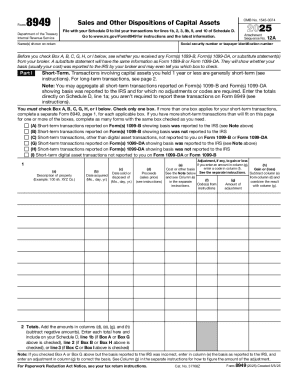

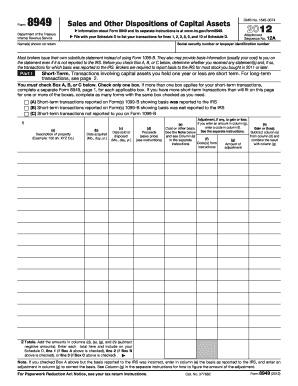

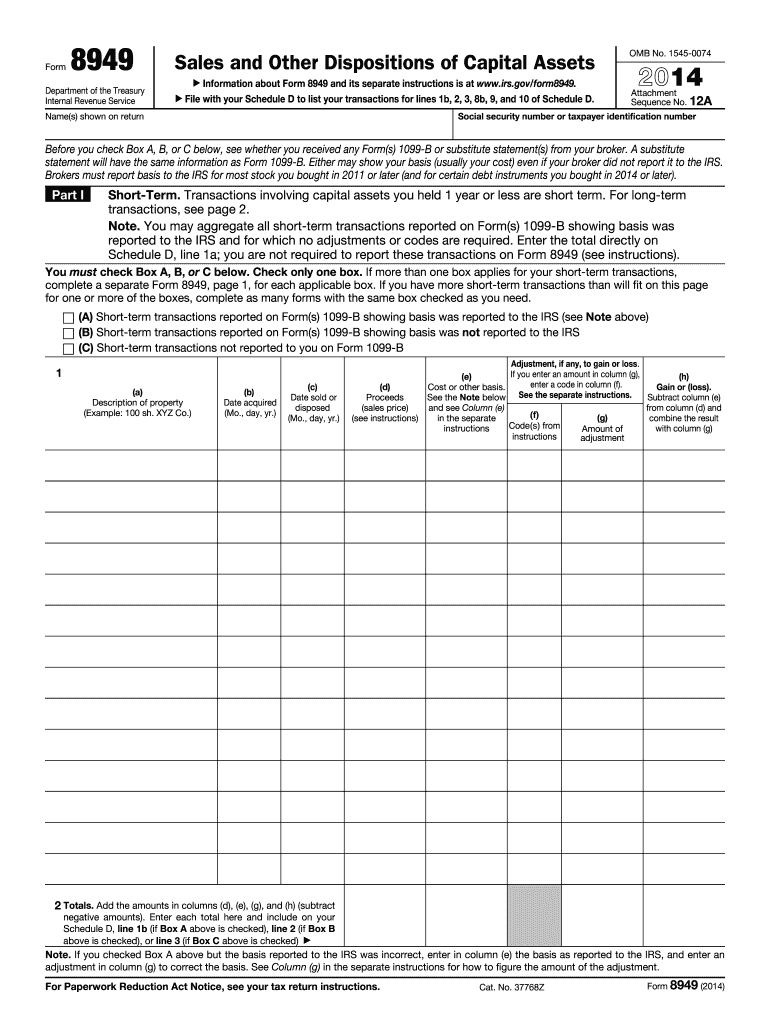

IRS 8949 2014 free printable template

Instructions and Help about IRS 8949

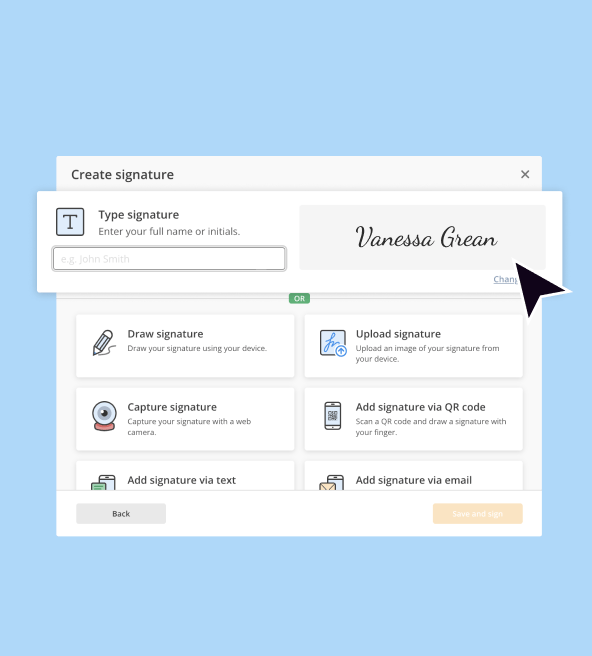

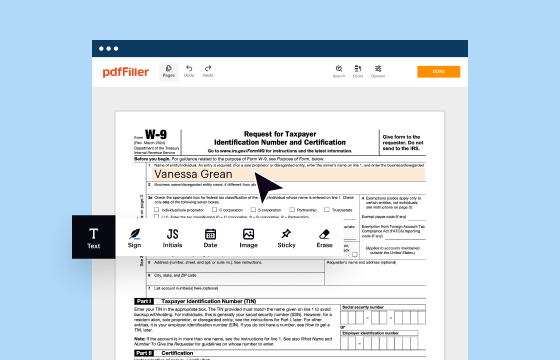

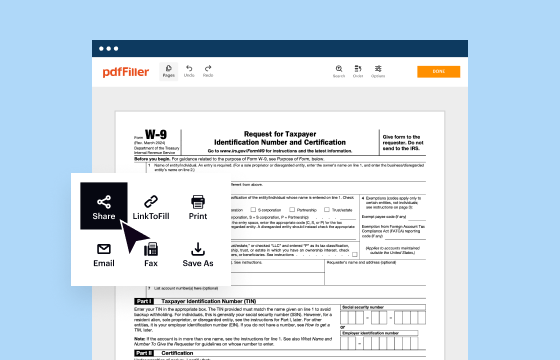

How to edit IRS 8949

How to fill out IRS 8949

About IRS 8 previous version

What is IRS 8949?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

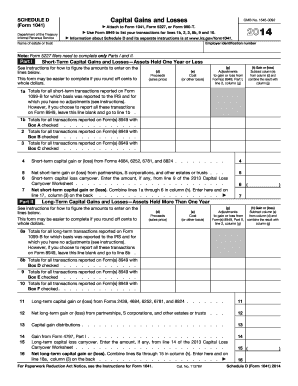

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8949

What should I do if I realize I've made a mistake on my IRS 8949 after filing?

If you need to correct a mistake on your IRS 8949, you should file an amended return using Form 1040-X. Ensure that you include the correct information and your updated IRS 8949. It's important to clearly indicate the changes made to avoid delays in processing.

How can I track the status of my IRS 8949 submission?

To verify the receipt and processing of your IRS 8949, you can use the IRS 'Where's My Refund?' tool if you filed electronically. Be alert for common e-file rejection codes, which can indicate issues that may need addressing before resubmission.

Are there specific privacy or data security concerns I should be aware of when filing the IRS 8949 electronically?

When filing your IRS 8949 electronically, ensure that your records are stored securely and that you use trusted software. Be mindful of e-signature requirements and know that there are guidelines for how long you should retain your records for audit purposes.

What are some common errors I should watch for when preparing my IRS 8949?

Common errors on the IRS 8949 include incorrect reporting of gains or losses, misclassification of assets, and failure to follow required transaction formats. To avoid these pitfalls, double-check your entries and consider using software that can guide you in accurately populating the form.

What options do I have if my IRS 8949 gets rejected after e-filing?

If your IRS 8949 is rejected after e-filing, you should receive a notice with the reason for rejection. You typically can rectify the issue directly through your software and re-submit. Be sure to confirm any changes to avoid repeated errors on future submissions.

See what our users say