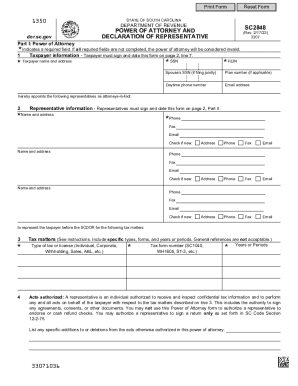

SC DoR SC2848 2011 free printable template

Show details

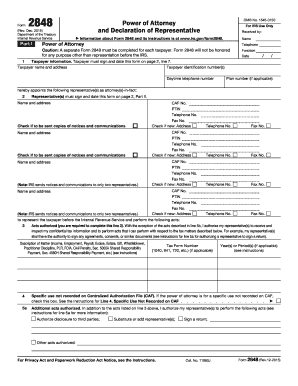

Substitute SC2848 Federal Form 2848 may be substituted for SC2848 even though the instructions for the two forms differ somewhat. STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC2848 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE Part I Rev. 12/1/11 Power of Attorney Note Taxpayer s must sign and date this form on page 2 line 8. Insert Designation - a-h Jurisdiction state above letter indicates required field. 33072026 Instructions for SC2848 General Instructions Purpose of Form Use...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc2848 2011 form

Edit your sc2848 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc2848 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc2848 2011 form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sc2848 2011 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC2848 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc2848 2011 form

How to fill out SC DoR SC2848

01

Obtain form SC DoR SC2848 from the official website or relevant authority.

02

Fill in your personal information in the designated fields, including name, address, and contact details.

03

Provide the details of the person you are authorizing, including their name, address, and relationship to you.

04

Clearly state the specific powers you are granting, and ensure they align with the form's requirements.

05

Sign and date the form at the bottom to validate your authorization.

06

Submit the completed form to the designated authority or the relevant office as instructed.

Who needs SC DoR SC2848?

01

Individuals who wish to authorize another person to act on their behalf in specific legal or financial matters.

02

Those who are unable to manage their own affairs due to absence, incapacity, or other reasons.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a SC power of attorney?

Steps for Making a Financial Power of Attorney in South Carolina Create the POA Using Software or an Attorney. Sign the POA in the Presence of Two Witnesses and Get It Notarized. File a Copy With the Land Records Office. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact.

What is a SC 2848 power of attorney form?

A South Carolina Tax Power of Attorney (Form SC-2848) or “Department Of Revenue Power Of Attorney And Declaration Of Representative” is a required submission when you wish to grant someone with the authority to act on your behalf when dealing with the South Carolina Department of Revenue.

Can South Carolina extension be filed electronically?

Request a six month filing extension for your South Carolina Individual Income Taxes by: Paying your balance due online using MyDORWAY on or before the due date.

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

Can taxpayers get up to $800 in Income Tax rebates in South Carolina?

South Carolina lawmakers in June approved the parameters for a tax rebate of $1 billion for South Carolinians. Eligible taxpayers have received up to $800 by direct deposit or paper checks. Nearly all of the $1 billion has been distributed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sc2848 2011 form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing sc2848 2011 form right away.

How do I edit sc2848 2011 form on an iOS device?

Create, modify, and share sc2848 2011 form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit sc2848 2011 form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share sc2848 2011 form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is SC DoR SC2848?

SC DoR SC2848 is a form used in South Carolina for taxpayers to designate a representative to act on their behalf in tax matters.

Who is required to file SC DoR SC2848?

Any individual or entity that needs to authorize a representative, such as an accountant or attorney, to handle tax matters with the South Carolina Department of Revenue.

How to fill out SC DoR SC2848?

To fill out SC DoR SC2848, provide the taxpayer's information, the representative's information, and specify the tax matters for which representation is authorized.

What is the purpose of SC DoR SC2848?

The purpose of SC DoR SC2848 is to allow taxpayers to formally appoint a representative to manage their tax affairs with the South Carolina Department of Revenue.

What information must be reported on SC DoR SC2848?

The form requires the taxpayer's name, address, identification number, the representative's name and contact information, and specific details about the tax matters being addressed.

Fill out your sc2848 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sc2848 2011 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.