USDA RD 4279-5 2005 free printable template

Show details

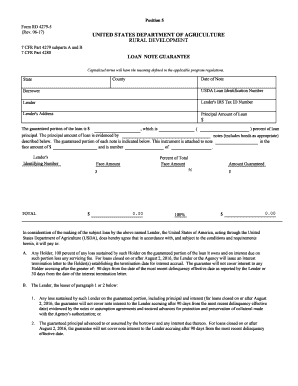

Protective Advances. provided in this Loan Note Guarantee notwithstanding the guaranteed portion of the loan that is held by another. The Loan Note Guarantee will not cover the note interest to the Holder on the guaranteed loans accruing after 90 days from the date of the original demand letter of the Holder to the Lender requesting the repurchase. Lender or any unenforceability of this Loan Note Guarantee by Lender except for fraud or misrepresentation of which the Holder had actual...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign USDA RD 4279-5

Edit your USDA RD 4279-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your USDA RD 4279-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing USDA RD 4279-5 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit USDA RD 4279-5. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

USDA RD 4279-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out USDA RD 4279-5

How to fill out USDA RD 4279-5

01

Obtain the USDA RD 4279-5 form from the USDA website or your local USDA office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the applicant's information, including name, address, and contact details.

04

Provide details about the loan request, including the amount and purpose.

05

Include information about the project or business for which the loan is being applied.

06

Attach any necessary documentation as specified in the instructions.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the appropriate USDA office for processing.

Who needs USDA RD 4279-5?

01

Individuals or businesses looking to secure funding for rural development projects.

02

Farmers or agricultural enterprises seeking loans for equipment, land, or infrastructure.

03

Nonprofit organizations involved in community development initiatives.

04

State and local governments planning to improve rural facilities or services.

Fill

form

: Try Risk Free

People Also Ask about

What is a form of guaranty?

This document is a legal form known as a "guaranty." The person signing the document (the "Guarantor") is guaranteeing to the "Creditor" that the Guarantor will ensure the "Customer" makes prompt, punctual, and full payment of any money that is or will be owed to the Creditor by the Customer.

What is a loan guarantee?

A guaranteed loan is a type of loan in which a third party agrees to pay if the borrower should default. A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money.

How do you guarantee a loan?

A guarantor is a financial term describing an individual who promises to pay a borrower's debt if the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans. On rare occasions, individuals act as their own guarantors, by pledging their own assets against the loan.

What is an example of a loan guarantee?

Uses of loan guarantee agreements Common examples are when parents guarantee a mortgage so a child can buy a house, or guarantee a loan for a car purchase. A loan guarantee also may be used to help someone out of a financial bind.

What does a guarantee on a loan mean?

A loan guarantee is a legally binding commitment to pay a debt in the event the borrower defaults. This most often occurs between family members, where the borrower can't obtain a loan because of a lack of income or down payment, or due to a poor credit rating.

What is an example of a guaranty?

A guaranty clause can take many forms; a primary example is a loan agreement that is co-signed, which can signify a guaranty from the co-signer to a specific amount, even if the loan agreement does not use a specific "guarantor" title.

What is the difference between loan and loan guarantee?

Guaranteed loans give high-risk borrowers a way to access financing, and provide protection for the lender. A guaranteed loan is not the same thing as a secured loan. Secured loans are backed by an asset, while a guaranteed loan is backed by a third party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify USDA RD 4279-5 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your USDA RD 4279-5 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the USDA RD 4279-5 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your USDA RD 4279-5 in minutes.

Can I edit USDA RD 4279-5 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as USDA RD 4279-5. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is USDA RD 4279-5?

USDA RD 4279-5 is a form used by borrowers to report information related to their financial status, project progress, and compliance with program requirements for Rural Development loans.

Who is required to file USDA RD 4279-5?

Borrowers who have received USDA Rural Development loans are required to file USDA RD 4279-5 as part of their ongoing compliance and reporting obligations.

How to fill out USDA RD 4279-5?

To fill out USDA RD 4279-5, borrowers should follow the instructions provided on the form, including entering their financial information, project details, and any additional required data or documentation.

What is the purpose of USDA RD 4279-5?

The purpose of USDA RD 4279-5 is to ensure that borrowers provide necessary financial and project-related information to USDA, enabling proper monitoring and oversight of loan conditions and compliance.

What information must be reported on USDA RD 4279-5?

Information that must be reported on USDA RD 4279-5 includes financial statements, income and expense reports, project progress updates, and any other relevant data that reflects the borrower's compliance with loan conditions.

Fill out your USDA RD 4279-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

USDA RD 4279-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.