file Return. For more information see the instructions for Form 8453-PE. Check the appropriate box...in Part II to either authorize the ERO to enter the choose to enter it in person Do not send this form to the IRS. The ERO must retain Form 8879-PE. ERO Responsibilities The ERO will Enter the name and employer at the top of the form Complete Part I using the amounts zero may be entered when appropriate from the partnership s 2014 return of Enter on the authorization line in Part II individual preparing the return if the ERO is authorized to enter the general partner or limited liability...company member manager s PIN Give the general partner or limited 8879-PE for completion and review this can be done by hand delivery U.S. mail private delivery service email or Internet website and and date. Form 8879-PE IRS e-file Signature Authorization for Form 1065 OMB No* 1545-0123 Do not send to the IRS* Keep for your records. Employer identification number Name of partnership Part I Return Information Whole dollars only Gross receipts or sales less returns and allowances Form 1065 line...1c. Gross profit Form 1065 line 3. Ordinary business income loss Form 1065 line 22. Net rental real estate income loss Form 1065 Schedule K line 2. Other net rental income loss Form 1065 Schedule K line 3c. Part II Declaration and Signature Authorization of General Partner or Limited Liability Company Member Manager Be sure to get a copy of the partnership s return Under penalties of perjury I declare that I am a general partner or limited liability company member manager of the above...partnership and that I have examined a copy of the partnership s 2014 electronic return of partnership income and accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. I further declare that the amounts in Part I above are the amounts shown on the copy of the partnership s electronic return of partnership income. I consent to allow my electronic return originator ERO transmitter or intermediate service provider to send the partnership s...return to the IRS and to receive from the IRS a an acknowledgement of receipt or reason for rejection of the transmission and b the reason for any delay in processing the return* I have selected a personal identification number PIN as my signature for the partnership s electronic return of partnership income.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8879-PE

How to edit IRS 8879-PE

How to fill out IRS 8879-PE

Instructions and Help about IRS 8879-PE

How to edit IRS 8879-PE

To edit IRS 8879-PE, secure a digital copy of the form. Use pdfFiller to modify fields, add your signature, and store the completed form securely. Ensure all edits maintain the integrity of the document for tax purposes.

How to fill out IRS 8879-PE

Filling out IRS 8879-PE involves careful attention to detail. Gather all necessary information, including the taxpayer's name, Social Security number, and specific income details. Follow these steps to complete the form:

01

Provide the taxpayer's identification information in the designated fields.

02

Indicate the tax year for which you are filing.

03

Confirm the appropriate box indicating whether you are e-filing.

04

Sign and date the form, ensuring that all information is accurate.

About IRS 8879-PE 2014 previous version

What is IRS 8879-PE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8879-PE 2014 previous version

What is IRS 8879-PE?

IRS 8879-PE is a tax form used by partnerships to electronically sign the partnership's income tax return. This form is essential for confirming that the partnership has reviewed and agrees to the contents of the tax return submitted electronically.

What is the purpose of this form?

The purpose of IRS 8879-PE is to authorize an electronic submission of the partnership return. It validates that the electronic submission is backed by a real partnership agreement and ensures compliance with IRS e-filing requirements.

Who needs the form?

Partnerships filing their return electronically are required to complete form IRS 8879-PE. All partners must consent to the electronically submitted return, making this form vital for each partnership's compliance with federal tax laws.

When am I exempt from filling out this form?

Exemptions from filing IRS 8879-PE typically occur when the partnership does not file electronically. If the partnership chooses to submit its return through traditional mail, this form is unnecessary.

Components of the form

The components of IRS 8879-PE include sections for taxpayer information, tax year, and e-filing confirmation. Key aspects of the form are aimed at ensuring that all partners understand and approve the electronic submission.

What are the penalties for not issuing the form?

Failure to issue IRS 8879-PE can lead to penalties, including delayed processing of the tax return. An incomplete or missing form could also lead to inaccuracies in the partnership's filing, potentially resulting in additional fines or interest on unpaid taxes.

What information do you need when you file the form?

Filing IRS 8879-PE requires specific information: the taxpayer identification number (TIN), the names of the partners, and proxy confirmation for the electronic filing. Accurate information is crucial to ensure compliance with IRS regulations.

Is the form accompanied by other forms?

This form may accompany the partnership's income tax return (Form 1065). Ensure that all necessary forms are submitted together to maintain compliance and speed up processing.

Where do I send the form?

IRS 8879-PE should be retained by the partnership. It is not submitted to the IRS with the electronic return but should be available in case the IRS requests documentation of consent from the partners.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

New User

I have used DocuSign and PDF Filler was easier to upload from Google Drive.

I used the trial version of PDFfiller…

I used the trial version of PDFfiller for 30 days and it did exactly what I needed. I intended to cancel my subscription on day 30 before I was charged because at the moment I only needed it for one task. They charged me on day 30 but I emailed support and they immediately refunded my money with utmost courtesy. I will DEFINITELY use their product in the future and pay for a full subscription should I have further need for their product.Steve

See what our users say